3 Altcoins Whales Are Selling Fast as October Ends

Altcoin whales are exiting fast as October ends. This analysis tracks three major tokens seeing heavy sell pressure — SHIBA INU (SHIB), CARDANO (ADA), and ZORA (ZORA). From SHIB’s stalled triangle breakout to ADA’s fading momentum and ZORA’s profit-taking drop, these coins show how whale exits are reshaping the altcoin market.

Whales are selling several major altcoins fast as October draws to a close. Since October 13, the total altcoin market cap (excluding Bitcoin) has dropped by over 11%, slipping from $1.62 trillion to $1.45 trillion.

The decline isn’t only due to falling prices — large holders have been steadily reducing exposure. While some projects still attract quiet accumulation, there are three altcoins that whales are selling fast. The selling spree comes amid delayed breakouts, profit-taking, and fading confidence.

Shiba Inu (SHIB)

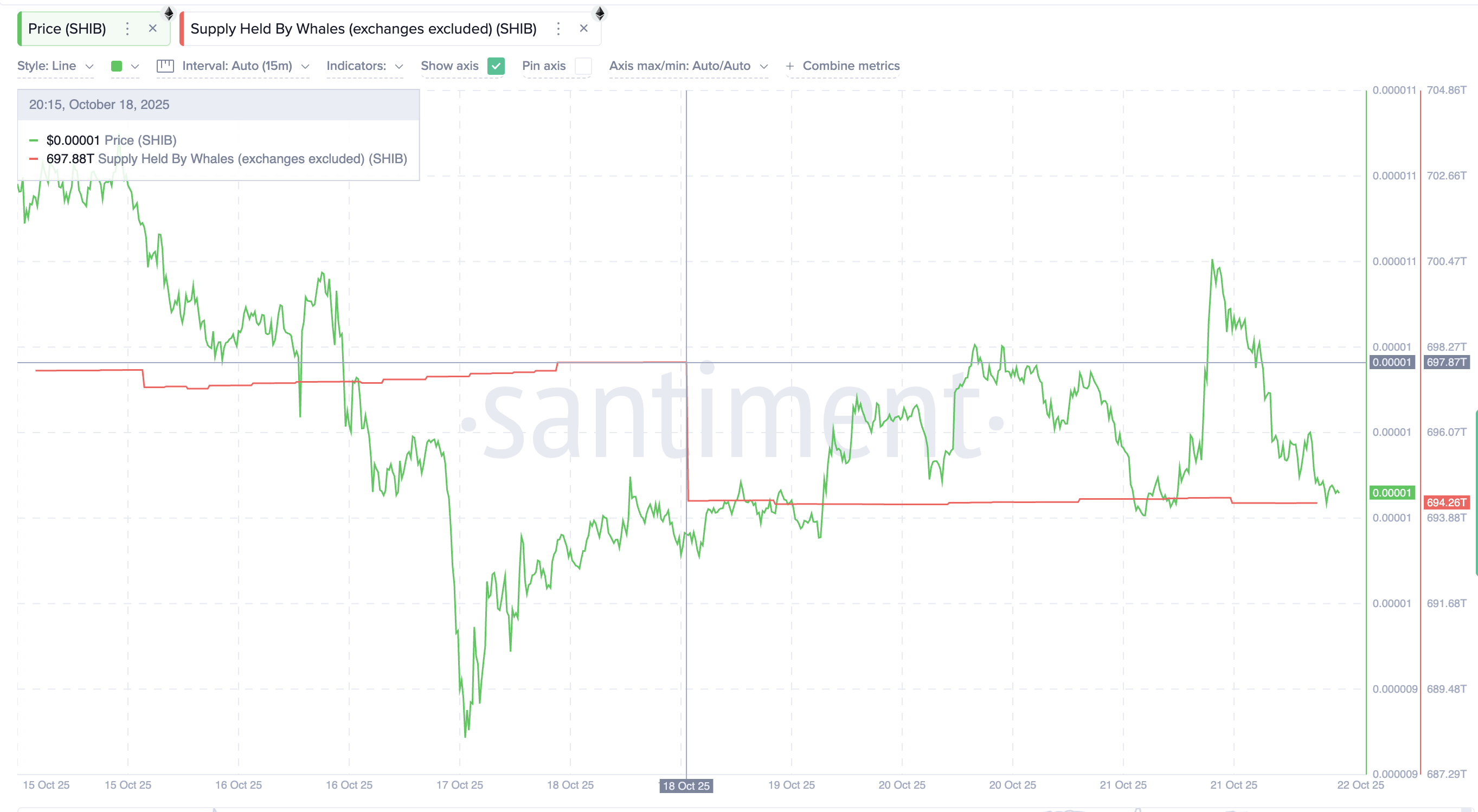

Whales appear to be losing interest in Shiba Inu, steadily offloading their holdings since October 18.

Data shows that wallets dropped their combined stash from 697.88 trillion to 694.26 trillion, a reduction of roughly 3.62 trillion SHIB, worth about $355,000 at the current price of $0.0000098.

SHIB Whales:

SHIB Whales:

This selling aligns with Shiba Inu’s chart setup. The token has been stuck inside a symmetrical triangle pattern since October 10, signaling indecision. Between October 14 and 20, the price formed lower highs while the Relative Strength Index (RSI), which measures price momentum, made higher highs.

This pattern is known as hidden bearish divergence, often signaling that a downtrend will continue.

SHIB Price Analysis:

SHIB Price Analysis:

The broader picture supports that view. SHIBA INU is down 27.2% over the past three months, confirming the ongoing downtrend.

A daily close below $0.0000097 could send it to $0.0000092, while a breakout above $0.000010 might open the door toward $0.000011. For now, however, whales seem unconvinced that such a SHIB price rebound is near.

Cardano (ADA)

