Ethereum Leads as Solana’s Developer Growth Challenges the Blockchain Hierarchy

A recent analysis of blockchain developer activity has revealed a strong influx of new talent across major ecosystems, with Ethereum maintaining its dominance. The report, based on data from Electric Capital, highlights shifting developer trends and growing debates over how blockchain contributions are tracked.

In brief

- Ethereum tops all blockchains with 31,869 active developers, maintaining dominance despite slower growth.

- Solana attracts over 17,000 developers, showing rapid expansion and challenging Ethereum’s long-held lead.

- Bitcoin ranks third with 11,036 developers, reflecting steady but slower ecosystem engagement.

- Debate rises over developer counts as experts question data accuracy and inclusion of automated projects.

Ethereum Retains Largest Developer Base, Followed by Solana and Bitcoin

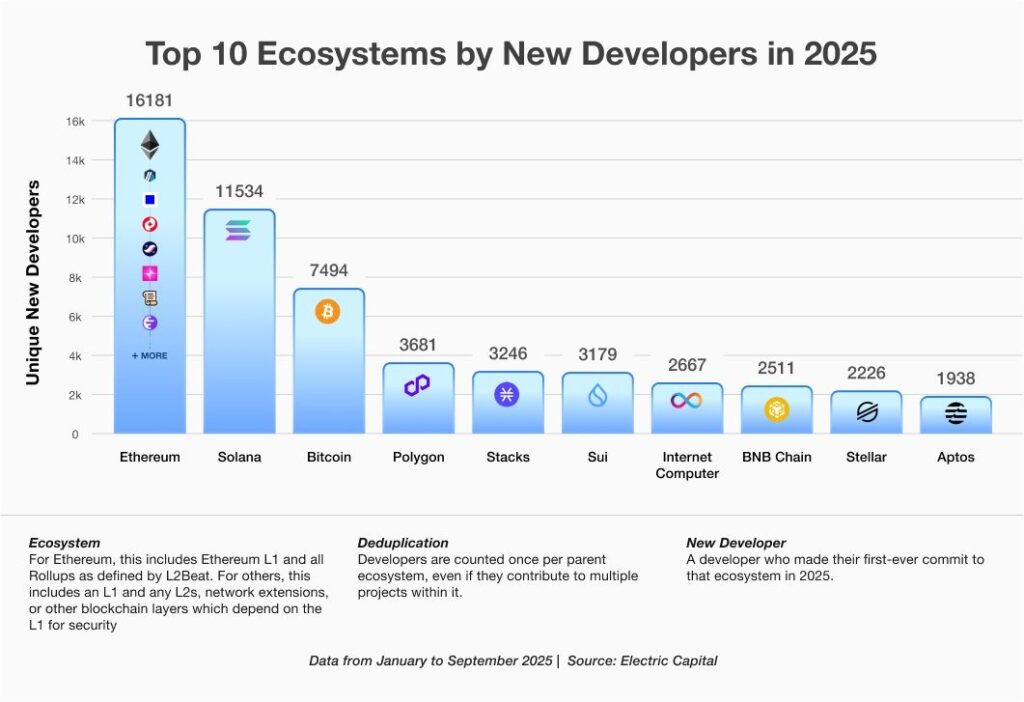

Between January and September, more than 16,000 new developers began contributing to the Ethereum ecosystem , according to data from the Ethereum Foundation. Solana followed with over 11,500 new developers, though a representative from the Solana Foundation suggested the data may be outdated. Bitcoin ranked third, attracting nearly 7,500 new developers in the same period.

A closer look at the data shows that:

- Ethereum leads with 31,869 active developers , making it the largest developer base across all blockchain ecosystems.

- Solana ranks second with 17,708 developers, showing continued strong developer interest.

- Bitcoin holds third place with 11,036 active developers contributing to its ecosystem.

- The Ethereum figure includes contributors to both layer-1 and layer-2 networks, such as Arbitrum, Optimism, and Unichain, without double-counting developers active across multiple projects.

It is worth noting that developers active across multiple Ethereum-based projects were not double-counted.

Ethereum Growth Slows as Solana Gains Momentum

Although Ethereum leads in total developer numbers, its growth has been modest—rising 5.8% over the past year and 6.3% over the past two years. By contrast, Solana has shown stronger momentum. Electric Capital’s tracker reports a 29.1% increase in full-time developers over the past year and a 61.7% rise over the past two years.

Despite these figures, Jacob Creech, Solana Foundation’s head of developer relations, claims that the data undercounts Solana developers by around 7,800. He urged developers to register their GitHub repositories to help improve Solana’s internal tracking.

Several community members have questioned how Electric Capital grouped developer data. Some chains operating on the Ethereum Virtual Machine (EVM) were merged, while others were excluded.

Tomasz K. Stańczak, founder of Nethermind, argued that EVM-based networks such as Polygon and BNB Chain should be considered together since they share compatible tooling and developer skill sets.

Skepticism Grows Over Reported Developer Numbers

Some industry observers remain skeptical of the reported developer numbers. Jarrod Watts, head of Australia for the layer-2 project Abstract, said the figures may be inflated by repositories generated by automated coding tools and temporary hackathon projects.

Watts suggested that short-term or low-quality code—such as hackathon projects and inactive repositories—may inflate the developer figures. He added that genuine new developer participation appears limited this year.

A social media user known as memevsculture noted a gap between the reported number of developers and the visible number of active decentralized applications , suggesting that developer counts may not fully reflect meaningful activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TWT’s 2025 Tokenomics Revamp: Redefining Utility and Investor Rewards on Solana

- Trader Joe's (TWT) 2025 tokenomics prioritizes utility over speculation, offering gas discounts, DeFi collateral, and governance rights. - A deflationary model with 88.9B tokens burned creates scarcity, while loyalty rewards redistribute existing tokens to avoid dilution. - Community governance allows holders to vote on platform upgrades, aligning token value with ecosystem growth and user participation. - This Solana-based approach redefines DeFi incentives by linking price appreciation to real-world ut

HYPE Token: Evaluating Immediate Price Fluctuations and Speculative Dangers in the Meme-Based Cryptocurrency Sector

- HYPE token, a meme-driven crypto, relies on social media hype and influencer endorsements rather than traditional financial metrics. - The $TRUMP meme coin example highlights extreme volatility, with large profits for top wallets and massive losses for retail investors. - Institutional products like CMC20 exclude meme coins, signaling limited recognition of their market utility despite growing crypto infrastructure. - Regulatory scrutiny intensifies as SEC targets influencer promotions, while foreign inv

PENGU Token Value Soars: An In-Depth Technical and On-Chain Examination of Market Trends

- PENGU token's 12.8% 24-hour surge driven by Bitcoin's 4.3% rally and altcoin rebound. - Technical indicators show short-term bullish momentum conflicting with long-term bearish trends. - Whale activity and $8.91M in exchange inflows contrast with 2B token outflows and leveraged shorts. - NFT sales decline and DeFi innovations like CMC20 index token add downward pressure. - Analysts urge caution due to structural weaknesses despite short-term trading opportunities.

Banks Transform Finance: Cryptocurrency Adoption Sparks Fundamental Shifts

- LevelField Financial secures state approval to acquire Burling Bank, aiming to integrate crypto services into traditional banking with $70M deal. - Post-2023 crypto bank collapses, regulators adopt cautious openness, enabling LevelField's renewed acquisition bid amid Trump's "crypto capital" agenda. - SGX Derivatives launches Bitcoin/Ethereum futures targeting institutions, aligning with $187B daily crypto derivatives volume in Asia. - Grab and GoTo struggle to consolidate Southeast Asian fintech despite