NFT sales double to $256m, Hypurrr tops the list

NFT sales volume more than doubled, surging by 103.11% to reach $256.9 million. This is a notable turnaround from last week’s $84.6 million in sales volume.

CryptoSlam data shows:

- The number of NFT buyers jumped by 18.25% to 694,348

- Sellers increased by 17.77% to 584,235.

- NFT transactions dipped by 8.67% to 1,874,619.

Bitcoin’s ( BTC ) rally to the $122,000 level has energized the entire crypto market. Ethereum ( ETH ) has followed suit, climbing to $4,500.

The global crypto market cap now stands at $4.2 trillion, up from last week’s $3.78 trillion. This bullish momentum has spilled over into the NFT sector, which has posted impressive gains.

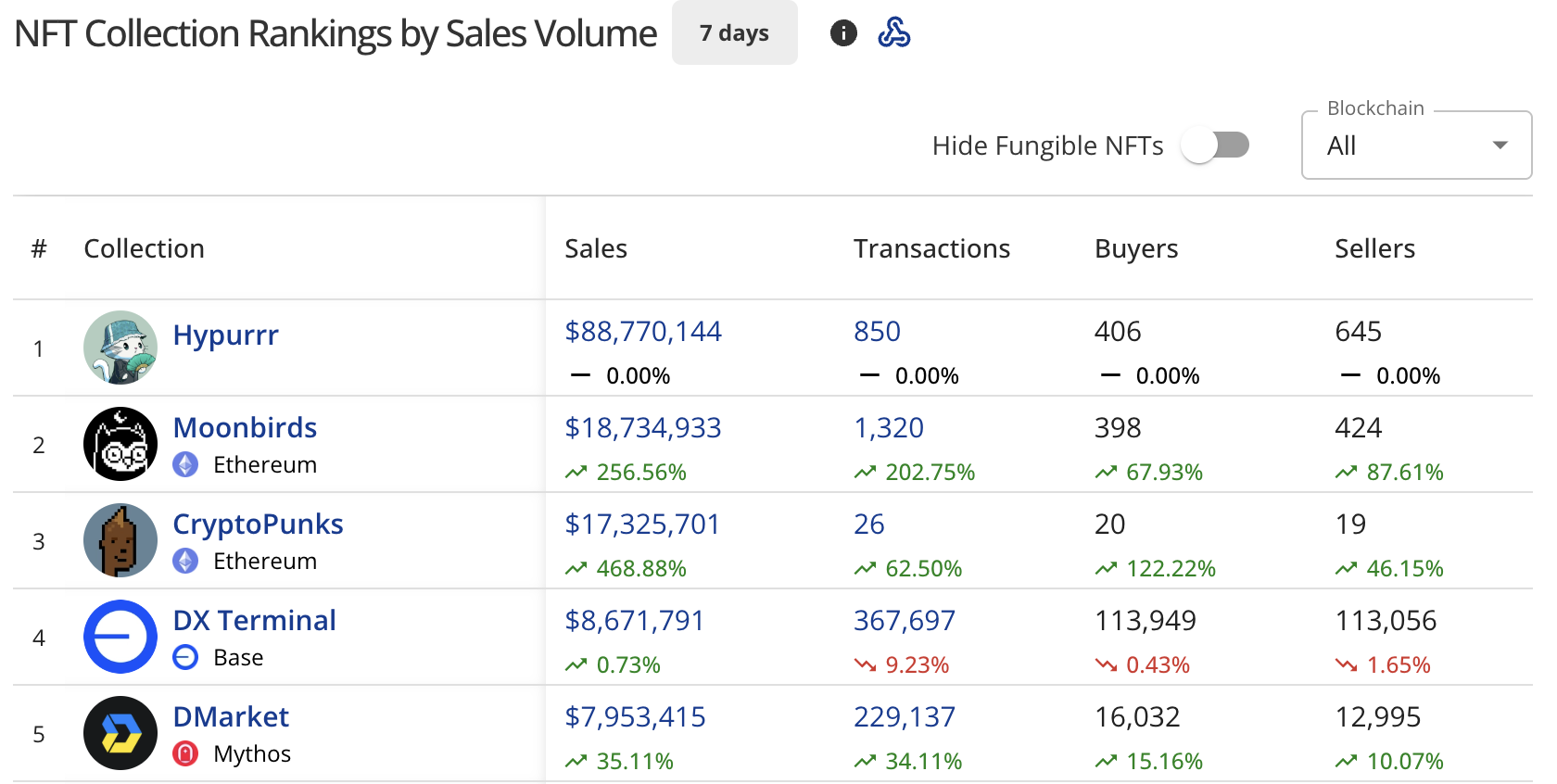

Hypurrr dominates NFT collections

The Hypurrr collection has emerged as the top performer this week, generating $88.77 million in sales across 850 transactions.