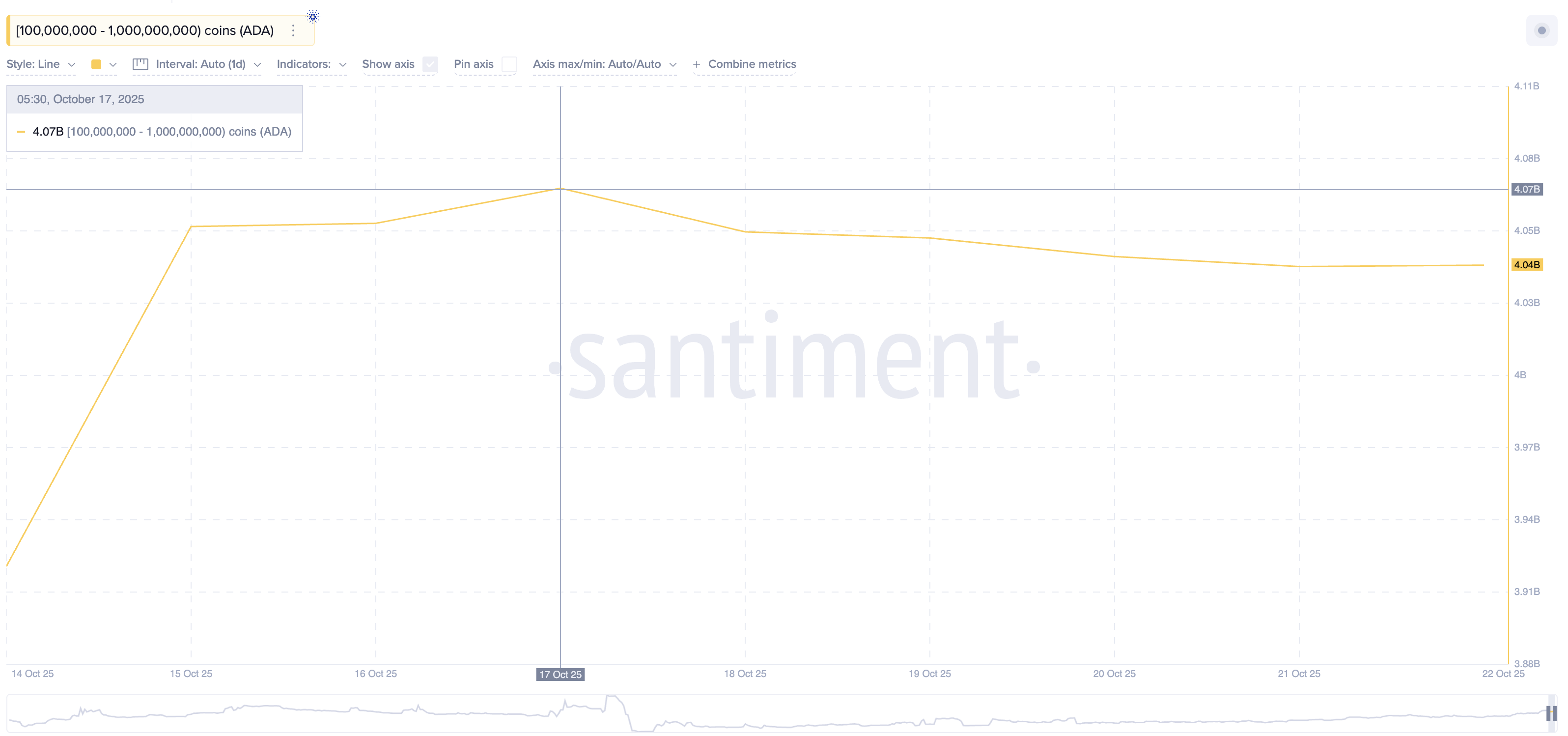

Crypto whales holding ADA between 100 million and 1 billion tokens have started trimming their positions since October 17. Their combined holdings fell from 4.07 billion ADA to 4.04 billion ADA, a reduction of about 30 million ADA, worth nearly $19 million at the current price of $0.63.

Cardano Whales Offloading:

Cardano Whales Offloading:

The timing of this sell-off is important. On October 17, ADA briefly broke below the ascending channel’s lower trendline, which has only two touchpoints and is structurally weak. The breakdown seems to have triggered mild panic among whales.

Although ADA prices recovered later, selling hasn’t stopped, suggesting confidence remains low.

Between October 13 and 20, the price made a lower high while the Relative Strength Index (RSI) formed a slightly higher high, indicating a hidden bearish divergence. This pattern usually points to trend continuation (21% down over the past three months) rather than reversal. If ADA fails to hold $0.61, it could slide toward $0.59 or even $0.50.

Cardano Price Analysis:

Cardano Price Analysis:

To invalidate this bearish outlook, ADA must clear $0.86, a resistance level, 36% higher than the current level. This level has capped multiple Cardano rallies before. Until then, the upside target near $1.12 (channel breakout point) remains unlikely — at least for now.

Zora (ZORA)

