T. Rowe Price Files for Actively Managed Crypto ETF, Surprising Analysts

Quick Breakdown

- T. Rowe Price has filed with the SEC to launch an actively managed crypto ETF holding 5–15 major cryptocurrencies.

- The move marks a significant shift from its mutual fund-dominated portfolio and conservative stance.

- Analysts say the filing shows legacy firms are racing to secure a foothold in the booming digital asset ETF market.

T. Rowe price makes nold entry into Crypto ETF market

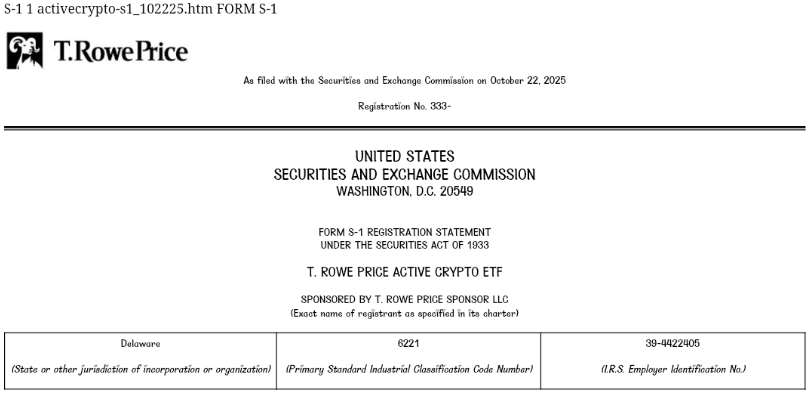

In a surprising twist, trillion-dollar asset manager T. Rowe Price has filed to launch an actively managed cryptocurrency exchange-traded fund (ETF) in the United States. The move marks a dramatic pivot for the 87-year-old investment firm, which has traditionally focused on mutual funds and remained cautious toward digital assets .

Source:

U.S SEC

Source:

U.S SEC

The filing , submitted to the U.S. Securities and Exchange Commission (SEC) on Wednesday, outlines plans for an “Active Crypto ETF” that will invest in five to fifteen cryptocurrencies approved under the SEC’s generic listing standards. Eligible assets include Bitcoin (BTC), Ether (ETH), Solana (SOL), and XRP, among others.

The filing has drawn strong reactions from industry observers. Nate Geraci, President of NovaDius Wealth Management, described the move as “completely from left field,” suggesting that traditional investment giants that missed the first wave of crypto ETFs are now racing to establish their positions.

Similarly, Bloomberg ETF analyst Eric Balchunas labeled the filing a “semi-shock,” noting that T. Rowe Price’s $1.8 trillion portfolio has long been centered around mutual funds. “Did not expect it, but I get it. There’s gonna be a land rush for this space too,” he said.

Active management and broader token exposure

Unlike single-asset ETF applications currently awaiting SEC approval, T. Rowe’s proposed fund aims to outperform the FTSE Crypto US Listed Index. Its asset weighting will be determined by fundamentals, valuation, and momentum rather than purely by market capitalization.

Other cryptocurrencies considered for inclusion include Cardano (ADA), Avalanche (AVAX), Litecoin (LTC), Dogecoin (DOGE), Hedera (HBAR), Bitcoin Cash (BCH), Chainlink (LINK), Stellar (XLM), and Shiba Inu (SHIB).

The fund’s diversified approach could give investors broader exposure to the crypto market without concentrating risk in a single token.

Notably, The U.S. SEC) is set to rule on 16 cryptocurrency exchange-traded fund (ETF) applications in October. The pending decisions cover major tokens such as Solana (SOL), XRP, Litecoin (LTC), Cardano (ADA), Hedera (HBAR), and Dogecoin (DOGE), with final deadlines staggered across the month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing KITE’s Price Prospects After Listing as Institutional Interest Rises

- Kite Realty Group (KRG) reported Q3 2025 earnings below forecasts but raised 2025 guidance, citing 5.2% ABR growth and 1.2M sq ft lease additions. - Institutional investors showed mixed activity, with Land & Buildings liquidating a 3.6% stake while others increased holdings, reflecting valuation debates. - Technical indicators suggest bullish momentum (price above 50/200-day averages) but a 23.1% undervaluation vs. 35.1x P/E, exceeding sector averages. - KRG lags peers like Simon Property in dividend yie

Evaluating How the MMT Token TGE Influences Crypto Ecosystems in Developing Markets

- MMT's volatile TGE highlights tokenized assets' dual role as liquidity engines and speculative risks in emerging markets. - Institutional investors allocate up to 5.6% of portfolios to tokenized assets, prioritizing real-world integration and cross-chain utility. - Regulatory fragmentation and smart contract risks demand CORM frameworks to mitigate operational vulnerabilities in DeFi projects. - MMT's deflationary model and institutional backing face macroeconomic challenges, requiring hedging against gl

Trust Wallet Token's Latest Rally and Growing Institutional Interest: Driving Sustainable Value

- Trust Wallet Token (TWT) surged in 2025 due to institutional partnerships, utility upgrades, and real-world asset (RWA) integrations. - Collaborations with Ondo Finance (tokenizing $24B in U.S. Treasury bonds) and Onramper (210M+ global users) expanded TWT's institutional-grade utility. - Governance upgrades, FlexGas payments, and Binance co-founder CZ's endorsement boosted TWT's credibility and institutional appeal. - Analysts project TWT could reach $5.13 by year-end, driven by cross-chain integrations

Clean Energy Market Fluidity and the Emergence of REsurety's CleanTrade Solution

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a regulatory breakthrough for clean energy trading infrastructure. - The platform addresses $16B+ in pent-up demand by providing liquidity, transparency, and institutional-grade safeguards for VPPAs, PPAs, and RECs. - CleanTrade's integration of carbon tracking analytics and ESG alignment tools enables institutional investors to quantify environmental impact alongside financial returns. - By resolving counterparty risks and enabling cross-asset