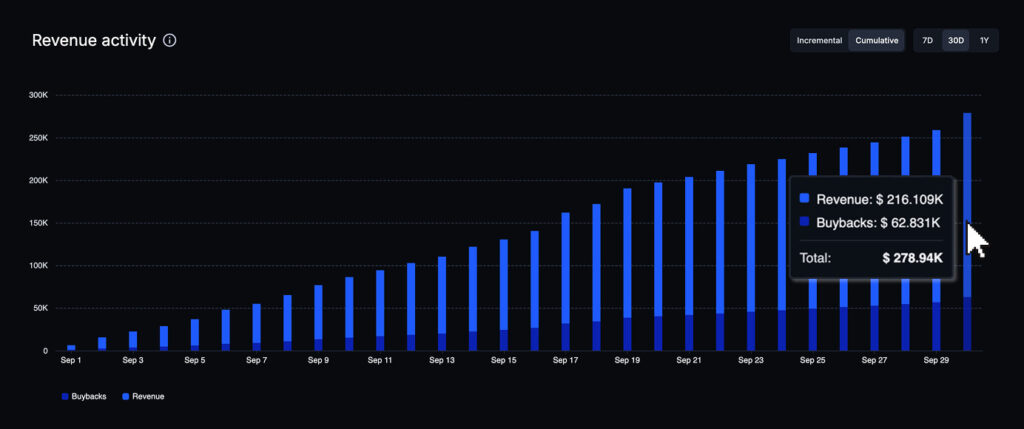

The leading token distribution platform on Solana, Streamflow, announced a record month of growth in September, generating over $280,000 in protocol revenue. Of this, more than $62,800 was distributed directly to $STREAM stakers through its Active Staking Rewards program, marking the highest monthly payouts to date.

Record Growth in Revenue and Buybacks

September’s strong performance builds on several months of growth for Streamflow, with $280,000 generated via their token locks, vesting solutions, airdrops, staking pools, whitelabel services and more. This milestone represents a significant increase from August’s $235,000 revenue, continuing a consistent trend of revenue growth for the protocol.

Buybacks have also risen alongside Streamflow’s revenue growth, with over $62,800 of protocol revenue being used to buy back $STREAM, the project’s native utility token.

This buyback and reward distribution mechanism, called Active Staking Rewards, programmatically uses a percentage of protocol revenue to purchase $STREAM from the open market every hour. The tokens are then distributed to active stakers on an hourly basis, who can claim them directly from the $STREAM staking dashboard . To qualify as an active staker and begin earning rewards, a user must stake $STREAM via the staking dashboard and participate in governance by voting on protocol proposals.

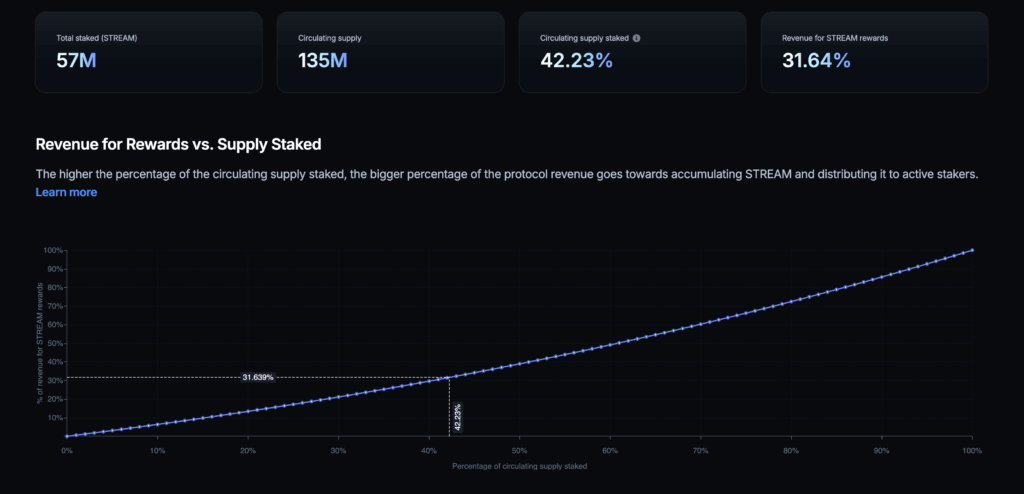

$STREAM Staking Reaches 57 Million with Active Staking Rewards Driving Growth

Beyond rising revenue, $STREAM staking participation has also reached new highs with the total supply of $STREAM that is staked climbing to over 57 million, representing 42.2% of the circulating supply. This growth strengthens the protocol’s core reward mechanism, Active Staking Rewards (ASR), which now uses almost a third of protocol revenue for rewarding $STREAM stakers.

The percentage of protocol revenue used for buybacks is directly correlated with the percentage of staked tokens: as more $STREAM is staked in total, an increasingly larger portion of protocol revenue is directed toward $STREAM buybacks and reward distribution. Projections of how these figures scale can also be explored in detail on the staking dashboard .

The effect of this mechanism is a feedback loop where staking drives stronger buybacks, and stronger buybacks increase the incentive to stake, all being boosted by protocol revenue growth. In September alone, this model distributed over $62,800 in rewards, demonstrating how protocol growth directly translates into tangible value for ecosystem participants.

With over 30% of revenue now allocated to this program, Streamflow is steadily reinforcing its position as one of the most sustainable token distribution models in the Solana ecosystem.

About Streamflow

Streamflow is a secure, easy-to-use, non-custodial platform designed to align token incentives throughout the entire token lifecycle, from fundraising and TGE to long-term ecosystem incentives. Its no-code products enable organizations to automate and customize token distribution across a wide range of operations, including token vesting, token locks, airdrops, staking, token mints, token dashboards and peer to peer contract transfers.

For developers, Streamflow provides an SDK that allows direct integration of its features into external applications. With a peak TVL of ~$2.5 billion, over 1.3 million users across multiple blockchains, and 25,000+ projects powered, Streamflow delivers full on-chain transparency and customization with support across Solana, Sui, and Aptos.

Company Name / Brand Name:

Contact Person: Vukan

Contact Person Title: Marketing