Crunch Lab raised $5 million to scale a decentralized AI network that runs encrypted modeling competitions to crowdsource predictive models, aiming to create an institutional “intelligence layer” for enterprises and drive real-world breakthroughs in finance, energy and biomedical research.

-

Crunch Lab secures $5M to expand its decentralized AI network and CrunchDAO.

-

Funding will build an institutional intelligence layer and expand use cases beyond finance into healthcare and energy.

-

Already used by institutions such as the Broad Institute of MIT and Harvard for cancer research; total protocol funding now $10M.

Decentralized AI network Crunch Lab raises $5M to build an institutional intelligence layer for enterprises; read funding details, use cases, and next steps.

What is Crunch Lab’s decentralized AI network and why does it matter?

Crunch Lab’s decentralized AI network is a blockchain-enabled platform that runs encrypted modeling competitions to crowdsource predictive models. It converts enterprise forecasting problems into privacy-preserving competitions that reward accuracy, unlocking diverse talent and improving decision-making across finance, energy and biomedical research.

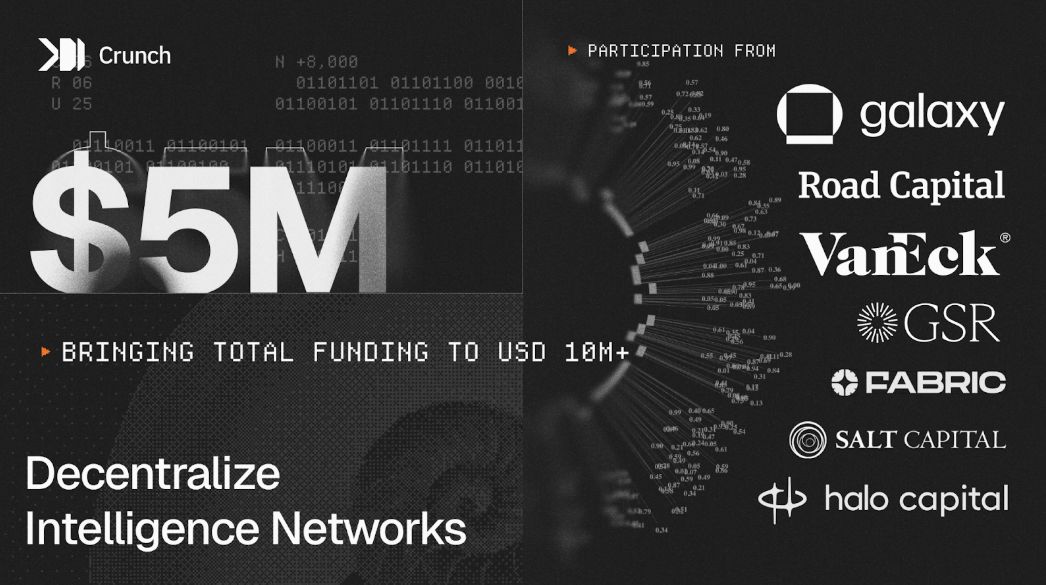

How was the $5M funding round structured and who participated?

Crunch Lab closed a $5 million strategic round co-led by Galaxy Ventures and Road Capital, with participation from VanEck and Multicoin. The latest raise brings the protocol’s disclosed funding to $10 million and targets development of an institutional “intelligence layer” for decentralized AI deployments.

Crunch Lab raises $5M for decentralized AI network. Source: Crunch Lab

Crunch Lab raises $5M for decentralized AI network. Source: Crunch Lab

How does CrunchDAO’s encrypted modeling competition model work?

CrunchDAO transforms enterprise problems into encrypted competitions where data scientists submit models without exposing raw data. The system evaluates submissions using secure scoring, rewards top performers, and iteratively improves models through incentives. This crowdsourced approach uncovers solutions internal teams may miss and preserves data privacy.

What real-world results has the decentralized AI network delivered?

Crunch Lab’s crowdsourced AI has supported applied research at the Broad Institute of MIT and Harvard, contributing to advances in cancer gene research and computer vision for cell-image diagnostics. The platform also produced double-digit accuracy improvements for a major sovereign wealth fund’s research arm and was leveraged in causal analysis by economist Guido Imbens.

Frequently Asked Questions

How much total funding has Crunch Lab raised?

Crunch Lab’s recent $5M strategic round raises the protocol’s disclosed funding to $10 million. Funds are earmarked for platform development and enterprise expansions.

Can enterprises protect sensitive data while using CrunchDAO?

Yes. The platform uses encrypted competitions and secure scoring to ensure raw data remains private while enabling model evaluation and aggregation.

Which institutions have used Crunch Lab’s network?

Notable users include the Broad Institute of MIT and Harvard for cancer research; other applications include sovereign research labs and academic studies in causal inference.

Key Takeaways

- Funding boost: $5M strategic round brings total disclosed funding to $10M and accelerates product development.

- Enterprise focus: Goal is to build an institutional intelligence layer enabling secure, crowdsourced forecasting.

- Proven impact: Platform contributed to cancer research at the Broad Institute and delivered accuracy improvements in institutional labs.

Conclusion

Crunch Lab’s $5 million raise advances a decentralized AI network that converts enterprise forecasting into encrypted modeling competitions, enabling secure access to global talent and demonstrable research gains. With notable institutional use cases and strategic backers, the project positions decentralized AI as a practical intelligence layer for enterprises; stakeholders should watch pilot deployments and accuracy metrics as the platform scales.

Published: 2025-10-07 | Updated: 2025-10-07 | Author: COINOTAG