Tokenized Gold Soars as Metal Hits Record Highs

Tokenized gold assets are surging as bullion prices hit record highs, driving $3 billion in market value. Tether’s XAUT0 and Paxos’ PAXG lead the rally, gaining over 60% year-over-year amid rising institutional demand.

Gold-linked digital assets are surging as the metal’s price climbs above $4,370 per ounce. The rally has prompted issuers to launch new blockchain-based products, turning gold into an on-chain financial instrument.

The surge reflects a wider convergence between traditional commodities and digital assets. As inflation concerns and geopolitical uncertainty persist, investors are turning to tokenized versions of gold as a stable, transparent, and easily transferable hedge against volatility.

Tether Launches XAUT0 as Gold Tokens Near $3.4B

The tokenized gold sector has grown rapidly in 2025, with total capitalization nearing $3.4 billion, up from $500 million early this year. It is one of the fastest-growing categories in the tokenization ecosystem, fueled by institutional demand for stable, asset-backed instruments.

In particular, Tether expanded its lineup with XAUT0, an omnichain gold token launched on October 15 through the Legacy Mesh interoperability framework on Solana. The system links Solana to Tether’s $175 billion cross-chain liquidity base across Ethereum, Tron, and other blockchains. As a result, each XAUT0 represents a fraction of a troy ounce of physical gold held in audited vaults.

The Legacy Mesh and XAUt0 are live on @solana.The largest stablecoin and the most trusted store of value, enabling internet capital markets, payments, and crypto applications on one of the largest blockchains in the world.Your USDT and XAUt, now on Solana.

— USDT0 (@USDT0_to) October 15, 2025

More than 7,300 XAUT0 tokens are now in circulation, processing over $25 billion in total bridge volume, according to Everdawn Labs.

“Gold-backed tokens are becoming the fastest-growing segment of tokenized assets,” said Alex Tapscott, CEO of CMCC Global Capital Markets.

He noted that daily trading in tokenized gold now exceeds $600 million, mirroring strong demand for physical bullion.

Surging Prices and Expanding Market Share

Analysts say tokenized gold bridges traditional finance and digital liquidity. Unlike physical bars, these tokens settle instantly and integrate into decentralized-finance platforms.

“Gold has a 5,000-year record as a store of value,” said Alex Melikhov, co-founder of BrettonWoods Labs. “Tokenization brings that reliability into a verifiable digital format.”

PAX Gold (PAXG)—trading around $4,413—has surged more than 65% year-over-year, while Tether Gold (XAUT)—priced near $4,360—has gained 63%. Their combined market capitalization is now approaching $3.0 billion, showing how physical value stores are shifting onto blockchains.

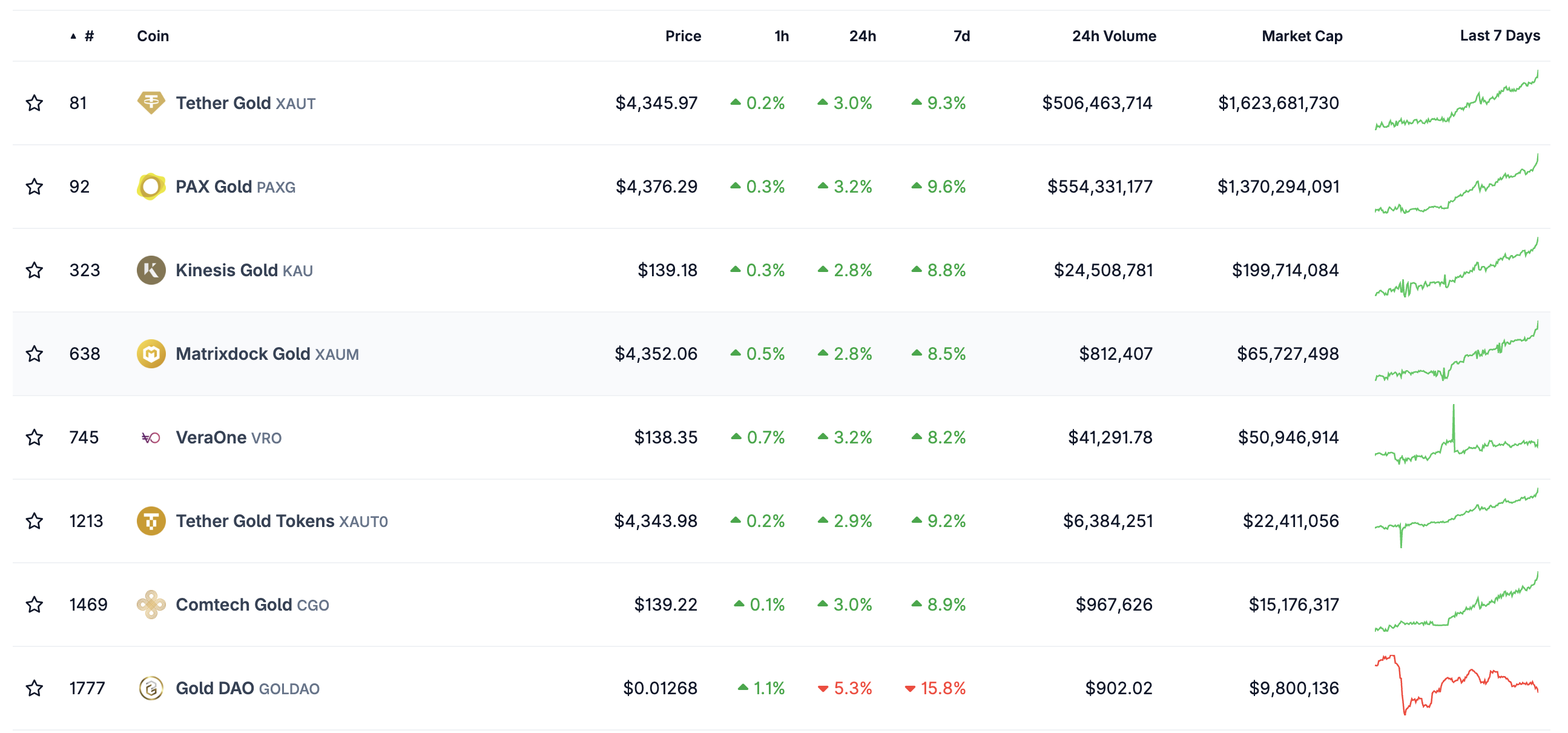

Leading Gold-Linked Tokens / Source:

Coingecko

Leading Gold-Linked Tokens / Source:

Coingecko

Moreover, average daily trading for PAXG has doubled over the past year, surpassing $300 million, CoinGecko data show. Analysts link this momentum to institutional inflows from funds and family offices seeking digital exposure to gold.

Regulators are slowly warming to tokenization. US SEC Chair Paul Atkins recently said, “If it can be tokenized, it should be tokenized,” calling it a key modernization priority.

Still, oversight and reserve transparency remain essential for investor trust.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price analysis today — Christmas Week 2025: Could BTC continue to rise?

Japan’s Rate Hike Goes Wrong: Yen Sinks—What It Means for Bitcoin

Massive $12M Futures Trading Competition Launched by ASTER Perpetuals Exchange

S&P 500 opera em alta antes do Natal com foco em inflação e confiança