Gold market cap hits $30T, is Bitcoin falling behind?

Gold’s market value has skyrocketed to more than $30 trillion for the first time in history, making it the largest asset by market cap to date. Can Bitcoin catch up?

- Gold’s market cap has surpassed $30 trillion for the first time in history as spot prices reached $4,369, reinforcing its dominance as the world’s largest asset.

- Meanwhile, Bitcoin’s market cap has dropped to $2.15 trillion after losing over $200 billion this week, widening the gap between the two assets.

According to data from Companies Market Cap, gold has surged by 1.49% in the past 24 hours. It is currently trading at $4,369 following the rise. This month, the precious metal asset surpassed the $30 trillion market cap threshold for the first time in history. At the time, spot prices were still standing at $4,280.

At press time, gold remains the largest asset by market cap. In fact, its market value far outweighs the other four assets in the top five by a significant margin. NVIDIA stands in second place with a market cap of $4.4 trillion, followed by Microsoft with $3.8 trillion and Apple with $3.6 trillion.

Meanwhile, its metal counterpart, silver, is still below the top five with a market cap of $2.9 trillion.

Ranking in eighth place is Bitcoin ( BTC ), which has lost billions in market cap following a series of market crashes in crypto following the $19 billion liquidation wipeout of October 10. As of Oct. 17, Bitcoin’s market cap stands at $2.15 trillion, having lost about $200 billion to $230 billion this week alone.

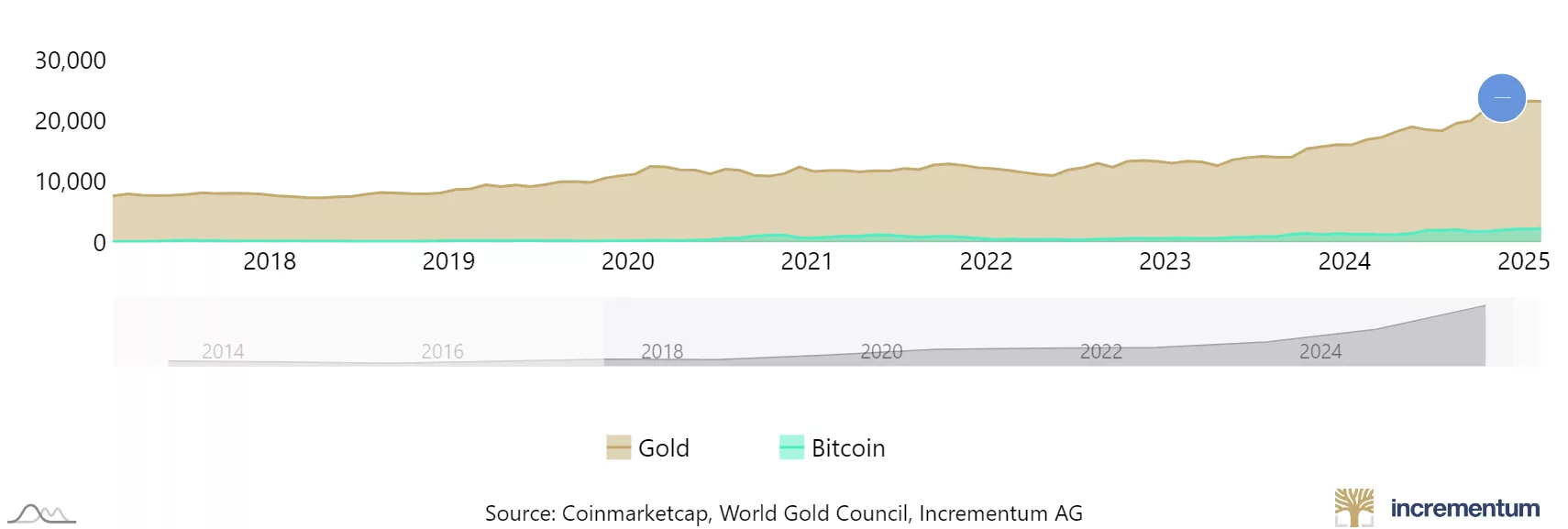

Gold’s market cap has surpassed $30 trillion, while Bitcoin has only risen by about $150 billion from $2 trillion | Source: In Gold We Trust

Gold’s market cap has surpassed $30 trillion, while Bitcoin has only risen by about $150 billion from $2 trillion | Source: In Gold We Trust

There was a time when Bitcoin was hitting record-highs consecutively when its market cap soared above major companies and even minerals like silver. Back in April 2025, the largest cryptocurrency by market cap rose through the ranks and became the world’s fifth largest asset when its market cap surged to $1.86 trillion.

At the time, Bitcoin was just shy of hitting the $100,000 mark. Despite having surpassed $100k and reaching a new ATH at $126,080 this month, Bitcoin’s growth has been relatively slow compared to the other assets which have seen market value increases to levels above $3 trillion.

Can Bitcoin really surpass gold’s market cap?

The gap between Bitcoin and gold as safe haven assets continues to widen. As Bitcoin struggles to stay afloat amidst falling crypto prices, gold has been thriving as more investors flock to it as a safe-haven asset in the middle of the economic uncertainty spurred on by Trump’s trade war with China.

At press time, Bitcoin has fallen by 4.5% in the past 24 hours. It is currently trading hands at $105,834, perched precariously at the edge of $100,000.

Meanwhile, gold’s price has jumped to a new record high at $4,300 and has already gone up by nearly 60% in the past year. On the other hand, Bitcoin has risen by 57.3%. However, it has been in a downward slump for the past week, as it struggles to reclaim its previous highs at $120,000.

At the end of 2024, founder and CEO of ARK Investment Management, Cathie Wood predicted that Bitcoin may one day surpass gold’s. At the time, BTC had just reached $2 trillion market cap while gold was still standing at $15 trillion. She described Bitcoin as being in its “early innings” considering it has managed to reach $2 trillion in just 15 years.

Meanwhile, gold has been around longer and managed to reach $15 trillion. However, the market value of gold has since doubled within the past year after reaching new all-time highs in the market while Bitcoin has not ventured too far above the $2 trillion mark.

Most recently, Deutsche Bank predicted that central banks will start buying BTC by 2030, which could boost its value on the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Warner Bros. Discovery rejects Paramount’s hostile bid, calls offer ‘illusory’

US Stock Market Drops as Dow Falls 0.12%, S&P 500 Dips 0.67%, Nasdaq Drops Over 1%

Ethereum Exodus: Exchange Balances Plummet to 8-Year Low

Bitcoin Whale’s 40x Long on 17 BTC Sinks 65%, Unrealized Loss Reaches $52k