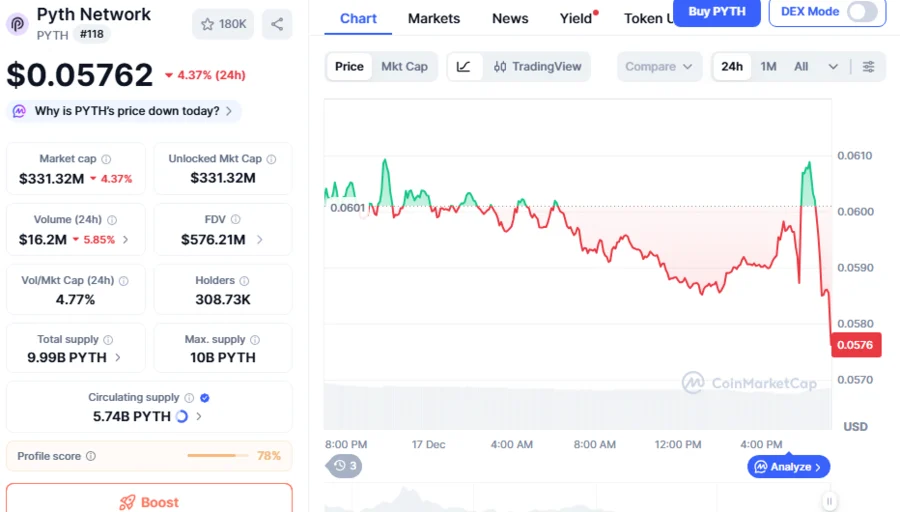

Pyth Network (PYTH), a cryptocurrency that provides real-time financial market data to blockchain applications, is witnessing difficult moments currently as its price has plunged 76% while its market cap dropped 11%, according to data reported today by market analyst Satoshi Club. The latest metrics obtained from CoinGecko market show that PYTH, which currently trades at $0.05762, has been down 12.9% and 33.7% over the past week and month, respectively, indicating persistent downturn movement and robust selling pressure.

One of the catalysts behind PYTH’s price squeeze is macro uncertainty, which continues to pressure risk assets. Most crypto assets are currently trading under pressure, as indicated by prominent tokens like BTC and ETH, which hold at $90,104 and $3,016, down 3.7% and 2.8% over the last month, respectively. Declining liquidity and global risk-off sentiment are pulling cryptocurrency prices down as investors wait for upcoming economic data to evaluate the path for monetary policy.

Pyth Price Slumps Despite Token Buyback Program Launch

Another cause of Pyth’s price pressure is that the network’s huge token unlock supply, which presses price down because of heightened selling pressure from long-term investors.

In the latest unlock event that occurred on May 18, 2025, Pyth Network released a massive 58% of the token supply. Still, approximately 47% of PYTH tokens are locked and waiting to enter the market, according to a revelation disclosed today by the analyst.

Last week on Friday, December 12, Pyth launched a token buyback program as part of efforts to bolster the value of its token, expand its revenue, and boost market confidence. The new buyback program, dubbed the “PYTH Reserve”, utilizes network revenue to acquire tokens each month.

The current price of PYTH is $0.05762.

The current price of PYTH is $0.05762.

Potential Breakout Looming and the Cause

Traders are now paying attention to whether the new “PYTH Network Reserve” program can bolster prices. The move by Pyth to debut this buyback initiative comes after multiple cryptocurrency projects (like Aave, Hyperliquid, Chainlink, and others) recently embraced a sustainable, revenue-backed value model.

With the introduction of the repurchase program, PYTH is set to stage an upturn move soon as supply squeezes monthly through buybacks could support the price. Also, combined with rising demand for blockchain infrastructure tied to oracles that feed real-world data into smart contracts, PYTH prices are poised to surge toward higher targets.