Ethereum News Update: Is This a Bearish Indicator or Arbitrage Opportunity? Whale's $390 Million DeFi to CEX Transfer Faces Examination

- Crypto whale deposits $390M USDC on Aave, borrows 42,000 ETH, transfers to Binance via two transactions. - Strategy combines DeFi lending and CEX trading, exploiting arbitrage or shorting opportunities amid volatility. - Market debates bearish Ethereum signals vs. risk-mitigated leverage, tracking Aave utilization and Binance liquidity. - USDC’s cross-chain role amplifies liquidity shifts, impacting broader crypto capital flows and volatility.

An influential crypto whale associated with the "1011 Insider Whale" address has transferred $390 million worth of

This whale’s moves have caught the eye of both traders and analysts, who are closely tracking funding rates and open interest for potential market-wide impacts. By leveraging Aave’s lending features to turn stablecoin collateral into ETH, the whale seems to be seeking arbitrage or short-term profit opportunities. The swift movement of borrowed ETH to Binance—where it could be traded, lent, or used for hedging—highlights the seamless flow of capital between DeFi and centralized exchanges. Experts point out that such large-scale transfers can intensify liquidity challenges and affect risk assessment throughout the crypto sector, especially as funding expenses and utilization on platforms like Aave shift, as noted in the Coinotag article.

There is also ongoing debate among market observers about whether the whale’s recent actions reflect a bearish outlook on

These transactions also emphasize the influence that large on-chain players have on market sentiment. By carrying out these operations, the whale has indirectly shaped perceptions of liquidity and funding needs, which can have ripple effects across both DeFi and centralized platforms. Yu Jin noted that such activity could heighten volatility if others in the market adjust their tactics in response. The focus on USDC—a stablecoin widely used across different chains—adds further complexity, as shifts in stablecoin liquidity can affect broader capital movement, according to the Coinotag report.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

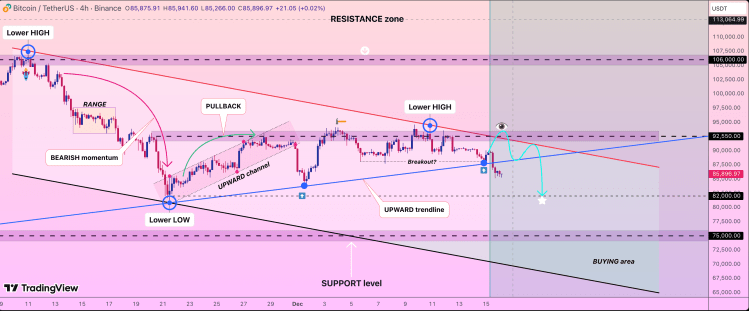

The Bearish Structure That Puts Bitcoin Price At $92,550, And Then $82,000

Is Monero (XMR) Gearing Up for a Bullish Breakout? This Key Pattern Formation Suggest So!

Aave charts post-SEC expansion as DeFi lender sharpens growth strategy

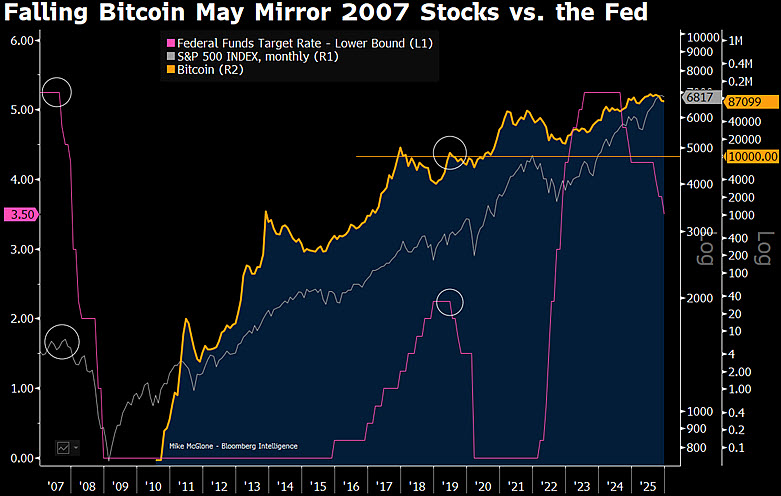

Don't Be Surprised If Bitcoin Resets to $10,000: Top Bloomberg Expert Reveals 2007 Parallel