Trader Says Large-Cap Ethereum Competitor Could Explode 2x After Overcoming Major Resistance Level, Unveils Targets for XRP, Dogecoin and Sui

A widely followed crypto analyst says that one large-cap rival of Ethereum ( ETH ) is poised to double up in price if it can break through a crucial resistance level while updating his outlook on other altcoins.

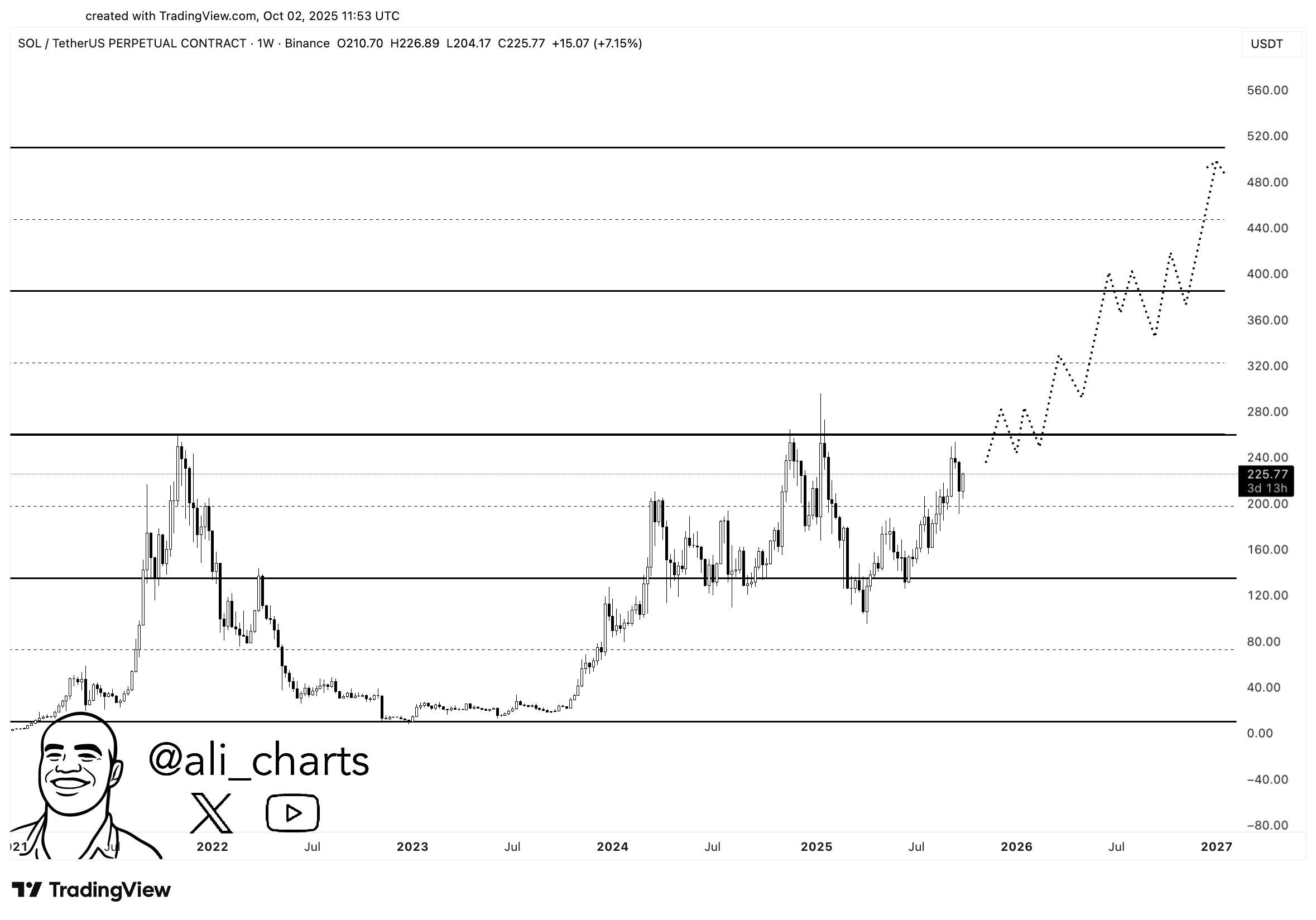

In a new thread, crypto trader Ali Martinez tells his 158,700 followers on X that the smart contract platform Solana ( SOL ) could explode all the way up to $520 if it has a weekly close over $260.

“A weekly close above $260 could ignite a Solana SOL bull rally to $520.”

Source: Ali Martinez/X

Source: Ali Martinez/X

However, according to the trader’s chart, an event like this wouldn’t happen until mid-2026 or 2027. Solana is trading for $230 at time of writing, a 1.9% rise during the last 24 hours.

Moving on to XRP , the digital asset associated with the payments platform Ripple, Martinez says the token appears as if it’s about to break out of a triangle, looking to hit a price tag of $3.60 sometime near the end of October.

“XRP looks set to break out of a triangle, with $3.60 as the target.”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is valued at $3.05 at time of writing, a 3% rise on the day.

