Crypto market wipes out $60 billion in 1 hour

The cryptocurrency market endured a sharp pullback on October 7, shedding roughly $60 billion in total value within a single hour.

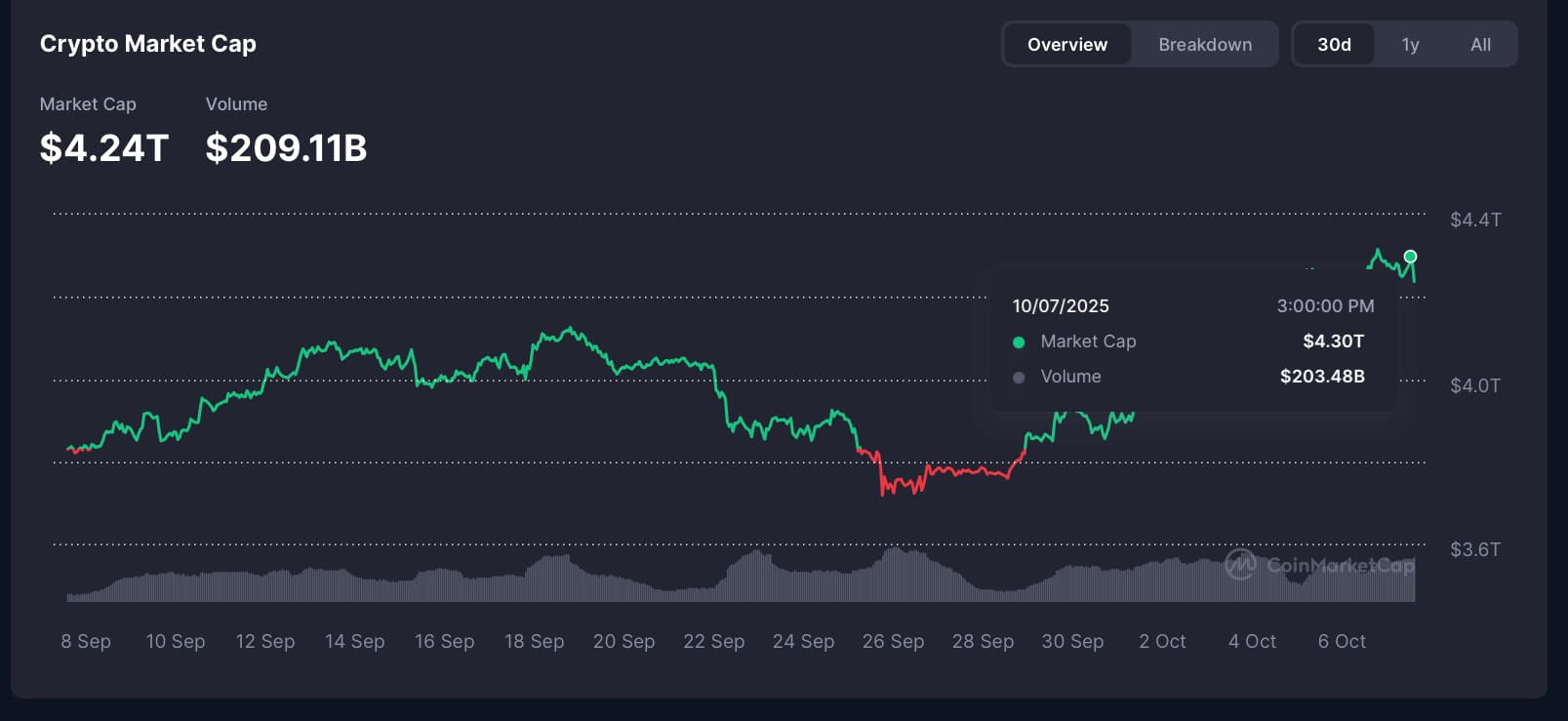

According to data retrieved by Finbold from CoinMarketCap, the global market capitalization dropped from $4.30 trillion at 3:00 p.m. UTC to $4.24 trillion by 4:00 p.m. UTC.

Bitcoin led the downturn. The flagship cryptocurrency, which had been tracking as high as $126,000 earlier in the session, slipped from $125,000 to $122,997 at press time, erasing around $40 billion from its market capitalization. The coin’s market cap declined from $2.49 trillion to $2.45 trillion over the same span.

Altcoin market turns red

Almost all of the top 10 cryptocurrencies by market cap followed Bitcoin lower. Ethereum (ETH), Solana (SOL), and XRP each registered intraday losses. The sole exception was BNB, which remained up 7% in the past 24 hours, highlighting ongoing rotation into exchange-native and regulatory-favored altcoins.

The retracement comes after a relentless multi-week rally that saw Bitcoin climb nearly 20% since late September. Analysts note that the dip reflects a round of profit-taking by traders and potential whale repositioning after BTC repeatedly stalled at the $125,000–126,000 resistance zone.

From a technical perspective, a close below Tuesday’s low near $121,000 could extend losses toward $117,000, the level where on-chain data shows approximately 190,000 BTC last changed hands, forming a strong support cluster.

Derivatives positioning suggests the pullback is more consolidation than capitulation. Open interest across major futures venues remains steady at $2.9 billion, down only 4.36% week-on-week. Meanwhile, spot ETF inflows continue to pour in, with $1.21 billion added across U.S. Bitcoin funds on October 6, led by BlackRock’s IBIT.

Traders are now eyeing Bitcoin can defend the psychologically key $120,000 handle as the market heads into Wednesday’s release of the FOMC minutes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Institutional Bitcoin Buzz vs. Arbitrage Facts: Hayes Reveals the Strategy

- Arthur Hayes challenges institutional Bitcoin bullishness, arguing major players exploit arbitrage strategies rather than hold long-term conviction. - Harvard University's $442.8M IBIT stake and 15% Q3 surge in BlackRock's ETF holders highlight growing institutional adoption. - Hayes reveals "basis trade" tactics where large holders buy IBIT shares while shorting Bitcoin futures to capture yield differentials. - ETF flows show $2.3B November outflows and Wisconsin's $300M IBIT liquidation, reflecting vol

Bitcoin News Update: Bitcoin Drops Under $95,000 as ETFs See $3.2 Billion Outflow, Institutional Interest Declines

- Bitcoin fell below $95,000 on Nov. 17, 2025, due to ETF outflows, weak institutional demand, and broken technical support levels. - Digital asset products saw $3.2B in outflows over three weeks, with U.S. spot Bitcoin ETFs losing $1.1B in a record fourth-largest weekly outflow. - MicroStrategy bought 8,178 BTC for $835.6M, reaffirming its commitment to Bitcoin as a treasury asset despite market weakness. - Solana and Ethereum fell over 15% and 11%, respectively, as broader crypto markets weakened amid fa

Bots Take the Lead Online as Automated Content Reshapes User Experience

Stobox and REAL Finance Join Forces to Revolutionize RWA Infrastructure