The collection attracted 406 buyers and 645 sellers. Hypurrr also dominated the top individual NFT sales, occupying four of the top five spots.

Source: Top collections by NFT Sales Volume (CryptoSlam)

Source: Top collections by NFT Sales Volume (CryptoSlam)

Moonbirds secured second place with $18.72 million in sales, posting a 254.57% increase. The Ethereum-based collection saw 1,319 transactions, with 398 buyers and 424 sellers participating.

CryptoPunks claimed third position at $17.33 million, recording a 468.88% surge. The collection had 26 transactions, with 20 buyers and 19 sellers.

DX Terminal on the Base blockchain came in fourth with $8.67 million in sales, up 0.73%. The collection processed 367,697 transactions and attracted 113,948 buyers.

DMarket rounded out the top five with $7.95 million in sales on the Mythos blockchain, up 34.95% from the previous week.

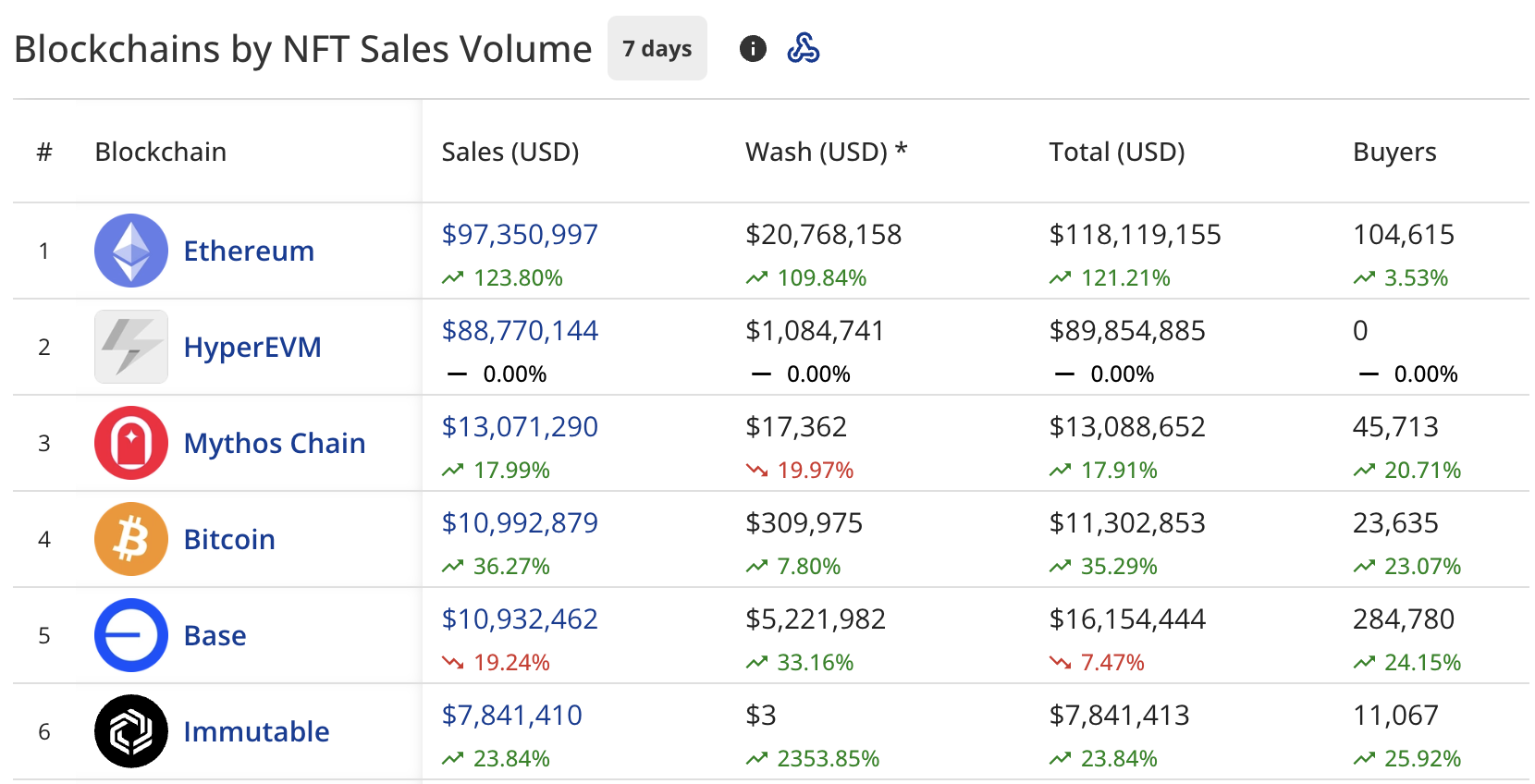

Ethereum leads blockchain rankings

Ethereum maintained its position as the leading blockchain for NFT sales, recording $97.4 million in volume, up 124.35% from last week’s $28.3 million.

The network processed wash trading worth $20.84 million, bringing its total to $118.24 million. The platform saw 104,625 buyers, up 3.55%.

HyperEVM took second place with $88.77 million in sales, driven entirely by the Hypurrr collection’s performance. Interestingly, the blockchain recorded zero buyers in the tracked period.

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Source: Blockchains by NFT Sales Volume ( CryptoSlam )

Mythos Chain ranked third with $13.07 million, up 17.69% from last week’s $10.9 million. The blockchain attracted 45,713 buyers, up 20.71%.

Bitcoin placed fourth at $10.97 million, which is a 36.20% increase from last week’s $14.12 million. The network saw 23,635 buyers, up 23.07%.

Base dropped to fifth position with $10.92 million, down 19.71% from the previous week. The blockchain had 284,780 buyers, up 24.15%.

Solana ( SOL ) landed in seventh place with $7.74 million, up 56.23% from last week’s $16.1 million. The blockchain recorded 56,811 buyers, up 18.33%.

Top individual sales

