Bitcoin Updates: Major Institutions Make Bold Moves Amid Crypto’s Volatile Shifts Between Optimism and Uncertainty

- Bitcoin and Ethereum faced sharp corrections below $110,000 and $3,900 amid geopolitical tensions and $19B liquidations triggered by Trump's tariff announcements. - Institutional buyers like BitMine ($250M ETH purchase) and MicroStrategy (168 BTC) signaled long-term crypto confidence despite market volatility. - Capital rotated from gold to crypto as Bitcoin surged past $113,000, fueled by Fed's "skinny master account" program and potential gold-to-crypto asset shifts. - U.S. spot Bitcoin ETFs recorded $

This week,

This sharp downturn arrived after a period of record-breaking gains, with Bitcoin climbing above $126,000 in early October before tumbling 19.56% within a matter of hours. Despite this, institutional investors remained active:

This correction happened alongside a rapid withdrawal of capital from conventional safe-haven assets. Gold and silver both suffered steep losses—over 6% and 8.7% respectively—as investors redirected funds into Bitcoin.

However, obstacles remained. U.S. spot Bitcoin ETFs saw outflows for four consecutive days, with BlackRock’s IBIT experiencing $100.65 million in withdrawals on October 20, according to

Despite ongoing volatility, some market observers remain optimistic. Activity on Ethereum’s network and within DeFi has rebounded, with daily transactions topping 1.2 million and total value locked increasing by 8% week-over-week. Should ETH break above $4,400, it could reach $5,000 before the year ends, according to forecasts from

The conflicting signals highlight how sensitive the crypto market is to global economic developments. While institutional investors and AI-powered strategies—such as

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

木頭姐豪擲$5,500萬加倉,Bitcoin Hyper受關注

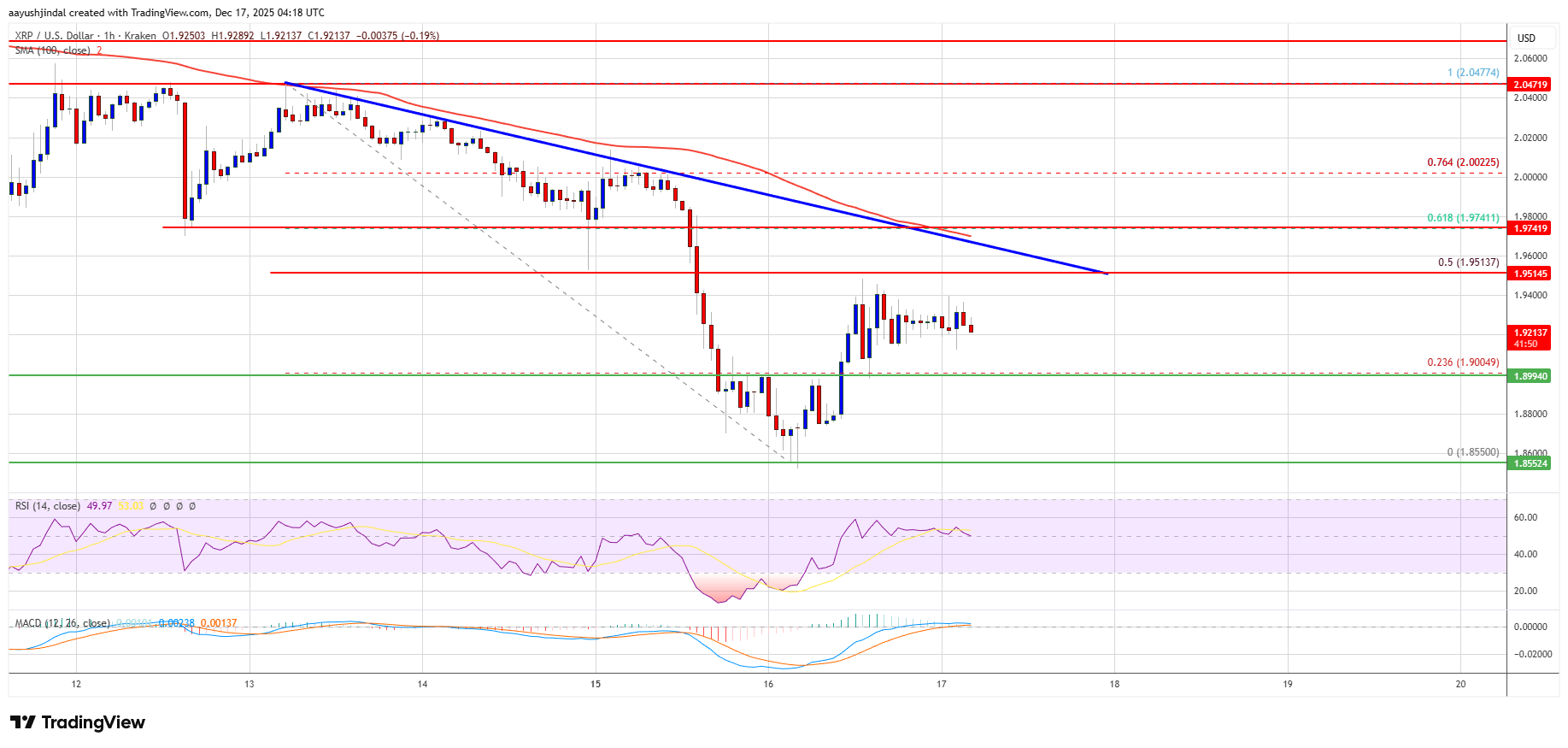

XRP Price Recovery Looks Fragile—Can Bulls Break the Cap?