Bits & Pretzels 2025 Review: Munich’s Startup Festival Balances Tradition and Transformation

Bits & Pretzels 2025 once again turned Munich into a meeting point for entrepreneurs and innovators from around the world. Set against the backdrop of Oktoberfest, this year’s event was packed with panels, startup pitches, and corporate showcases — but also marked by unusual circumstances, including a bomb warning that led to the closure of Oktoberfest for the first time in decades.

Despite the disruption, the community spirit stood strong. Attendees found creative ways to continue networking, turning an unexpected challenge into new opportunities.

From Startups to Corporates: A Changing Landscape

Bits & Pretzels has always positioned itself as the festival for founders, but this year’s edition reflected how the startup ecosystem is evolving.

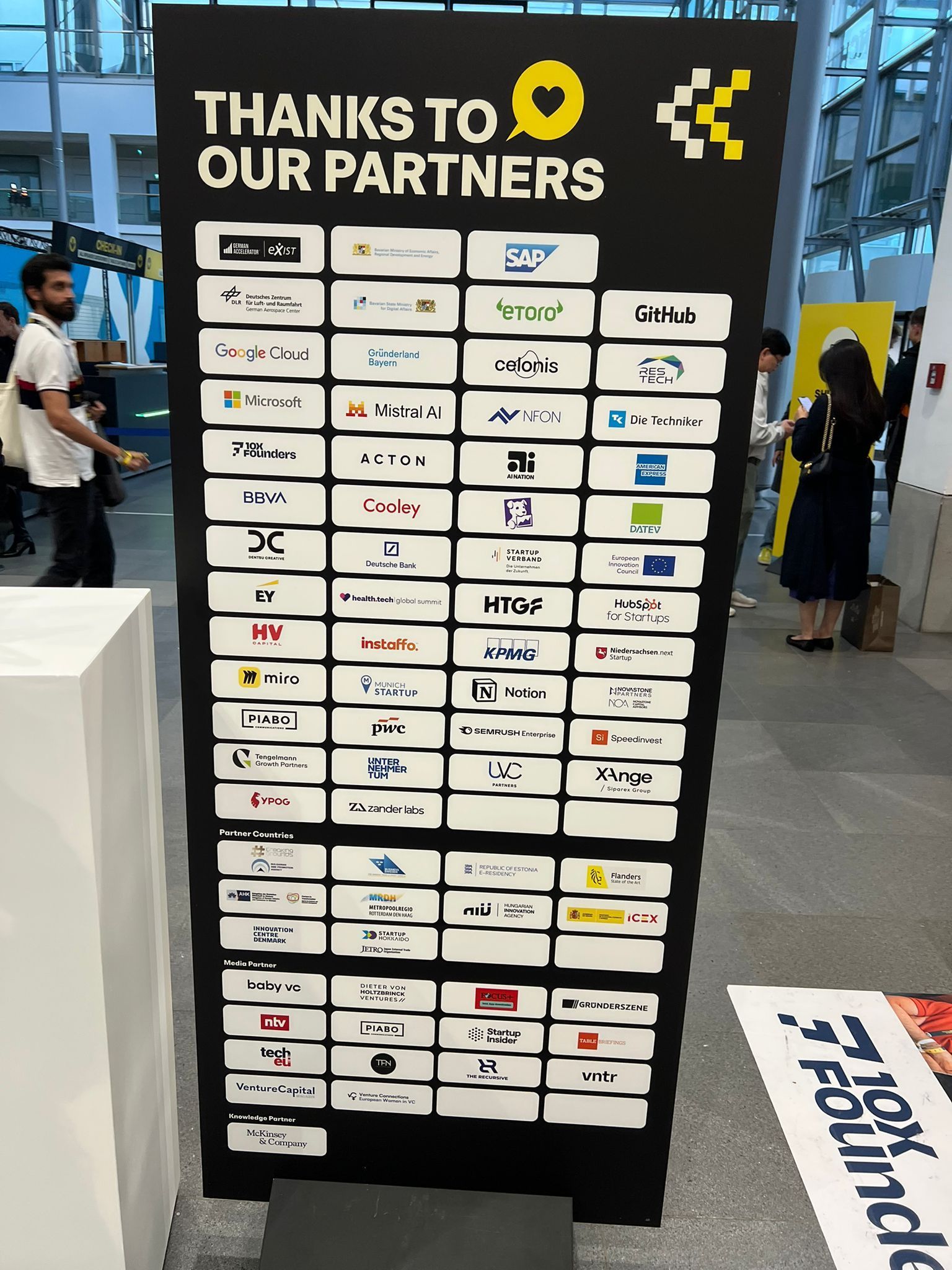

Larger corporations, consulting firms, and established institutions had a stronger presence than in previous years, while smaller early-stage projects were less visible.

