Global ETP Inflows Hit $353 Billion in 2025 as Crypto and Active ETFs Lead the Charge

Quick Breakdown:

- Global ETP inflows hit $353.25 billion YTD, driven by strong demand for active and crypto-linked funds.

- iShares Bitcoin Trust (IBIT US) ranked among top performers, attracting $2.66 billion in new inflows.

- Active ETFs dominated, with $56.05 billion in September and $363.22 billion year-to-date.

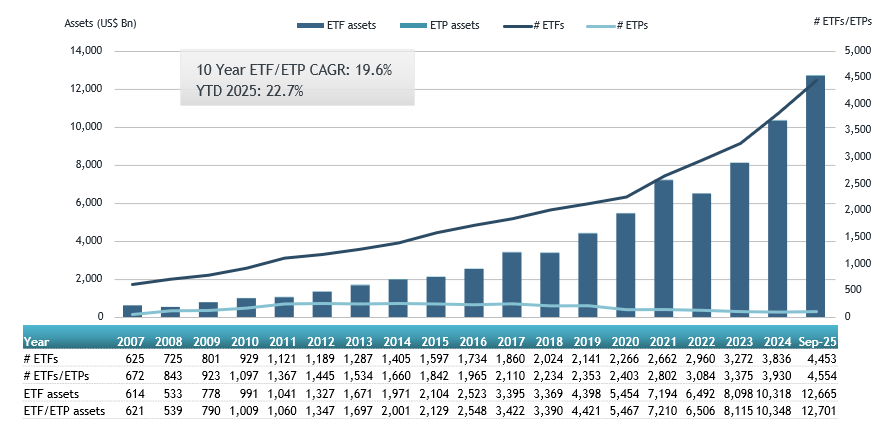

Global exchange-traded products (ETPs) extended their strong performance into September, with total year-to-date (YTD) net inflows reaching $353.25 billion — surpassing the $337.81 billion recorded during the same period in 2024. According to ETFGI data, this momentum reflects renewed investor appetite for crypto-linked and active ETFs, which have emerged as the standout performers of 2025.

Global ETP Inflows Hit $353 Billion in 2025. Source: ETFGI

Global ETP Inflows Hit $353 Billion in 2025. Source: ETFGI

Crypto and active ETFs dominate inflows

Active ETFs and ETPs drew $56.05 billion in net inflows during September alone, pushing their YTD total to $363.22 billion, up sharply from $206.87 billion a year ago. A large portion of this growth came from digital asset products, led by the iShares Bitcoin Trust (IBIT US), which attracted $2.66 billion in net inflows for the month.

Bitcoin-focused ETFs continue to anchor institutional participation, benefiting from rising adoption, regulatory clarity, and macro uncertainty that has boosted demand for alternative assets. Commodity ETFs also regained momentum, with SPDR Gold Shares (GLD US) and iShares Gold Trust (IAU US) bringing in $4.21 billion and $2.93 billion, respectively — signaling that investors are balancing inflation hedges with crypto exposure.

ETFs sustain record growth across asset classes

Fixed income ETFs and ETPs maintained strong growth, recording $22.52 billion in inflows in September and lifting YTD totals to $174.31 billion, up from $145 billion in 2024. Commodity ETPs added another $11.21 billion during the month — a sharp rebound from last year’s modest outflows of $9.17 million. The top 20 ETFs globally accounted for $73.71 billion of September’s inflows, led by the iShares Core S&P 500 ETF (IVV US) with $18.67 billion.

Market attention now turns to October, when the U.S. Securities and Exchange Commission (SEC) is expected to rule on 16 cryptocurrency ETF applications. Bloomberg ETF analyst James Seyffart noted that the outcome could mark a major milestone for the industry.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Clearer Regulations Propel XRP ETFs to $628M as the Asset Earns Greater Legitimacy

- Canary Capital's XRPC ETF dominates XRP ETF market with $250M inflows, outpacing all competitors combined. - Grayscale's GXRP and Franklin Templeton's XRPZ drove $164M debut inflows, boosting total XRP ETF AUM to $628M. - 2025 SEC ruling cleared XRP's secondary sales as non-securities, enabling institutional adoption and $2.19 price rebound. - XRPC's 0.2% fee waiver and institutional focus fueled $6B+ ETF trading volumes, reversing prior outflows. - Analysts project $6.7B XRP ETF growth within 12 months

Bitcoin Updates: Anxiety Sweeps Crypto Market, Yet ETFs Ignite Optimism for Recovery

- Crypto Fear & Greed Index hits 20, signaling extreme fear as BTC/altcoins face renewed volatility amid Tether's "weak" stablecoin downgrade. - Tether CEO defends USDt stability with $215B Q3 assets, while Bitcoin-focused firms adopt defensive stances against mNAV risks. - Altcoin Season Index at 25/100 shows modest rebound, with Zcash surging 1,000% and Grayscale filing first U.S. Zcash ETF. - Upcoming spot altcoin ETF launches and potential Fed rate cuts (80% priced) spark optimism despite fragile on-ch

The Impact of Artificial Intelligence on Transforming Business Efficiency and Entrepreneurial Expansion

- AI-driven tools are becoming essential for SMEs and startups to enhance productivity and operational efficiency amid competitive pressures. - McKinsey reports 71% of organizations now use generative AI in 2025, but SMEs lag behind large enterprises in scaling AI adoption. - AI adoption delivers measurable ROI, with case studies showing 15-140% productivity gains in sectors like legal, sales, and customer service. - Investors are prioritizing AI-enhanced SaaS platforms that address SME pain points, enabli

The Federal Reserve's Policy Change and Its Effects on Solana (SOL): How Infrastructure Funding and Clearer Regulations Are Speeding Up Blockchain Adoption in 2025

- Fed's 2025 policy clarity and liquidity injections accelerated Solana's institutional adoption in blockchain finance. - Regulatory frameworks like OCC Letter 1186 and GENIUS Act enabled banks to engage with Solana's stablecoin and DeFi infrastructure. - Solana's Alpenglow upgrades (100ms finality) and $508M funding fueled partnerships with Visa , Western Union , and Coinbase . - $2B ETF inflows and $1T DEX volume highlight Solana's role in reshaping cross-border payments and DeFi ecosystems.