21Shares Files for First-Ever Leveraged DeFi ETF Tracking Hyperliquid

Quick Breakdown

- 21Shares seeks SEC approval for a 2x Long HYPE leveraged ETF.

- The fund offers exposure to Hyperliquid’s DeFi market without holding tokens.

- Analysts say niche DeFi ETFs could become major growth drivers.

Crypto asset manager 21Shares has filed with the U.S. Securities and Exchange Commission (SEC) to launch a first-of-its-kind leveraged exchange-traded fund (ETF) that tracks the performance of Hyperliquid (HYPE), a decentralized perpetual futures protocol. The proposed fund, titled 21Shares 2x Long HYPE ETF, aims to deliver twice the daily returns of HYPE’s market performance before fees and expenses.

ETF targets double exposure to Hyperliquid’s perpetual market

According to the filing submitted on October 16, the ETF would use swap agreements, options, and potentially spot HYPE exchange-traded products (ETPs) to achieve its daily leverage target. While no U.S.-based spot HYPE ETPs currently exist, the fund’s structure is designed to mirror the perpetual futures and fee mechanisms of the Hyperliquid DeFi system — without holding the token directly.

Instead, 21Shares plans to use derivative instruments to provide exposure to HYPE’s on-chain market dynamics. This approach minimizes custody risk and allows traditional investors to participate in DeFi-based market activity through a regulated ETF vehicle. The product employs a daily reset mechanism, a feature more common in traditional leveraged ETFs, making it one of the most experimental crypto-linked fund structures to date.

Industry analysts see Opportunity in niche DeFi exposure

Market analysts say the filing underscores the growing demand for specialized crypto ETFs amid a broader land rush for thematic investment products. Eric Balchunas, a senior ETF analyst, described the filing as “niche but potentially transformative,” drawing comparisons to early thematic ETF trends such as smart beta and currency hedging strategies.

21Shares Files for First-Ever Leveraged DeFi ETF. Source: Eric Balchunas

21Shares Files for First-Ever Leveraged DeFi ETF. Source: Eric Balchunas

If approved, the 21Shares 2x Long HYPE ETF would mark the first U.S.-listed leveraged fund tied to a live decentralized protocol — a milestone that could further blur the lines between DeFi innovation and traditional finance.

Alongside the HYPE filing, 21Shares also revealed plans for another ETF tracking SEI, according to a separate S-1 filing on Thursday. The fund will follow SEI prices using CF Benchmarks, a crypto index provider that aggregates data from multiple exchanges.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

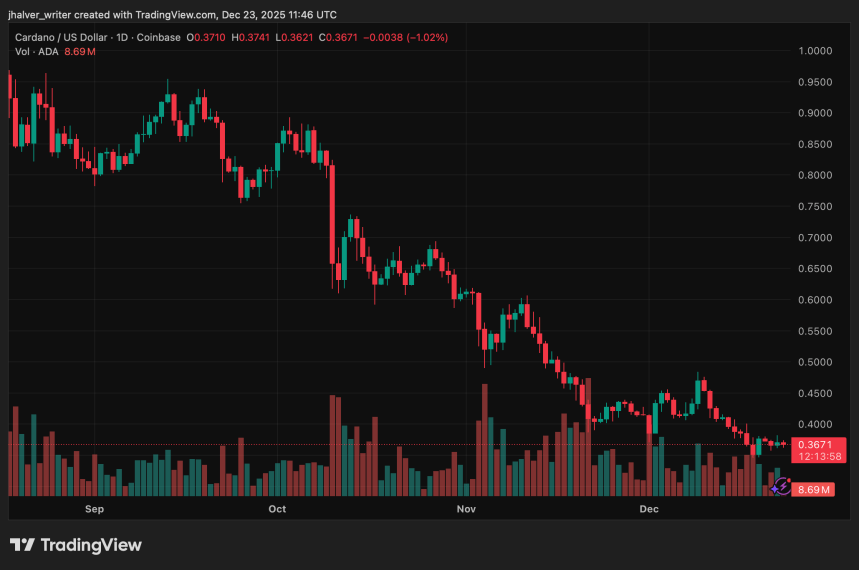

Founder Signals Long-Term Opportunity in Cardano DEXes as Price Consolidation Persists

AI Crypto Coins: ETHZilla Liquidates $74M Worth of ETH, DeepSnitch AI’s $875K Presale Takes Hold of the AI Sector

XRP Breaks $1.95 Support After 13 Months, Analyst Sees $0.90 Next

TikTok Users Claim They’ve 'Unredacted' the Epstein Files