CryptoPunks #1563 led individual sales at $12.05 million (2745 ETH), sold two days ago.

Four Hypurrr NFTs followed:

- Hypurrr #3926 sold for $7.86 million

- Hypurrr #175 sold for $7.82 million

- Hypurrr #1131 sold for $7.63 million

- Hypurrr #3460 sold for $6.46 million

All four Hypurrr sales occurred five days ago.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: JPMorgan's Move into Bitcoin Poses New Competition for Crypto Treasury Companies

- JPMorgan reclassifies Bitcoin as a "tradable macro asset" via 1.5x leveraged notes, challenging crypto treasury firms and expanding institutional liquidity. - Institutional ETF inflows ($12.87B in Ethereum) and technical indicators suggest growing market confidence despite 30% crypto drawdowns since October. - Regulatory delays (Switzerland's 2027 crypto tax framework) and strategic partnerships (Bitget-Ampersan) highlight fragmented yet expanding institutional integration. - JPMorgan's $240,000 Bitcoin

South Africa's Central Bank Drops CBDC Plans to Address Stablecoin Threats

- South Africa's central bank abandoned retail CBDC plans, prioritizing payments infrastructure upgrades and regulating private digital assets like stablecoins. - Stablecoin trading volumes surged to 80 billion rand by 2024, surpassing volatile cryptocurrencies as dominant instruments due to lower price volatility. - With 7.8 million crypto users and $1.5 billion in custodial accounts, the SARB warned of systemic risks from unregulated cross-border digital asset flows bypassing exchange controls. - Authori

Bitwise's BAVA ETF: AVAX’s Gateway for Institutions Featuring Zero Fees and Staking Rewards

- Bitwise's BAVA ETF for Avalanche (AVAX) offers 0.34% fees, lower than competitors, with waived charges for the first month or $500M AUM. - The ETF integrates AVAX staking rewards and institutional infrastructure, including Coinbase Custody and BNY Mellon, marking a U.S. crypto first. - AVAX rose 7% toward $18 resistance as Europe's Securitize secured EU approval for Avalanche-based tokenized securities, boosting institutional adoption. - With $2.5M in seed capital and $6.41B market cap, AVAX's 2026 outlo

Pi Network (PI) Retesting Its Key Breakout – Could a Rebound Be Near?