Pendle Settles $69.8 Billion in Yield Bridging the $140T Fixed Income Market to Crypto

October 21st, 2025 – Singapore, Singapore

Pendle is advancing the tokenization of yield in the decentralized finance (DeFi) sector, introducing mechanisms that align with established financial principles.

With the global fixed-income market projected to reach $198.58 trillion by 2030, Pendle’s approach highlights a potential link between traditional financial instruments and decentralized systems.

This week, Pendle revealed a major milestone: the protocol has settled $69.8 billion in fixed yield and facilitated over $6 billion in Total Value Locked (TVL), making it one of the most impactful real-world asset (RWA) applications in DeFi to date. This announcement comes as Pendle expands its capabilities by integrating USDe yield markets in collaboration with Ethena, enabling tokenized access to fixed yields in a crypto-native, transparent environment.

“We’re building a world where fixed income is programmable and permissionless,” Pendle stated in a recent post. “By integrating USDe yield markets and building the fixed-rate layer for RWAs, we’re laying the foundation for institutions to access DeFi-native fixed income at scale.”

Fixed-Income Market Potential

Pendle’s work targets one of the largest sectors in global finance: the fixed-income market, valued at $145.26 trillion in 2024 and projected to reach nearly $200 trillion by 2030, growing at a 5.3% compound annual rate.

The global non-household debt market—closely linked to fixed income through corporate and sovereign bond issuance—has exceeded $150 trillion as of Q1 2025. This massive and complex market is traditionally dominated by players such as JPMorgan Chase, Goldman Sachs, BlackRock, Fidelity Investments, and The Vanguard Group.

Despite its scale, the fixed-income sector continues to face challenges related to limited transparency, accessibility barriers for smaller participants, and dependence on intermediaries. Pendle’s approach seeks to introduce a more transparent and efficient model through tokenized and decentralized fixed-income instruments.

Pendle’s Distinct Approach

Pendle enables yield-bearing assets to be divided into two components: Principal Tokens (PT) and Yield Tokens (YT). This structure allows fixed yield to be programmed and traded within a decentralized environment, mirroring a key element of the traditional fixed-income market.

Through its integration with various DeFi protocols, Pendle has expanded its fixed-rate yield capabilities. By developing fixed-rate markets for stablecoins and real-world assets (RWAs).

These developments have attracted growing participation from both individual and institutional users. With more than $69.8 billion in fixed yield settled and over $6 billion in total value locked (TVL) across Ethereum and other networks, Pendle has established itself as a leading protocol in decentralized fixed-income solutions.

A New Financial Frontier

Tokenizing the fixed-income market carries important implications for global finance. Traditional fixed-income instruments, while established and reliable, often face limitations related to accessibility and settlement efficiency. In contrast, tokenized fixed income introduces features such as:

- Continuous liquidity and trading

- Global accessibility

- Fractional ownership with lower participation thresholds

- Interoperability within decentralized finance (DeFi) systems

As institutional engagement with digital assets expands, platforms like Pendle are contributing to the development of infrastructure that connects traditional finance with DeFi. The inclusion of fixed-rate instruments provides greater predictability and supports risk management—both essential considerations for institutional market participants.

At the time of writing, stablecoin-based fixed yields available through Pendle reach up to approximately 20%, compared with around 12% for CCC-rated high-risk corporate bonds. Pendle’s continued growth and record of yield settlements demonstrate the operational stability of its fixed-yield infrastructure, offering an alternative model for fixed-income exposure within decentralized markets.

Looking Ahead

Pendle’s work is more than just another DeFi innovation — offering a framework that could enable broader access to capital across traditional and decentralized markets. As the global financial system gradually digitizes, the fusion of fixed-income markets and crypto infrastructure could redefine how value is stored, transferred, and grown.

If Pendle maintains its current trajectory, it may facilitate the integration of the $140 trillion fixed-income market with digital assets, contributing to the evolution of fixed-income products within the decentralized ecosystem.

