Tech Giants Dominate S&P 500, Raising Risk Alerts

Valuations of artificial intelligence are soaring, sometimes without profitability to support them. Voices are rising, recalling the excesses of the 2000 Internet bubble. Disproportionate weight of sector giants in indices, massive investments, widespread enthusiasm: signs of a possible overheating are accumulating. In this climate of euphoria, a question reemerges : is AI the engine of a new economic era or that of a speculative bubble ready to burst ?

In brief

- Valuations in the artificial intelligence sector are reaching record levels, despite the lack of profitability for the majority of companies.

- Institutions like the IMF, the Bank of England, and JPMorgan warn of a possible rush comparable to the 2000 Internet bubble.

- Alarming market ratios, extreme concentration in indices, and the massive arrival of individual investors increase concerns.

- Colossal investments in AI infrastructure raise fears of overcapacity, while concrete economic returns remain limited.

Giants valued at a loss

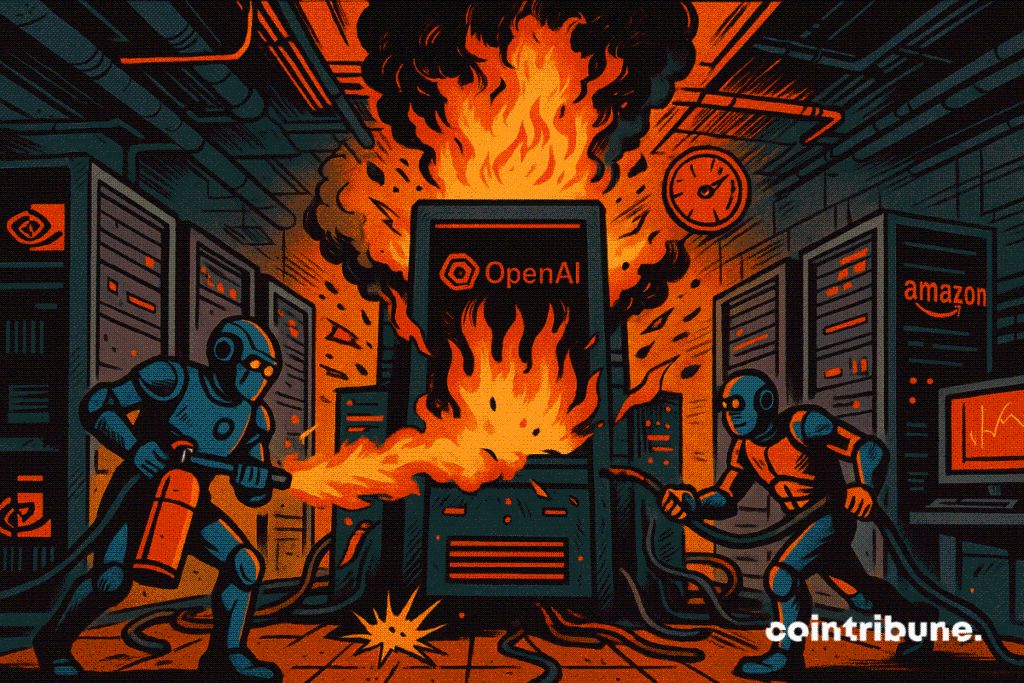

At the end of August, Sam Altman, founder of OpenAI, expressed his own doubts about the frenzy surrounding artificial intelligence and promised a more human AI . “Are we in a phase where investors overall are overexcited about artificial intelligence? I think so,” he declared .

A few weeks later, his startup, still not publicly listed and unprofitable, was valued at $500 billion, an unprecedented level for a company of this profile. This stratospheric valuation is not an isolated case. Tech giants Apple, Nvidia, Microsoft, Alphabet, and Amazon now concentrate nearly 30 % of the total S&P 500 capitalization, a historic weight in the markets.

In this context, the International Monetary Fund, the Bank of England, and several major banks publicly question a possible overheating comparable to that observed in the late 1990s.

Market indicators reveal several objective signs of euphoria, according to consistent analyses :

- The S&P 500 price/earnings ratio is now 23, a level close to the peak of 25 reached just before the bursting of the Internet bubble in 2000 ;

- The total equity value of American companies represents 363 % of nominal GDP in the second quarter of this year, an all-time record, significantly higher than the 212 % peak in the first quarter of 2000 ;

- The IMF warns that a “disappointment caused by AI results” could lead to a sharp market revaluation of tech stocks.

