Chainlink adoption surged on Oct 1, 2025, as Chainlink added 1,963 new addresses, the largest daily increase in over a month; this on-chain growth, coupled with CCIP integrations and institutional pilots, supports renewed bullish momentum for LINK.

-

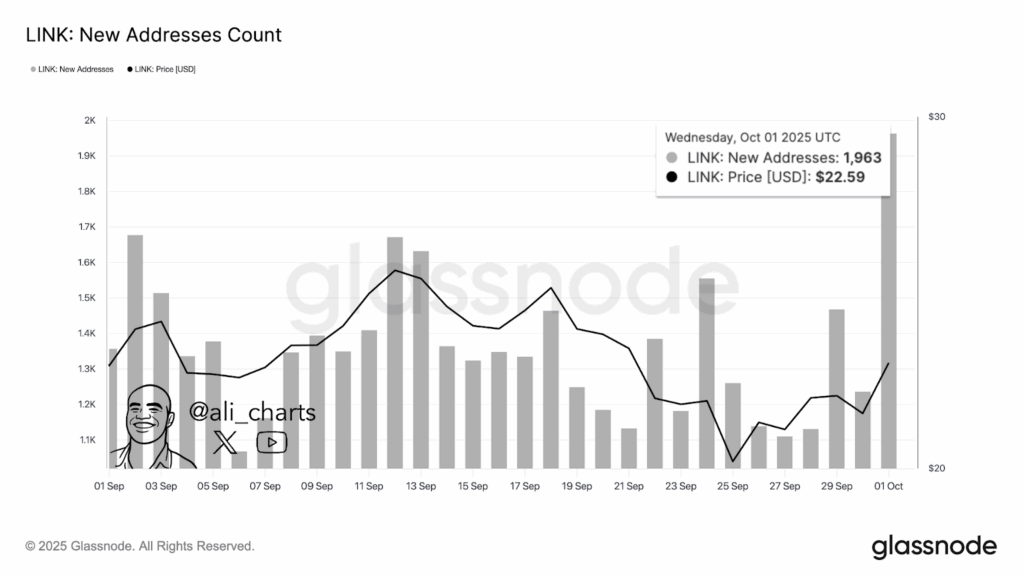

1,963 new addresses on Oct 1 — highest daily spike in over a month

-

LINK holds key support at $20.24 with breakout targets up to $46.31

-

CCIP, Data Streams, and institutional pilots (Swift, UBS Asset Management) underpin adoption metrics

Chainlink adoption surges as 1,963 new addresses lift LINK; read price targets, on-chain data, and actionable takeaways for traders and investors.

Chainlink ($LINK) received 1,963 new addresses on Oct 1, the highest in a month, signaling strong adoption.

Chainlink roared back to life on October 1, adding a record 1,963 new addresses as LINK surged over 10% this week. With fresh tech integrations and growing adoption, bullish momentum is building fast despite a slight daily dip.

What caused Chainlink’s new-address surge on Oct 1, 2025?

Chainlink adoption spiked after on-chain metrics recorded 1,963 new addresses on Oct 1, 2025, the largest daily rise in weeks. This increase aligns with CCIP rollouts, Data Streams integrations, and institutional pilot announcements, which together boosted network activity and investor interest.

How many new Chainlink addresses were added and why it matters?

On-chain data provider Glassnode reported 1,963 new addresses for Chainlink on Oct 1, a clear uptick from the September daily range of 1,100–1,700. New-address growth is a leading indicator of user adoption and can precede extended price rallies when coupled with demand drivers.

Source: Ali Charts Via X

How is LINK’s price reacting to the address growth?

LINK’s price rebounded to $22.59 following the address surge, riding a short-term recovery trend. The correlation between rising new addresses and price suggests increased demand and participation, which technical setups may confirm if resistance levels are cleared.

TradingView shows LINK holding the $20.24 support (0.786 Fibonacci). Bulls are eyeing a breakout in the $23–$24 zone. Confirmed breaches could target $28.98, $35–$39, and a full extension to $46.31. Current price actions show a 3-day gain of 4.09% and price testing the mid-line of an ascending parallel channel.

Source: Ali Charts Via X

Why do CCIP and real-world integrations matter for adoption?

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Data Streams integrations expand utility by enabling secure cross-chain transfers and real-time data feeds. The Worldcoin Data Streams integration and Cross-Chain Token standard lower developer friction and increase potential end-user reach.

Chainlink Labs and Tools for Humanity characterized the upgrades as pivotal for scaling DeFi and cross-chain payments. These fundamentals complement on-chain metrics, making the adoption signal stronger than isolated price moves.

When did institutional pilots add confidence to LINK’s outlook?

Institutional pilots with Swift and UBS Asset Management showcased tokenized fund use cases at Sibos, highlighting enterprise interest in Chainlink’s oracle and cross-chain services. These pilots provide institutional validation that supports medium-term adoption narratives.

Frequently Asked Questions

How does new-address growth affect LINK’s price?

New-address growth increases on-chain demand signals, often preceding price rallies when paired with positive fundamentals. For LINK, rising addresses have coincided with higher trading volumes and renewed bullish technical setups.

Is the CCIP integration already live?

CCIP integrations have begun rolling out, with Data Streams and the CCT standard enabling cross-chain token flows. Adoption timelines vary by project, but early integrations with Worldcoin demonstrate practical use cases.

Key Takeaways

- On-chain signal: 1,963 new addresses on Oct 1 — strongest daily spike in weeks.

- Technical levels: Key support at $20.24, breakout zone $23–$24, targets to $46.31.

- Fundamental drivers: CCIP, Data Streams, CCT standard and institutional pilots strengthen adoption thesis.

Conclusion

Chainlink adoption appears to be accelerating: 1,963 new addresses, CCIP integrations, and institutional pilots together present a cohesive growth story for LINK. Traders should monitor the $23–$24 breakout and on-chain flows for confirmation, while developers watch CCIP rollouts for long-term utility gains.

Published: 2025-10-02 · Updated: 2025-10-02 · Author: COINOTAG