Solana News Update: BlockDAG and XMR Rally: The Evolution of Crypto Towards Practical Use and Technological Advancement

- BlockDAG's $600M presale nears completion with 31 batches sold, while Monero (XMR) surges 11% past $307.37 resistance. - Hybrid DAG-PoW architecture enables 2,000-15,000 TPS with Bitcoin-level security, supported by CertiK/Halborn audits and EVM compatibility. - Market shift favors projects with tangible use cases: BlockDAG's $0.05 listing target and XMR's $367 technical target highlight innovation-driven adoption. - F1 team partnership and 3.5M X1 miners amplify visibility, aligning with crypto's Octobe

The cryptocurrency sector is currently energized by two significant events: BlockDAG’s technology advances and market achievements, as noted in

BlockDAG’s innovative structure merges Directed Acyclic Graph (DAG) technology with Proof of Work (PoW), supporting between 2,000 and 15,000 transactions per second while retaining security on par with Bitcoin, as described in

BlockDAG continues to grow, distributing 27 billion BDAG tokens to more than 312,000 participants. With a confirmed listing price of $0.05 and a $600 million roadmap, BDAG is positioned as a leading candidate for the largest Layer-1 launch in 2025, according to

BlockDAG’s alliance with the BWT Alpine Formula 1® Team has significantly boosted its international profile, tapping into the sport’s audience to drive mainstream adoption. The partnership features interactive simulators, hackathons, and Web3 engagement areas, supporting the project’s mission to connect blockchain with traditional industries. Meanwhile, the network’s rapid growth is evident with 3.5 million X1 app miners and 20,000 hardware miners.

Monero’s latest rally comes after its Fluorine Fermi upgrade, which improved privacy by blocking surveillance nodes; more technical insights are available in

While

As the crypto market enters a crucial October, BlockDAG’s organized rollout and XMR’s technical strength reflect a larger movement: projects that blend innovation, openness, and real-world utility are gaining momentum. With Genesis Day on the horizon and XMR targeting new highs, investors are closely monitoring these unfolding trends.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EE bets on Wi-Fi 7 to fix home dead zones across UK full-fibre plans

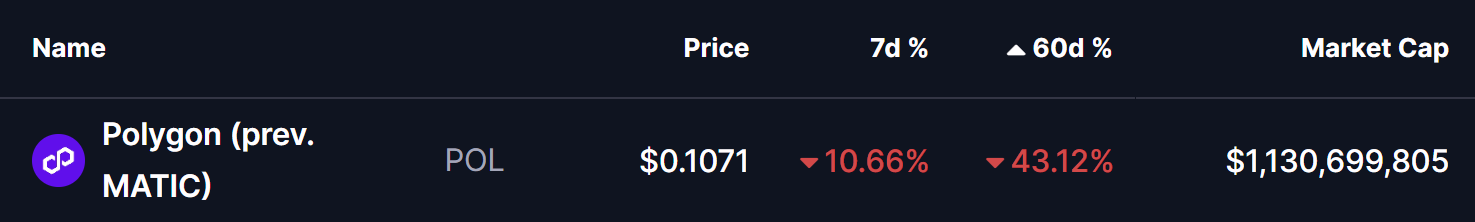

Polygon (POL) Flashes Potential Bullish Reversal Pattern – Will It Bounce Back?

XRP ETFs Sustain Positive Inflows for 30 Days Straight: Bullish?