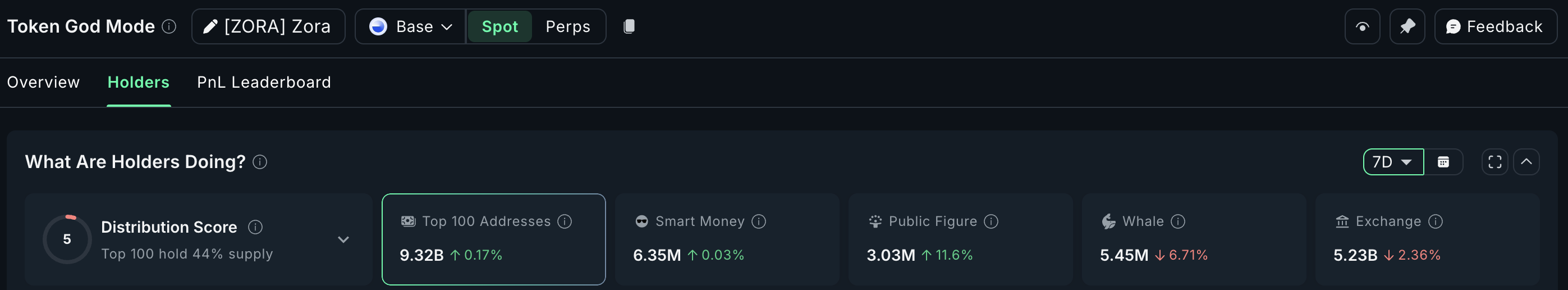

ZORA whales are cashing out. They are likely taking profits after their strong monthly rally. The token has gained over 61% in the past 30 days but has slipped 15.6% in the last week as large holders started selling.

Whale wallets have reduced their holdings by 6.71%, cutting their collective stash to 5.45 million ZORA. That means roughly 390,000 ZORA tokens have been sold in the past seven days.

ZORA Whales:

ZORA Whales:

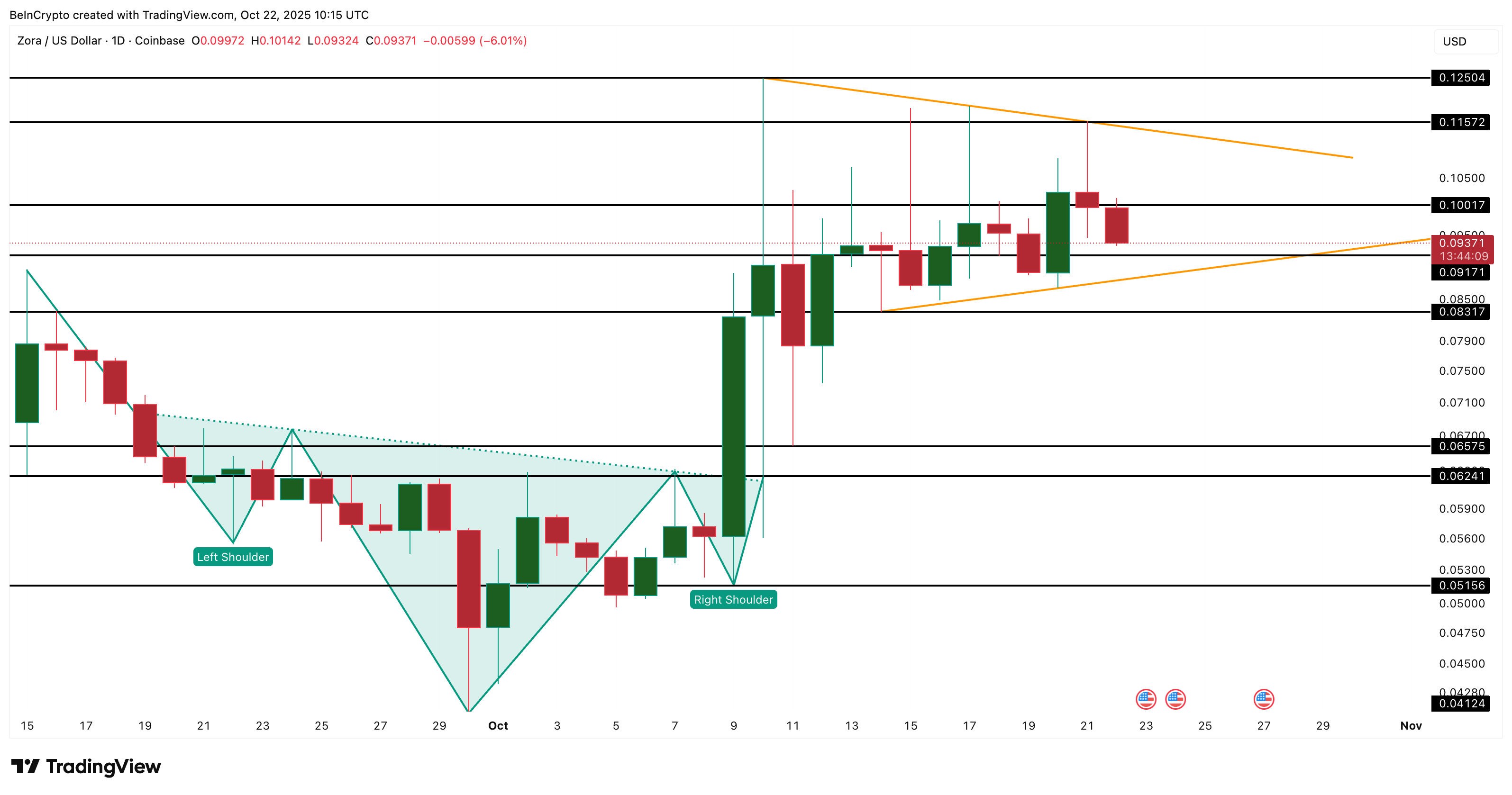

ZORA’s price action reflects this cooldown. After breaking out of an inverse head-and-shoulders pattern as predicted earlier this month, it’s now consolidating inside a symmetrical triangle, showing a pause in momentum.

If $0.091 fails to hold, a deeper correction toward $0.083 or even $0.065 could follow.

ZORA Price Analysis:

ZORA Price Analysis:

Still, this looks more like a profit-booking phase than a full trend reversal. A daily close above $0.10 and then $0.11 would invalidate the short-term bearish setup, opening room for another push higher — and possibly reviving whale interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wellness-Driven Industries: A Profitable Intersection of Individual Health and Economic Wellbeing

- The global wellness industry, valued at $2 trillion, is reshaping healthcare , tech, and education through holistic well-being integration. - Younger generations drive 41% of U.S. wellness spending, prioritizing mental resilience and financial stability alongside physical health. - AI and wearables bridge health and financial wellness, with startups like Akasa and Meru Health leveraging tech for personalized solutions. - Education institutions adopt wellness programs, supported by public-private partners

Financial Well-being and Investment Choices: The Impact of Individual Financial Stability on Market Involvement and Building Lasting Wealth

