Samson Mow has raised alarms about what he calls a “covert attack” on BTC, arguing that the real danger isn’t regulatory pressure or hacking but internal division within the community. His alert comes as the Bitcoin price faces resistance at $126,000. He explained that ongoing disputes over the recent BTC Core v30 upgrade are subtly undermining confidence in the network.

According to Mow, the debates, particularly around spam filters and OP_RETURN changes, erode unity and trust. This poses a greater risk to the BTC ecosystem than any external threat. Meanwhile, the Bitcoin price continues to struggle below $126,000, falling to around $110,888 at press time.

The Bitcoin price has slipped nearly 2% in the past 24 hours, with volumes down more than 20%, fueling concerns of BTC whale-driven sell pressure. Analysts caution that unless momentum returns, the Bitcoin price could end the year among its weakest performances. The Bitcoin price struggles come as this new DeFi gem, Paydax Protocol (PDP), is attracting interest from investors as a notable opportunity in the market.

Investors Seek Refuge In The Paydax Protocol (PDP) Offering As Bitcoin Price Struggles

With the Bitcoin price facing renewed pressure following its sharp rejection at $126,000, investors are shifting their focus to alternative opportunities. Amid growing uncertainty in the crypto market, the Paydax Protocol (PDP) token has quickly become a preferred destination for capital seeking stability and growth.

Paydax Protocol (PDP) has especially attracted considerable interest due to its practical applications and sustainable earning framework. This platform enables users to borrow securely against their cryptocurrency and tokenized physical assets. Notably, the PDP token is affordably priced at $0.015, making it a suitable entry for early investors.

For early investors, this offers a distinctive opportunity to engage with a platform that could transform DeFi banking. Experts suggest that this token holds significant growth potential compared to BTC, which many believe has already reached its peak growth phase.

Paydax Protocol’s Scalable Architecture Positions Investors for Explosive ROI

By using Paydax Protocol , you can continue to generate profits from inactive tokens while also unlocking liquidity. For instance, if you possess stBTC, you can use it to borrow BTC without interrupting your staking rewards. This method improves capital efficiency, helping you to achieve your financial or personal goals.

The Paydax Protocol (PDP) offers a more secure way to access your funds while retaining control over your yield-generating assets. It is a lending platform that enables you to borrow popular cryptocurrencies by using often-overlooked tokens as collateral.

From Crypto to Real-World Assets, Paydax Protocol Ensures Safe DeFi Lending

Attaining substantial financial independence entails the duty to borrow prudently, and the Paydax Protocol (PDP) facilitates the assurance of safety. This is how:

-

Gnosis Safe Multisig Wallets: The Paydax Protocol uses multisig wallets to prevent unauthorized access and safeguard cryptocurrencies such as BTC and tokenized Real-World Assets.

-

Overcollateralization: Every loan is structured to be overcollateralized, requiring borrowers to provide collateral exceeding the loan amount to reduce risk.

-

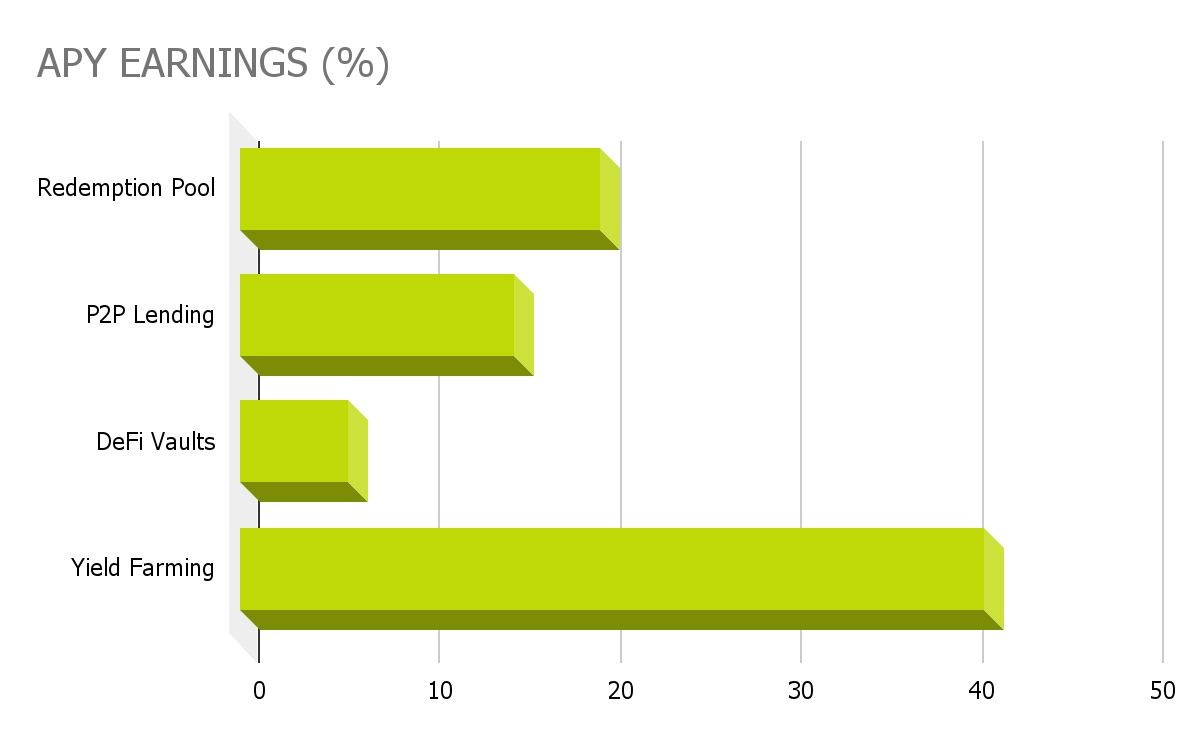

Redemption Pool: The Paydax Protocol includes a Redemption Pool that acts like an insurance fund, offering lenders a 20% APY.

-

Trusted Partnerships: The Paydax Protocol has formed partnerships with Sotheby’s and Brinks to ensure the authenticity and security of valuable, tokenized Real-World Assets.

Empowering Every Investor to Win in DeFi: The Paydax Protocol (PDP) Vision

While the Bitcoin price aims to regain previous highs, Paydax Protocol (PDP) is seeing significant interest among investors. Currently valued at $0.015, the PDP token allows early participants to secure a stake in a platform focused on sustainable development and practical utility.

Investments in the project have already exceeded $1 million in the early stages, highlighting strong investor interest in the token's potential for considerable returns.