Australia’s Crypto ATMs Under Fire — Regulators Push for Ban Powers

Australia is set to intensify oversight of crypto ATMs by granting the Australian Transaction Reports and Analysis Centre (AUSTRAC) authority to restrict or ban high‑risk services. Regulators cite growing concerns over fraud, money laundering, and other illicit activities linked to these machines. Rapid Expansion Raises Concerns The number of crypto ATMs in Australia has surged from

Australia is set to intensify oversight of crypto ATMs by granting the Australian Transaction Reports and Analysis Centre (AUSTRAC) authority to restrict or ban high‑risk services.

Regulators cite growing concerns over fraud, money laundering, and other illicit activities linked to these machines.

Rapid Expansion Raises Concerns

The number of crypto ATMs in Australia has surged from roughly 23 in 2019 to over 2,000 today. A survey of frequent users indicated that about 85 % were either victims of scams or acting as intermediaries for illicit funds. AUSTRAC estimates around 150,000 transactions occur annually through these machines, with a total value of roughly US$275 million.

Australia now ranks as the world’s third-largest crypto ATM market, behind Canada and the US. Regulators are particularly concerned about senior citizen users: those aged 50–70 account for nearly 72 % of transaction values and are more vulnerable to fraud.

New regulatory measures

AUSTRAC’s prior steps included capping cash deposits at $3,250 (AUD 5,000). They also enforced stronger customer due diligence requirements and mandated scam-warning notices on machines.

The proposed legislation would broaden AUSTRAC’s authority, allowing the regulator to address entire categories of high-risk products and services, rather than individual operators alone.

AUSTRAC CEO Brendan Thomas noted the new powers would enable more responsive actions against evolving risks, particularly where money-laundering remains prevalent. The law could potentially allow outright bans on specific crypto ATM services.

The move signals that operators must strengthen compliance, risk management, and transaction monitoring. While some industry voices argue crypto ATMs already incorporate KYC procedures and a ban might hinder innovation, regulators stress that their objective is crime prevention, not stifling technological development.

Australia’s approach mirrors international trends, with jurisdictions increasingly targeting cash-to-crypto channels. By enhancing AUSTRAC’s authority, the government aims to reduce scam exposure, safeguard vulnerable users, and maintain the financial system’s integrity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

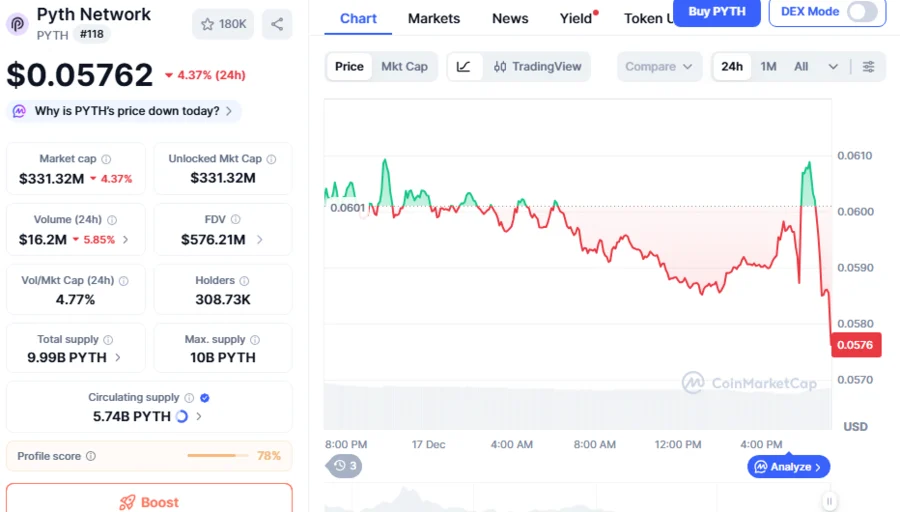

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day