Hackers steal $3.05m XRP from cold wallet, ZachXBT traces funds

Crypto investigator ZachXBT traced the funds of a victim who lost their life savings of $3.05 million in XRP.

- A victim lost their life savings of $3.05M worth of XRP from an Ellipal cold wallet

- The hack happened after the victim imported their seed phrase into Ellipal’s mobile app

- ZachXBT traced the funds to a Southeast Asian laundering ring

Self-custody is a powerful tool for security, but only if users know what they are doing. On Sunday, Oct. 19, crypto investigator ZachXBT revealed a case of a victim losing $3.05 million in XRP from a cold wallet. The investigator ultimately traced the funds to a Southeast Asian crypto laundering ring.

The initial theft happened on Oct. 12, when attackers drained the victim’s (XRP) wallet. The victim used an Ellipal hardware wallet, which markets itself as a cold wallet. However, the victim made the mistake of importing their seed phrase into the Ellipal mobile app.

This effectively made it into a hot wallet, meaning it became connected to the internet. ZachXBT explained that importing a seed phrase into a mobile app completely defeats the purpose of cold storage and exposes users to hacks.

How hackers laundered $3.05 in XRP

Following the breach, hackers used the cross-chain bridge Bridgers to swap the XRP into Tron (TRX) in over 120 transactions. The transactions appeared to go to Binance, but this was actually part of Bridgers’ liquidity path.

After the laundering steps, the attackers moved all tokens into a single Tron wallet, making it easier to move the funds off-chain. For that purpose, they used OTC desks adjacent to Huione, a Southeast Asia–based illicit online marketplace.

According to ZachXBT, Huione has connections to hacks, pig-butchering scams, money laundering, and more. The exchange has also been sanctioned by the U.S. government for facilitating massive illicit crypto flows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

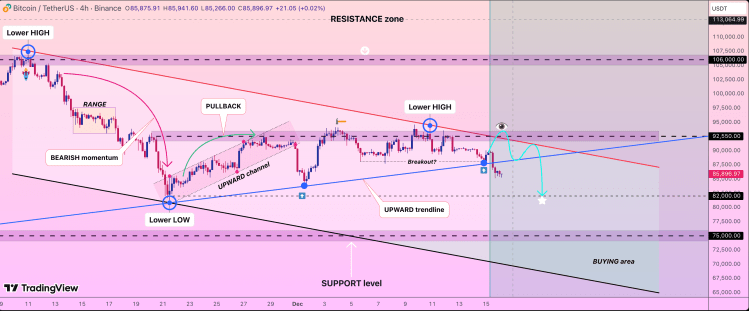

The Bearish Structure That Puts Bitcoin Price At $92,550, And Then $82,000

Is Monero (XMR) Gearing Up for a Bullish Breakout? This Key Pattern Formation Suggest So!

Aave charts post-SEC expansion as DeFi lender sharpens growth strategy

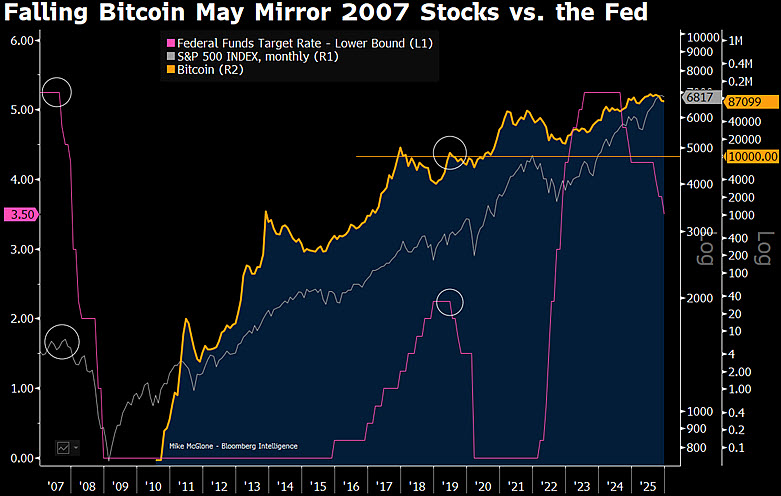

Don't Be Surprised If Bitcoin Resets to $10,000: Top Bloomberg Expert Reveals 2007 Parallel