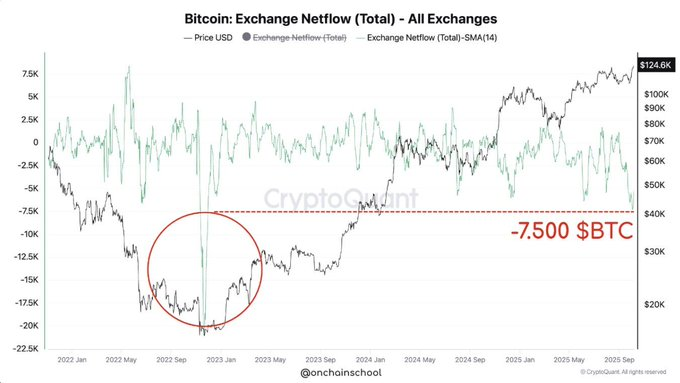

Bitcoin exchange netflows are at a three-year low, with a 14-day SMA averaging roughly –7,500 BTC, signaling sustained outflows from exchanges and reduced short-term selling pressure as long-term holders accumulate and move coins into self-custody.

-

14-day SMA: ~–7,500 BTC outflow

-

Outflows are the largest since the 2022–2023 cycle, showing lower exchange liquidity.

-

Regular withdrawals and constrained exchange supply indicate accumulation by long-term holders.

Bitcoin exchange netflows hit a 3-year low, averaging –7,500 BTC over 14 days; read analysis and implications for holders and market structure.

What are Bitcoin exchange netflows indicating?

Bitcoin exchange netflows measure coins moving into minus out of exchanges; a sustained negative netflow means more BTC is leaving exchanges than entering, signaling lower immediate sell supply and higher accumulation by holders. This typically reduces available on‑exchange liquidity and can amplify price reactions to demand shifts.

How did netflows reach a 3-year bottom?

On-chain tracking shows the 14-day Simple Moving Average (SMA) of exchange netflows averaging about –7,500 BTC. OnChainSchool data places recent outflows at the largest volume since the 2022–2023 cycle. These figures point to consistent withdrawals rather than short-term profit taking.

Bitcoin exchange netflows reach a 3-year low, showing strong holder conviction as investors move BTC off exchanges despite record prices.

- The average outflow of bitcoin exchange is -7,500 BTC in 14 days, and the volume of its withdrawal is the highest since the 2022-2023 cycle.

- The long-term confidence and the weak pressure to enter short-term sales can be interpreted by the fact that investors keep selling BTC out of exchanges despite new all-time highs.

- Regular outflows and constrained exchange supply show a maturity stage of the market where accumulation is taking over the speculative activity of long-term holders.

Netflows of Bitcoin exchanges have dropped to a three-year low, indicating that holders are moving coins off exchanges more rapidly than they are sending them in. This trend suggests diminishing short-term selling pressure as more BTC becomes illiquid on exchanges and more remains in long-term wallets.

Outflows Reach the Largest Level Since 2022–2023

On-chain data indicates the 14-day SMA of Bitcoin exchange netflows is near –7,500 BTC, reflecting the largest withdrawal volume outside the 2022–2023 cycle. The scale of withdrawals is notable for its consistency across major exchanges.

Source: OnChainSchool

Source: OnChainSchool

Fewer coins being deposited to exchanges typically means less immediate liquidity for selling. Investors moving assets into self-custody wallets demonstrates a preference for holding through volatility rather than realizing gains at current all-time highs.

Reduced exchange balances tighten available supply for market participants, which can magnify price sensitivity when demand changes. The netflow trend highlights a structural shift toward accumulation over speculative turnover.

Investor Behavior Signals Long-Term Confidence

Outflows persisted even as Bitcoin recently reached new all-time highs, showing holders are not broadly seeking to exit positions. This retention behavior underlines confidence in long-term prospects rather than short-term profit taking.

OnChainSchool’s on-chain metrics show persistent withdrawals from exchanges, signaling that investors prioritize custody and long-term storage strategies. That mindset is consistent with a maturing market dominated by accumulation.

Reduced Selling Pressure Reinforces Market Stability

Declining netflows correspond with lower on-exchange inventories, which typically reduces immediate selling pressure. With less BTC readily available on exchanges, price moves can become less driven by speculative liquidation and more by genuine supply-demand dynamics.

Institutional participation and growing long-term holder concentration further support a less volatile distribution profile, as accumulation by strong hands decreases the frequency of rapid sell-offs.

Frequently Asked Questions

What does a negative exchange netflow mean for Bitcoin price?

A negative exchange netflow (more outflows than inflows) reduces exchange liquidity and often creates tighter supply, which can amplify price upside if demand rises. It does not guarantee price increases but lowers immediate selling capacity.

How is the 14-day SMA of exchange netflows calculated?

The 14-day Simple Moving Average sums daily netflow values (inflows minus outflows) over 14 days and divides by 14. This smooths short-term noise to reveal persistent trends like the current –7,500 BTC average.

Why are investors withdrawing BTC despite all-time highs?

Investors often withdraw at highs to secure long-term holdings in self-custody, reduce counterparty risk, and avoid short-term liquidation. This behavior reflects confidence and a preference for accumulation over trading.

Key Takeaways

- Outflows are significant: 14-day SMA near –7,500 BTC, highest since 2022–2023.

- Liquidity tightens: Fewer coins on exchanges can magnify price reactions to demand.

- Market maturity: Consistent accumulation suggests long-term investor conviction and reduced speculative turnover.

Conclusion

Bitcoin exchange netflows at a three-year low point to a market dominated by accumulation and reduced short-term selling pressure. With long-term holders moving BTC into private custody, exchange supply is tighter and market dynamics are shifting toward less speculative volatility. Monitor netflows alongside on-chain indicators for ongoing signals.