Through these on-chain data, it is the growing disconnect between market capitalization and real profitability that worries. While AI promises significant productivity gains, its concrete effects on profits remain largely speculative for the time being.

The explosion of expenses and the concentration of technological power

Beyond disconnected valuations, it is now the sector’s internal dynamics that fuel concerns. According to the Gartner firm, global investments in AI infrastructure are expected to reach $1.5 trillion this year , mainly directed towards data centers and computer hardware in the United States.

This investment volume recalls that of the 2000s in fiber optics and telecommunications. However, the lack of profitability triggers distrust : “80% of companies in the AI field are not profitable,” observes Alexandre Baradez, analyst at IG.

Added to this is another phenomenon: the circularity of agreements between major players. In one month, OpenAI signed a $100 billion deal with Nvidia , then announced the purchase of equipment worth several billion from AMD, before considering a partnership with Broadcom. These cross operations, considered by some as “incestuous,” evoke speculative mechanisms observed during the Dotcom bubble.

The very structure of the market has evolved, with a record involvement of individual investors. More than 35% of American shares are now held by individual investors, a figure much higher than that observed in 2000.

These data translate a potential overestimation of growth prospects, at a time when the IMF anticipates only 2 % growth for the United States in 2026. Furthermore, a “strong acceleration of earnings per share seems unlikely,” according to a note from the Swiss private bank J. Safra Sarasin.

While the analogy with the Internet bubble cannot be mechanically established, current leaders such as Microsoft, Alphabet, Amazon, or Nvidia, whose capitalization reaches $4.68 trillion, driven by AI demand , are largely capitalized and much stronger than the precarious startups of 2000, the scenario of a sharp revaluation remains credible. In sum, the question is whether its current valuation rests on sufficiently solid foundations to avoid a collapse.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: How REsurety's CleanTrade Platform is Transforming the Industry

- REsurety's CleanTrade platform, CFTC-approved as a SEF, standardizes trading of VPPAs, PPAs, and RECs to boost clean energy liquidity. - By aligning with ICE-like regulations and offering real-time pricing, it reduces counterparty risks and bridges traditional/renewable energy markets. - The platform achieved $16B in notional volume within two months, signaling maturing markets where clean assets gain institutional traction. - CleanTrade's analytics combat greenwashing while streamlining transactions, en

ChainOpera AI Token Experiences Steep Drop and Highlights Wider Dangers in AI-Based Cryptocurrency Initiatives

- ChainOpera AI's 2025 token collapse (99% loss) exposed systemic risks in AI-driven crypto projects through structural, governance, and technical vulnerabilities. - Extreme centralization (88% in ten wallets) worsened liquidity risks, while C3.ai's governance failures and regulatory pressures accelerated investor flight to stable assets. - Technical flaws in AI-integrated blockchains and lack of audits highlighted urgent need for decentralized governance, AI-powered compliance tools, and real-time vulnera

LUNA Drops 9.92% in 24 Hours Following Recent Intense Volatility

- LUNA token fell 9.92% in 24 hours on Dec 12 2025 but gained 59.74% weekly, contrasting with a 61.25% annual decline. - Amazon Luna cloud gaming expanded to Xfinity devices via voice-activated access, offering Prime members free play on 50+ titles. - Comcast reports 30% annual growth in gaming traffic, with cloud gaming now accounting for 70% of network usage. - Analysts note no direct link between Amazon-Comcast's cloud gaming expansion and LUNA token's price movements. - Market volatility persists for L

Investing in eco-friendly urban infrastructure as an approach to reduce climate impacts

- Global climate goals demand urgent urban action to limit warming to 1.5°C by 2050, with cities responsible for 70% of emissions. - Decentralized energy systems, solar transit, and behavioral interventions reduce emissions while delivering 18–30% ROI through regenerative models. - Cities like Copenhagen and New York demonstrate feasibility, with decentralized systems cutting emissions by 80% and energy costs by 20%. - IPCC mandates emissions peak by 2025, making urban sustainability investments critical f