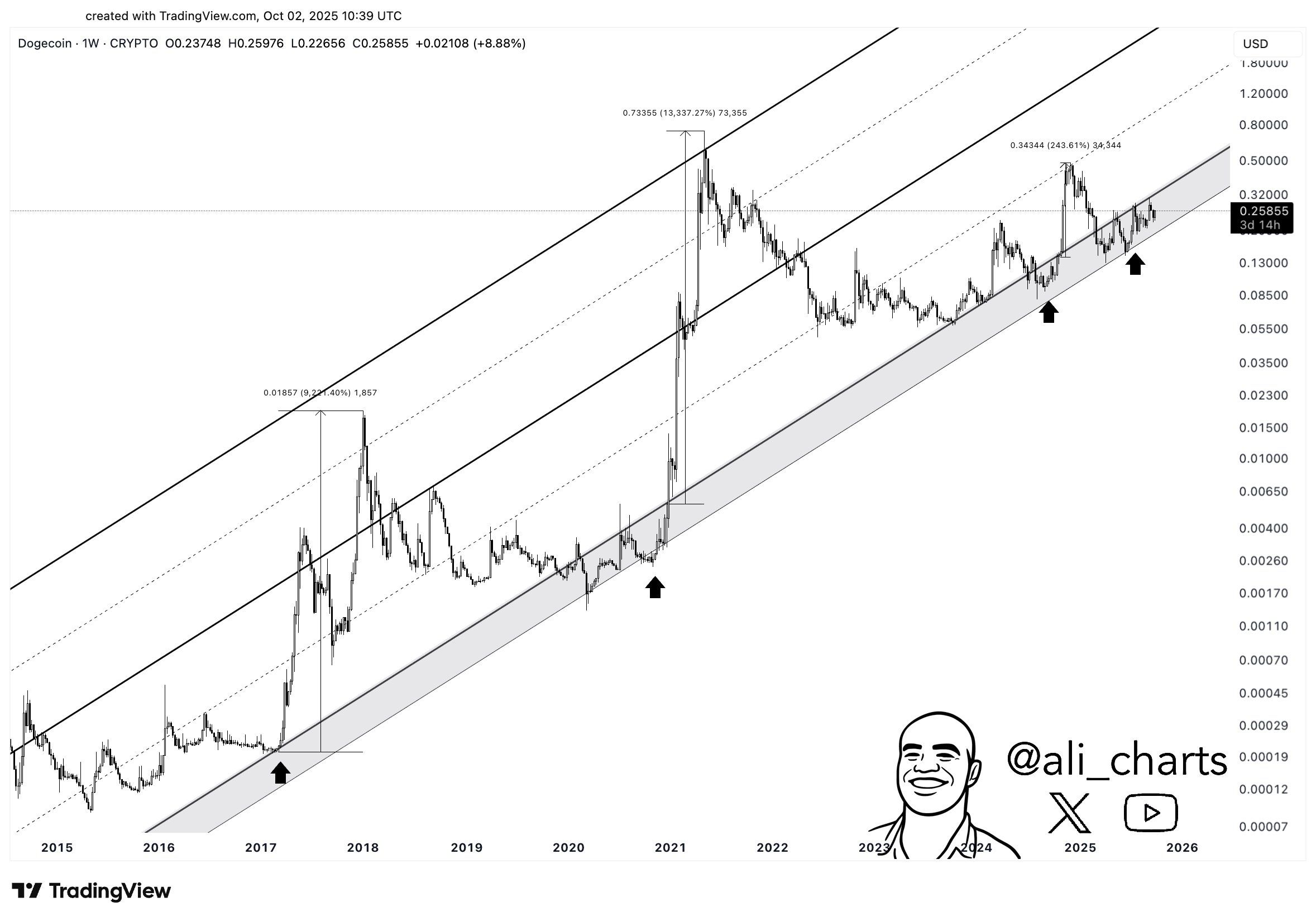

Next up, Martinez brings up the popular meme asset Dogecoin ( DOGE ), noting that it’s still in its accumulation phase and that a breakout is imminent.

Source: Ali Martinez/X

Source: Ali Martinez/X

DOGE is trading for $0.257 at time of writing, a 2.4% rise during the last 24 hours.

Concluding his analysis with the layer-1 blockchain Sui Network ( SUI ), Martinez says the asset appears to be in its prime “buy zone” before it works its way up to a price of $7 sometime before the end of the year.

Source: Ali Martinez/X

Source: Ali Martinez/X

SUI is valued at $3.61 at time of writing, a 2.8% gain on the day.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Harvard’s Investment in Bitcoin Challenges Previous Doubts as Major Institutions Turn to Cryptocurrency

- Harvard University increased its stake in BlackRock’s IBIT to $442.8 million, now its largest U.S. holding, reflecting growing institutional crypto adoption. - The move marks a strategic shift toward Bitcoin and gold as inflation hedges, despite past skepticism from Harvard economists like Kenneth Rogoff. - Other institutions, including Abu Dhabi’s Al Warda and Emory University, also boosted Bitcoin ETF holdings, aligning with $60.8B in net inflows since 2024. - Analysts view Harvard’s 0.6% allocation as

Ethereum News Update: Optimism Surrounding Ethereum’s Supercycle Faces $1.4B ETF Outflows and Skepticism from Competitors

- Ethereum (ETH) fell below $3,100 on Nov 16, 2025, amid institutional selling and macroeconomic uncertainty, with ETF outflows reaching $1.42 billion since early November. - Fundstrat's Tom Lee argued ETH could enter a Bitcoin-like "supercycle," but critics questioned its defensibility against rivals and unique utility compared to other chains. - Harvard's $443M allocation to BlackRock's IBIT ETF highlighted growing institutional crypto interest, contrasting with Bitcoin ETFs' $1.6B three-day outflows. -

Tokenized Gold Market Climbs to $3.9B While Stablecoin Supply Surges

Solana and XRP Battle for the Next Major Spot in the Crypto Market Shake-Up