Medicare Expenses Increase Faster Than Social Security's 2.8% COLA, Raising Concerns Among Seniors

- SSA announced a 2.8% 2026 COLA for 75M beneficiaries, raising average benefits by $56/month to $2,071. - Critics argue CPI-W-based adjustment fails seniors, as 11.6% Medicare premium hikes could erase COLA gains. - 77% of seniors call 2.8% insufficient; AARP survey shows most need ≥5% to maintain living standards. - Trustee report warns Social Security could become insolvent by 2034 without congressional action.

On October 24, 2025, the Social Security Administration (SSA) revealed that the cost-of-living adjustment (COLA) for 2026 will be

The 2.8% COLA is determined by the

For a lot of older adults, the benefit of the COLA is further diminished by sharp hikes in Medicare premiums. The standard

This disconnect is echoed in public opinion. A recent

The SSA’s update also brought attention to deeper financial issues facing Social Security. The June 2025

Advocates have long called for changes to how COLA is calculated, suggesting the use of the Consumer Price Index for the Elderly (CPI-E), which better matches seniors’ actual spending. The

The 2026 COLA announcement also came during a federal government shutdown, which delayed key data from the Bureau of Labor Statistics. Although the SSA released the adjustment as planned, the situation highlighted the system’s vulnerabilities. Commissioner Frank J. Bisignano said the COLA "ensures benefits are in line with today’s economic conditions," but critics argue that the program’s long-term stability is still unresolved.

As the January 2026 implementation of the COLA approaches, many retirees are left facing the reality that these modest increases may not be enough to ease their financial burdens. With inflation continuing and healthcare costs rising, the debate over how to better tailor Social Security adjustments to seniors’ needs is expected to grow more urgent.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

木頭姐豪擲$5,500萬加倉,Bitcoin Hyper受關注

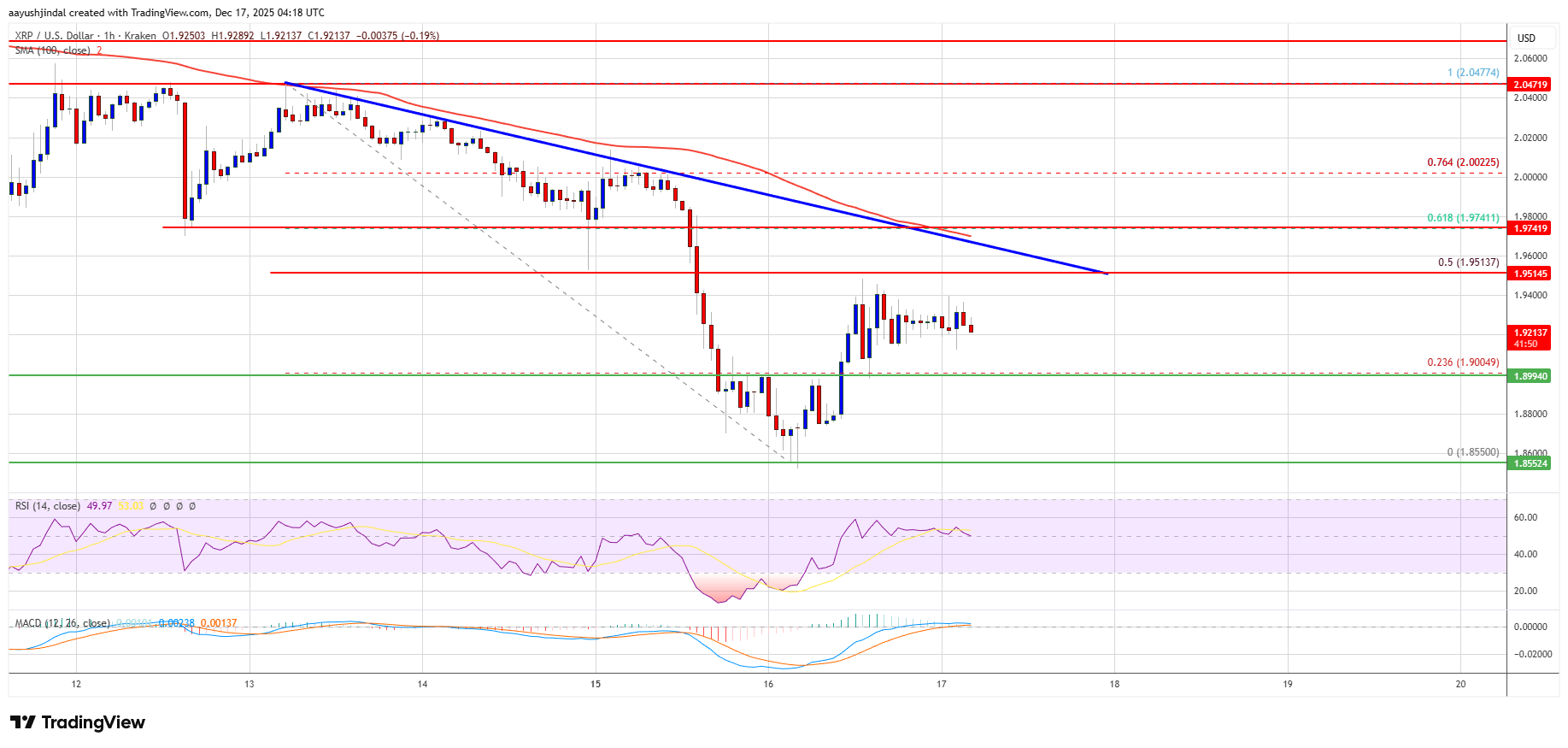

XRP Price Recovery Looks Fragile—Can Bulls Break the Cap?