Bloomberg Analyst Eric Balchunas Shares a Key List of Altcoin ETFs! Here Are the Details…

The government has been shut down in the US since the beginning of October, so official institutions are operating on a limited basis.

The government shutdown has affected all sectors, and cryptocurrency is one of them. The wave of ETF approvals for altcoins like XRP and Solana (SOL) expected in October has also been delayed.

At this point, it seems that the number of altcoin ETFs, whose final approval decisions have not been announced by the SEC due to the government shutdown in the US, will increase in the coming period.

Bloomberg senior ETF analyst Eric Balchunas predicted in his post that more than 200 crypto ETPs could be launched within a year.

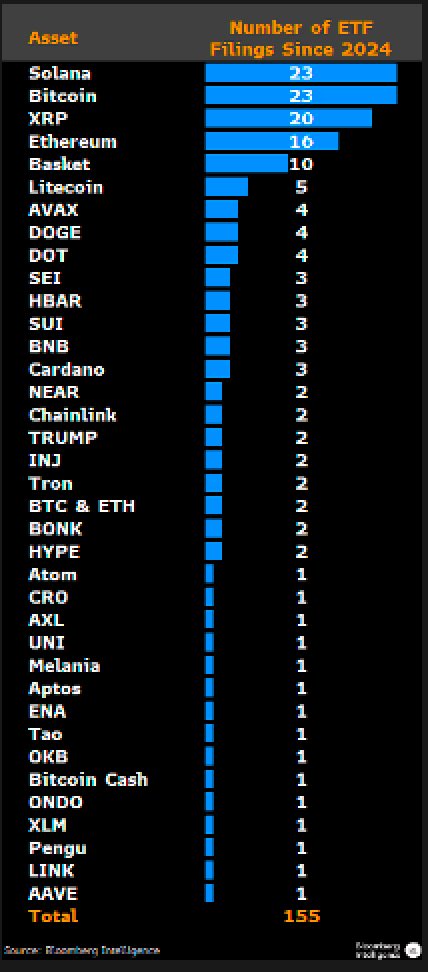

According to Eric Balchunas, there are currently 155 ETFs on the market that track 35 different cryptocurrencies.

Balchunas predicted that more than 200 ETFs are likely to launch in the next 12 months.

The cryptocurrencies with the most ETFs are Solana (SOL) and Bitcoin (BTC), followed by XRP and Ethereum (ETH).

Popular altcoins such as Litecoin (LTC), Avalanche (AVAX), and Dogecoin (DOGE) also top the list.

Analysts expect more institutional investors to enter the market with the SEC's approval of crypto ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TWT’s 2025 Tokenomics Revamp: Redefining Utility and Investor Rewards on Solana

- Trader Joe's (TWT) 2025 tokenomics prioritizes utility over speculation, offering gas discounts, DeFi collateral, and governance rights. - A deflationary model with 88.9B tokens burned creates scarcity, while loyalty rewards redistribute existing tokens to avoid dilution. - Community governance allows holders to vote on platform upgrades, aligning token value with ecosystem growth and user participation. - This Solana-based approach redefines DeFi incentives by linking price appreciation to real-world ut

HYPE Token: Evaluating Immediate Price Fluctuations and Speculative Dangers in the Meme-Based Cryptocurrency Sector

- HYPE token, a meme-driven crypto, relies on social media hype and influencer endorsements rather than traditional financial metrics. - The $TRUMP meme coin example highlights extreme volatility, with large profits for top wallets and massive losses for retail investors. - Institutional products like CMC20 exclude meme coins, signaling limited recognition of their market utility despite growing crypto infrastructure. - Regulatory scrutiny intensifies as SEC targets influencer promotions, while foreign inv

PENGU Token Value Soars: An In-Depth Technical and On-Chain Examination of Market Trends

- PENGU token's 12.8% 24-hour surge driven by Bitcoin's 4.3% rally and altcoin rebound. - Technical indicators show short-term bullish momentum conflicting with long-term bearish trends. - Whale activity and $8.91M in exchange inflows contrast with 2B token outflows and leveraged shorts. - NFT sales decline and DeFi innovations like CMC20 index token add downward pressure. - Analysts urge caution due to structural weaknesses despite short-term trading opportunities.

Banks Transform Finance: Cryptocurrency Adoption Sparks Fundamental Shifts

- LevelField Financial secures state approval to acquire Burling Bank, aiming to integrate crypto services into traditional banking with $70M deal. - Post-2023 crypto bank collapses, regulators adopt cautious openness, enabling LevelField's renewed acquisition bid amid Trump's "crypto capital" agenda. - SGX Derivatives launches Bitcoin/Ethereum futures targeting institutions, aligning with $187B daily crypto derivatives volume in Asia. - Grab and GoTo struggle to consolidate Southeast Asian fintech despite