Satoshi-Era Bitcoin Whale Awakens After 14 Years: Will It Move BTC Price?

A dormant Bitcoin whale from 2009 has moved $16 million after 14 years, stirring questions about who’s behind it — and what it means for BTC.

A Bitcoin wallet dating back to the cryptocurrency’s earliest days has just come to life after more than 14 years of inactivity.

The address, believed to have mined around 4,000 BTC between April and June 2009, transferred 150 BTC this week — the first movement since June 2011.

Rare Movement from the Early Bitcoin Era

The coins, worth just $67,724 when last active, are now valued at roughly $16 million. On-chain data shows the wallet initially consolidated its mined BTC into a single address in 2011 and had remained untouched since.

A Satoshi-era wallet that mined 4,000 BTC between April and June 2009 – just months after Bitcoin’s launch – and consolidated everything into one wallet in June 2011, has just transferred out 150 BTC after 14.3 years of dormancy.It was worth $67,724 back in 2011.Now that same…

— MLM (@mlmabc)

Transfers from Satoshi-era wallets are extremely rare. Data from Glassnode suggests only a handful of pre-2011 wallets move funds each year.

The coins from this period were mined when Bitcoin’s creator, Satoshi Nakamoto, was still active in online discussions, making such movements a magnet for speculation.

Historically, old-wallet awakenings trigger short-term jitters in the market. Traders often interpret these moves as early holders preparing to sell, sparking fears of large inflows to exchanges.

However, in most past cases, the coins were not sold but simply moved to new addresses for security, inheritance, or consolidation purposes.

Bitcoin Price Chart In October. Source:

Bitcoin Price Chart In October. Source:

Why the Timing Matters

The move comes as Bitcoin trades around $110,000, consolidating after a steep drop from its recent all-time high above $126,000 earlier this month.

The market is recovering from the largest liquidation event in crypto history, with $19 billion wiped out across leveraged positions.

Sentiment remains fragile. Any signal suggesting potential sell pressure — especially from long-dormant wallets — can amplify caution.

Still, the 150 BTC transfer represents a negligible share of daily Bitcoin trading volume, which exceeds $20 billion, making the market impact mostly psychological.

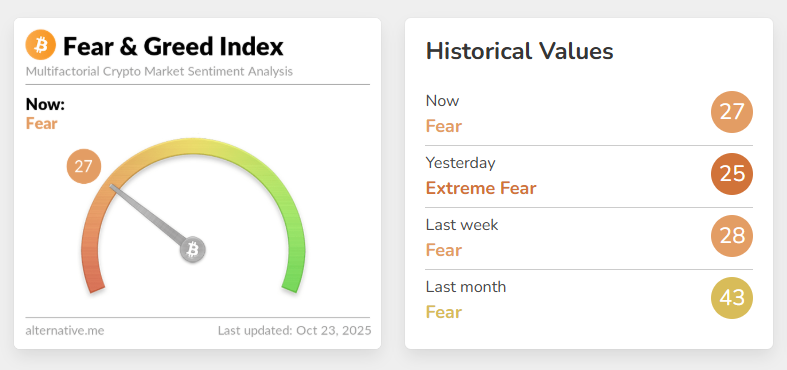

Crypto Fear and Greed Index. Source:

Crypto Fear and Greed Index. Source:

Possible Explanations

There are several plausible reasons behind the move. The owner could be migrating coins to a modern, secure wallet, executing estate planning, or testing transaction functionality.

Unless the funds are later traced to exchange-linked addresses, it is unlikely that the coins were sold.

Similar awakenings in 2021 and 2023 did not lead to sustained price drops. Those transactions were eventually linked to personal reorganization rather than liquidations.

Market Context and Implications

The Bitcoin market has been volatile in recent weeks, shaped by macroeconomic tension and heightened sensitivity to on-chain data.

With prices consolidating between $108,000 and $111,000, traders are looking for direction amid fears of further corrections.

In this environment, old-wallet movements act as symbolic reminders of Bitcoin’s early decentralization — and the immense fortunes still sitting dormant.

For investors, unless these coins reach exchange wallets, such awakenings hold psychological weight, not market-moving power.

Bottom Line

The 14-year-old wallet’s activity is a historic anomaly rather than a harbinger of major market shifts. It reflects Bitcoin’s longevity and the vast untapped wealth from its earliest mining era.

For now, the market continues to watch closely — but the move appears more like digital housekeeping than a signal of imminent selling.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing How COAI's Abrupt Price Decline Influences Technology and Security Shares: Shifts in Sector Risk and Changes in Investor Sentiment After the Crash

- COAI index's 88% 2025 collapse exposed fragility of speculative crypto AI assets due to governance failures and regulatory uncertainty. - Institutional investors shifted capital to cybersecurity (e.g., CrowdStrike) and AI infrastructure (Nvidia) as post-crash safe havens. - Divergent investor psychology emerged: 60% retail optimism vs. 41% institutional skepticism toward AI valuations. - U.S. AI Action Plan and cybersecurity policies accelerated capital reallocation to secure-by-design infrastructure and

Ripple celebrates milestones – while XRP struggles below USD 2

MicroStrategy retains its place in the Nasdaq-100 despite Bitcoin dominance

Interactive Brokers allows account funding with stablecoins