River Transforms Time into Airdrops, Revolutionizing Liquidity Mechanisms

- River's $RIVER token surged over 5x post-TGE via DAC mechanism and Binance Futures listing, hitting $10 on Oct. 24. - DAC allows 180-day conversion of River Pts to $RIVER with exponential rate improvements, enabling arbitrage and long-term incentives. - $100M+ 24-hour trading volume and 80,000+ addresses highlight market adoption, with analysts calling DAC a tokenomics breakthrough. - The mechanism redefines airdrops by embedding time into liquidity dynamics, drawing AMM-like comparisons for strategic va

Since its token generation event (TGE) on September 22, 2025, River’s $RIVER token has experienced a more than fivefold increase in value, fueled by the introduction of its Dynamic Airdrop Conversion (DAC) system and a listing on Binance Futures. The token reached a record high of $10 on October 24, while River Pts—airdrop points based on ERC-20—soared by 40 times, creating active opportunities for arbitrage and strategic swaps, according to

The DAC system lets holders exchange River Pts for $RIVER at any time within 180 days after the TGE, with the conversion rate improving dramatically as time passes. For instance, keeping 1 million River Pts for the full 180 days could result in receiving 270 times more $RIVER than converting on the first day, according to

The rapid rise in $RIVER’s value happened alongside its debut on Binance Futures, Bybit, and other trading platforms, resulting in more than $100 million in daily trading volume, according to Decrypt. Over 80,000 wallets and 40,000 X accounts are eligible to claim River Pts, with participants exploring tactics like hedging with perpetual contracts or timing their conversions for maximum benefit, as noted by Cryptopolitan. Influencers such as @AirdropAlchemis and @Mars_DeFi have pointed out the game-theory aspects of the mechanism, likening it to automated market makers (AMMs) for its integration of time into value creation, a perspective also highlighted in River’s blog post.

River’s strategy stands apart from conventional airdrops, which usually conclude once tokens are distributed. Instead, DAC turns the airdrop into a 180-day liquidity event, where user actions have a direct impact on price and supply, according to a

The project’s overarching goal is to develop a chain-abstraction stablecoin platform, with satUSD supporting cross-chain collateral and yield opportunities. Still, River’s DAC system has stood out as a significant innovation in tokenomics, drawing attention for its balance of instant liquidity and long-term rewards, as described in River’s blog post. With $RIVER now stabilizing between $3 and $4, some analysts believe this mechanism could become a model for future token launches, favoring flexible systems over strict unlock periods, a sentiment echoed by Cryptopolitan.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cardano Mirrors Its 2020 Blastoff: Is ADA Headed for $5 or $10 This Altseason?

Weeks after raising $100M, investors pump another $180M into hot Indian startup MoEngage

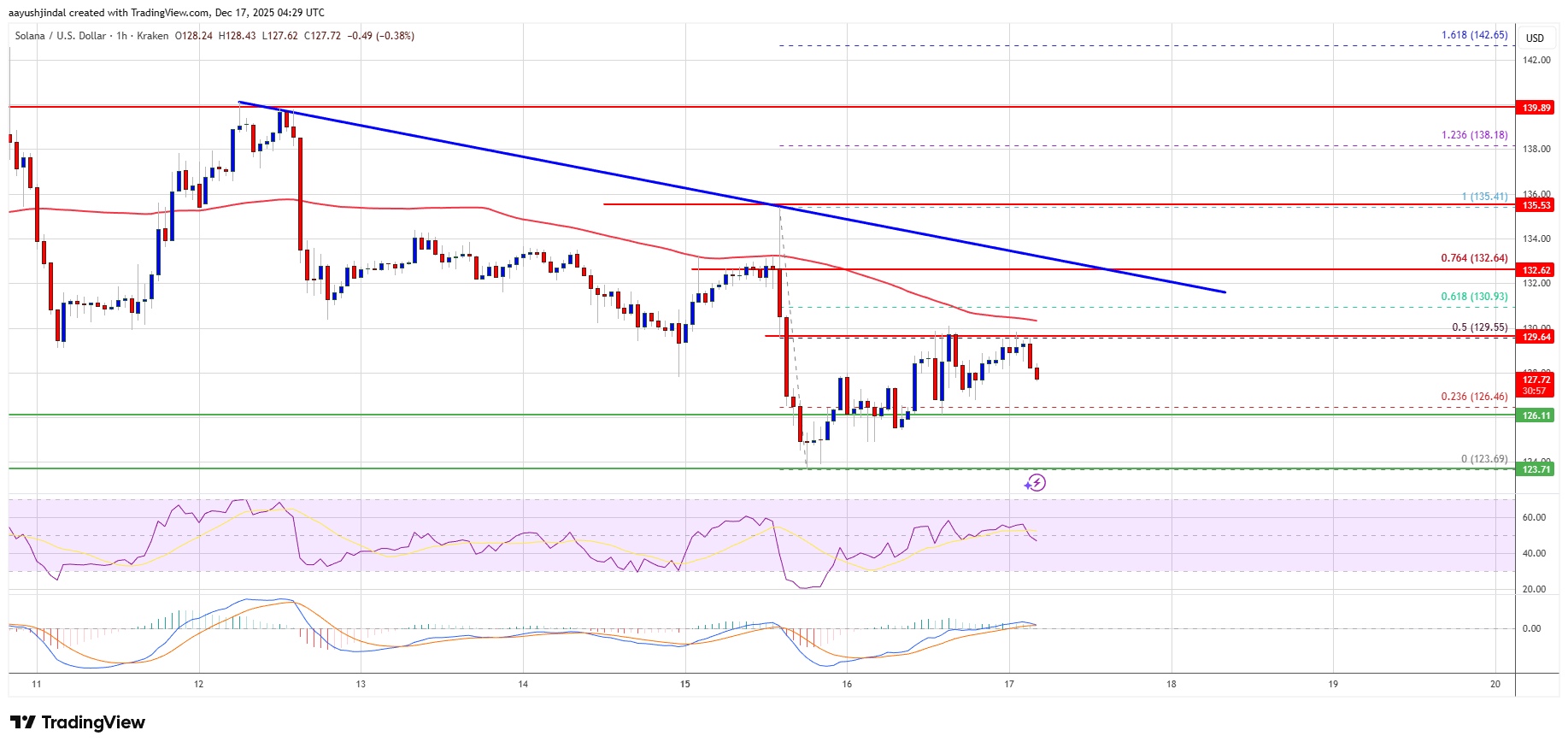

Solana (SOL) Loses Momentum—Could Sellers Take Control Again?

Fed Chair Selection: How Christopher Waller’s Crypto-Friendly Stance Could Transform US Monetary Policy