Some attendees saw this as a natural step — a sign that the event has matured into a broader innovation platform. Others missed the raw startup energy that once defined the festival.

Still, the mix of participants highlighted how Munich’s startup scene continues to blend traditional business with new tech innovation.

Networking Beyond the Booths

One of the event’s defining qualities remains its atmosphere. From casual meetings in beer gardens to spontaneous discussions between founders and investors, Bits & Pretzels fostered the kind of in-person interactions that digital conferences can’t replicate.

Even after Oktoberfest’s unexpected cancellation, attendees kept the networking alive — gathering at nearby venues and continuing conversations over Bavarian beer and food.

As one participant put it: “The event may have paused, but the connections didn’t.”

Themes and Takeaways

- Innovation meets Structure: More organized formats, structured investor areas, and curated access sessions gave the event a more professional tone.

- Sustainability Focus: From vegan menus to refill stations, Bits & Pretzels showed its commitment to greener practices — though not everyone found it convenient.

- Corporate Meets Community: Big players like PwC, Fraunhofer, and Etoro joined emerging startups, underlining Munich’s role as a European innovation hub.

- Space and AI in Focus: New tech themes like AI and space innovation attracted interest, showing that Germany’s startup scene continues to diversify.

Final Thoughts

Bits & Pretzels 2025 proved that even in challenging moments, the entrepreneurial spirit thrives. The event’s transformation — from a purely startup-focused gathering to a global innovation forum — mirrors how Europe’s tech landscape is growing.

Whether attending for inspiration, partnerships, or networking, Bits & Pretzels remains a must-visit experience for those shaping the future of business.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MMT Value Forecast and Investor Outlook for November 2025: Evaluating Reliability During Economic Changes

- MMT token surged 1,300% in Nov 2025 due to Binance listings, airdrops, and institutional investments. - 1607 Capital increased MMT-linked fund stake by 84.7%, but dividend sustainability remains unclear. - Fed policy and missing inflation data (due to 2025 government shutdown) cloud macroeconomic alignment. - MMT's volatility ($4.40 to $2.54) highlights speculative nature despite structural catalysts. - Long-term credibility depends on macroeconomic clarity and Fed policy shifts, not just exchange-driven

LUNA Declines by 0.62% as Ongoing Yearly Downtrend Persists in Uncertain Market Conditions

- LUNA fell 0.62% on Nov 16, 2025, continuing an 80.61% annual decline amid crypto market volatility. - The drop reflects macroeconomic pressures, regulatory scrutiny, and waning investor risk appetite in digital assets. - Technical analysis shows broken support levels and weak buying pressure, indicating a prolonged bearish phase. - Backtesting reveals sharp declines often trigger panic selling and sector-wide market erosion, compounding losses. - Prolonged depreciation risks eroding investor confidence u

The Momentum ETF (MMT) Rally: Institutional Accumulation and the Mindset Behind Small-Cap Expansion in 2025

- Momentum ETF (MMT) surged 1330% in Q3 2025 due to $10M institutional investments from Coinbase Ventures, OKX, and Jump Crypto. - Market psychology shifts toward small-cap growth as Hartford Funds forecasts 2025 small-cap earnings to outpace large-cap peers amid macroeconomic uncertainty. - MMT's $12B DEX volume and $265M TVL highlight liquidity-driven speculation, but analysts warn long-term success depends on proving real-world utility beyond short-term inflows. - Mercurity Fintech's inclusion in MSCI S

Bitcoin News Update: DeFi Faces Liquidity Challenges Amid Bitcoin Falling Under $100K

- Bitcoin's drop below $100K triggered DeFi liquidity crises, with $650M in leveraged positions liquidated as automated stop-losses activated. - Wrapped Bitcoin (WBTC) integrated with Hedera blockchain to reduce MEV and frontrunning, aiming to inject liquidity into DeFi protocols. - Hyperion DeFi reported 60% MoM validator growth and new partnerships, emphasizing staking yields over leveraged positions to avoid market volatility. - Analysts like Tom Lee predict 6-8 weeks for recovery, contingent on stabili