- Financial wellness, combining objective health and subjective well-being, directly influences market participation and investment success according to 2025 studies. - Four financial wellness quadrants reveal systemic gaps: only 38% achieve high health and well-being, while millennials show mixed confidence amid rising debt and stagnant wages. - Behavioral biases affect all investors: 84% of high-net-worth individuals seek education to counter overconfidence, while young investors rely on social media for

The Growing Impact of Artificial Intelligence on Learning and Professional Development

- Global AI in education market to grow from $7.57B in 2025 to $32.27B by 2030 (31.2% CAGR), driven by classroom AI adoption and workforce training. - Asia-Pacific leads growth (35.3% CAGR), with 60% U.S. teachers and 86% global students using AI for personalized learning and content summarization. - Institutions like Farmingdale State College pioneer AI integration through interdisciplinary programs and NSF-funded ethical AI research initiatives. - Strategic partnerships (e.g., IBM-Pearson) and platforms

The Influence of TWT’s Updated Tokenomics on the Dynamics of the Cryptocurrency Market

- TWT/TON's 2025 tokenomics shift from speculative governance to utility-driven ecosystem integration, embedding tokens in platform functions like Trust Premium. - Deflationary mechanisms (88.9B tokens burned) and cross-chain FlexGas systems create scarcity, mitigating oversupply risks while expanding transactional use cases. - Governance reforms prioritize community voting on fees and partnerships, but face challenges from regulatory uncertainty and Solana network dependencies. - Institutional adoption gr