Pendle has also recently announced Boros, an innovative product that enables the trading of funding rates from exchanges, allowing a future view of rates in DeFi

About Pendle

Pendle is the world’s largest crypto yield trading platform, enabling the tokenization and trading of future yield. Pendle facilitates fixed-rate and yield speculation strategies in a permissionless and composable environment. The protocol supports real-world assets, synthetic dollars, and a wide array of DeFi-native opportunities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

木頭姐豪擲$5,500萬加倉,Bitcoin Hyper受關注

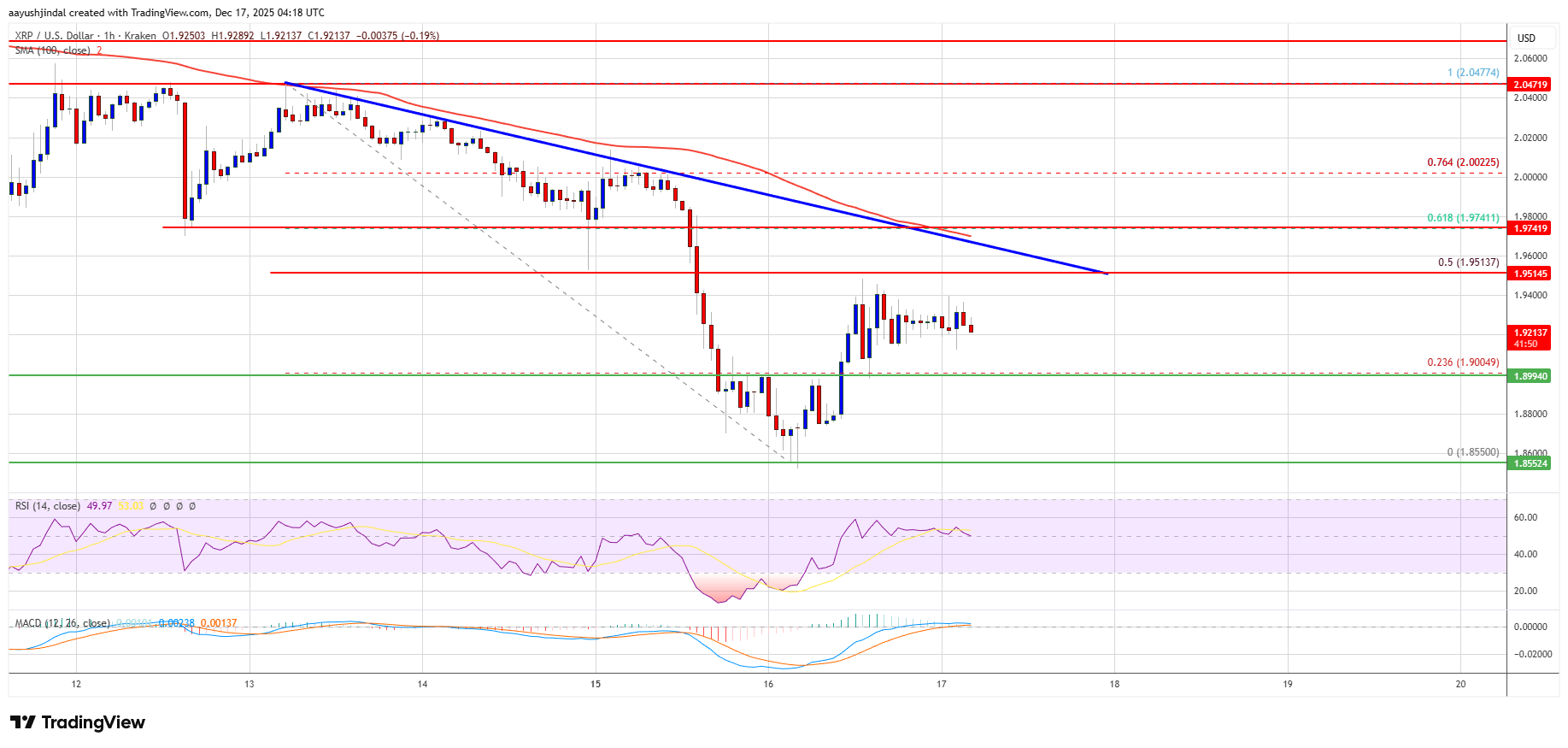

XRP Price Recovery Looks Fragile—Can Bulls Break the Cap?