Bitcoin News Today: Bitcoin’s Dormant Coins Move After 7 Years: Sign of Bullish Buying or Warning of Upcoming Correction?

- Bitcoin's 7-year-dormant coin activity surged to annual highs in 2025, per CryptoQuant, signaling potential market shifts from old miners, institutions, or strategic reserve adjustments. - Price consolidation near $115,000 faces bearish risks below $100,000 and bullish potential toward $126,000, with analysts monitoring on-chain flows for trend clarity. - "Dolphin" holders (100–1,000 BTC) control 26% of supply, adding 681,000 BTC in 2025—near historical averages—suggesting sustained bull-cycle fundamenta

Bitcoin’s on-chain metrics have experienced a notable uptick, with coins that have been untouched for more than seven years reaching their highest activity level in a year, hinting at possible changes in the market landscape. This trend, observed by on-chain analytics provider CryptoQuant, has fueled discussions, as highlighted in

The recent movement of long-inactive Bitcoin—surpassing previous 2024 records—has caught the eye of both market analysts and investors. These assets, which include coins from early miners, company reserves, and institutional portfolios, may reflect either a resurgence of trust in Bitcoin or partial sell-offs to support new projects. CryptoQuant links this activity to reasons such as transferring assets between cold wallets, strategic changes in reserves, and potentially the reactivation of wallets from earlier market cycles, according to Benzinga.

At the same time, Bitcoin’s price is consolidating near a crucial resistance point at $115,000. Bulls are aiming for another attempt at the $126,000 record high, but bearish forces remain, with $100,000 serving as a significant support level. Should the price fall below this mark, a steeper decline toward $75,000 could follow, according to Benzinga.

The figures also underscore the influence of so-called “Dolphin” holders—those with 100 to 1,000 BTC—who collectively possess 26% of all Bitcoin. These major players, including ETFs and large companies, have accumulated 681,000 BTC so far in 2025, outpacing the yearly average of 730,000 BTC. Historically, such accumulation has preceded price surges, indicating the ongoing strength of the bull market despite recent fluctuations, Benzinga observed.

CryptoQuant’s research points out that the NVT (Network Value to Transactions) Golden Cross, an indicator of market overheating, is currently well below its historical highs. Unlike previous bull market tops where this metric exceeded 3, current readings suggest the cycle still has room to run. “Without an upward phase, a crypto winter cannot occur,” the firm stated, highlighting Bitcoin’s robust long-term outlook, as reported by Benzinga.

Nevertheless, further price increases depend on continued accumulation by large holders. A slowdown in Dolphin activity could indicate a change in market mood, possibly leading to an extended downturn. Market participants are watching on-chain data closely to determine whether the current period is a temporary pause in the bull trend or the start of a bearish shift, according to Benzinga.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

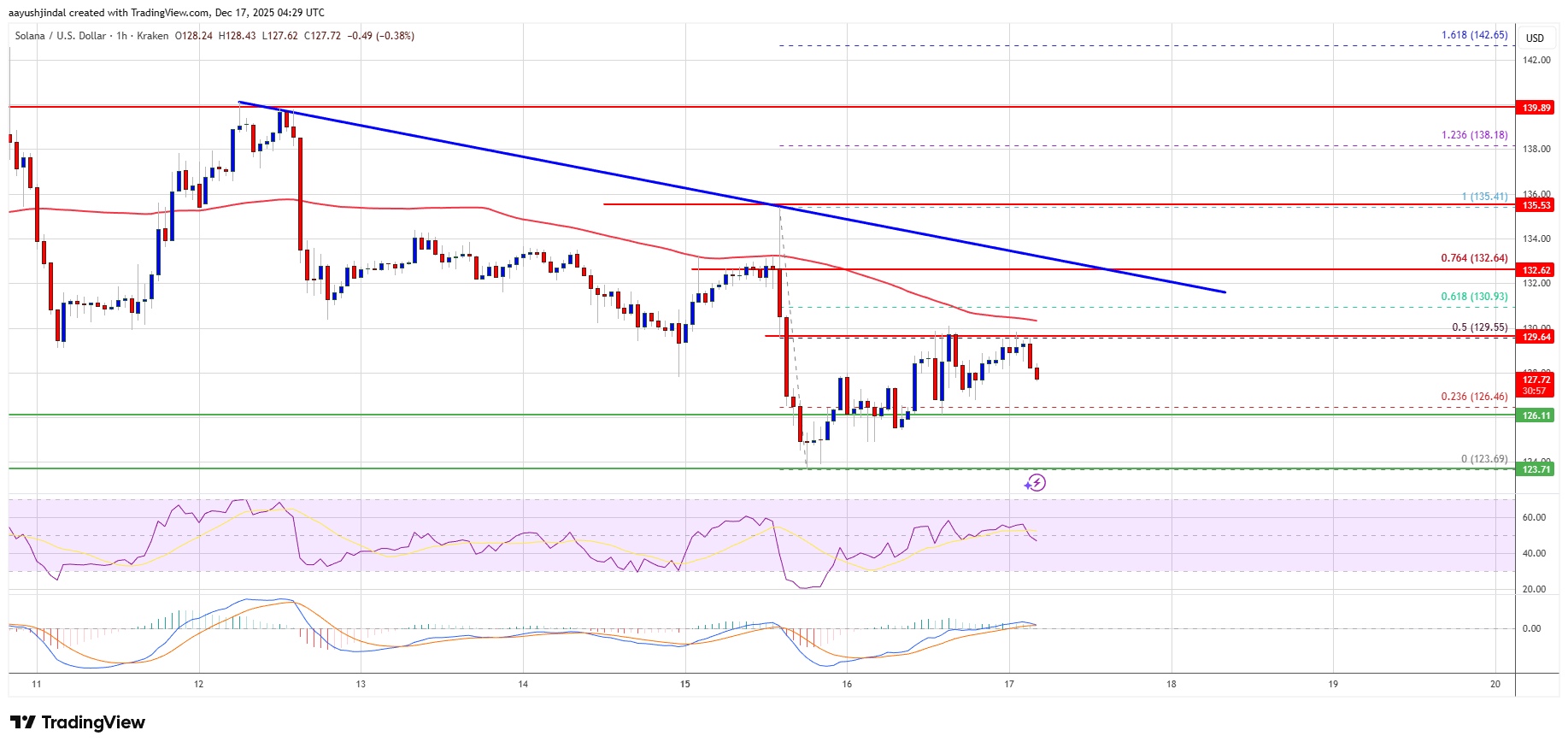

Solana (SOL) Loses Momentum—Could Sellers Take Control Again?

Fed Chair Selection: How Christopher Waller’s Crypto-Friendly Stance Could Transform US Monetary Policy

Securitize to launch first natively tokenized stocks in Q1 2026

Bitcoin, Ethereum Plunge Triggers Near-$600 Million Crypto Long Flush