PayPal’s PYUSD stablecoin supply doubles to $2.5b in a month

PayPal’s PYUSD supply has surged 113% month-over-month, hitting an all-time high of $2.54 billion.

- PayPal’s PYUSD stablecoin doubled its circulating supply, reaching $2.54 billion

- Over the past month, the token’s supply surged 113%

- USDT and USDC still dwarf all other stablecoins combined

PayPal’s stablecoin PYUSD has broken out of its quiet launch phase. On Friday, Oct. 3, the stablecoin reached an all-time high in circulating supply at $2.54 billion. Over the past month, this figure rose 113%. At the same time:

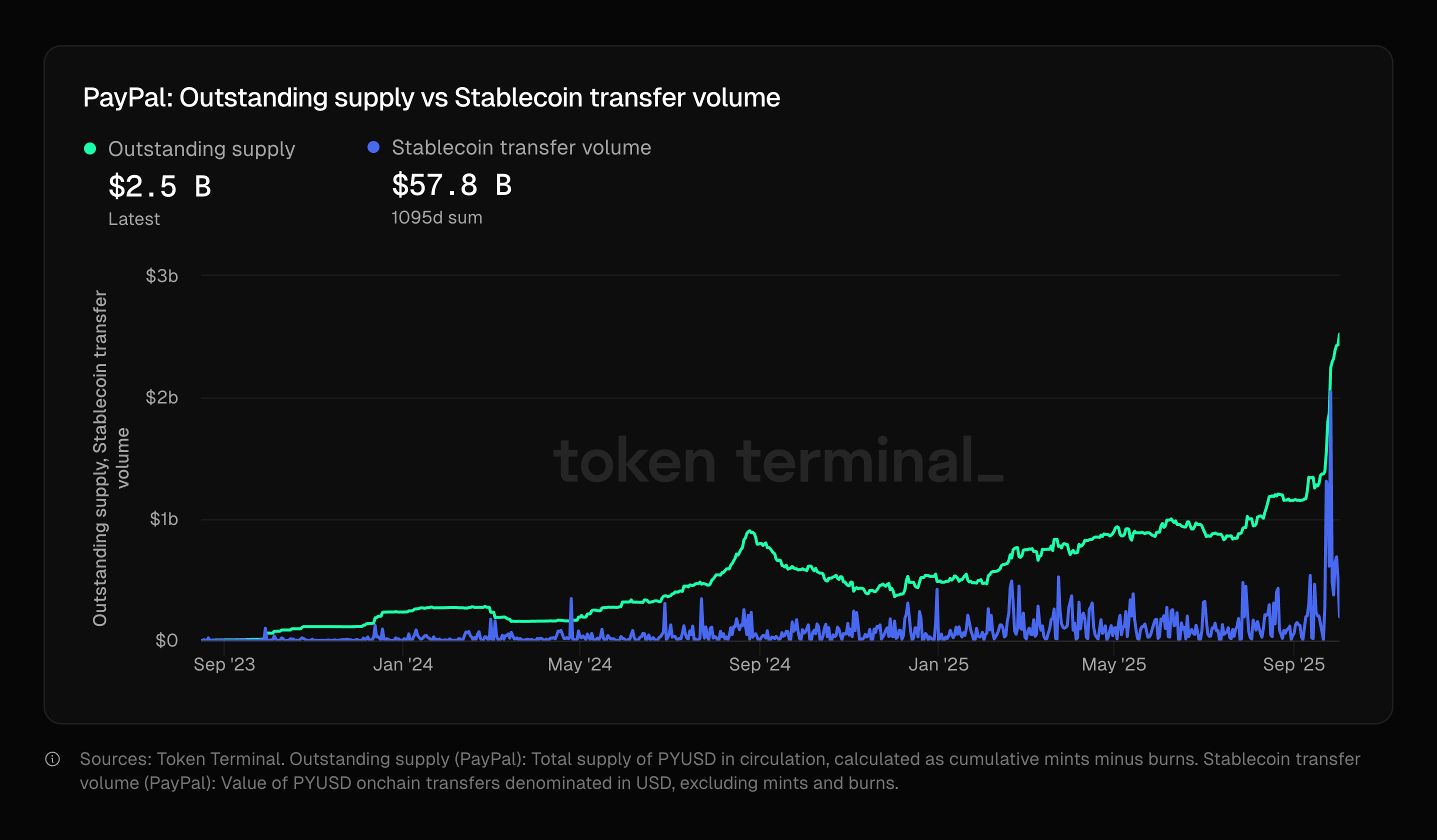

PayPal’s PYUSD outstanding supply and stablecoin transfer volume | Source: Token Terminal

PayPal’s PYUSD outstanding supply and stablecoin transfer volume | Source: Token Terminal

A circulating supply of $2.54 billion puts PYUSD in seventh place among stablecoins, behind USDe, USDS, DAI, and USD1. Much of that supply, specifically $1.84 billion, is on Ethereum (ETH) . At the same time, $624 million worth of PYUSD is on Solana (SOL) .

PYUSD transfer volume peaked at $2 billion daily on Sept. 26, according to data from Token Terminal. So far, the stablecoin has facilitated almost $60 billion in total transfers. PYUSD has also reached a milestone of 40,000 holders, a figure that has risen consistently since January 2025.

Still, giants Tether and USDC continue to dominate the market, with $176 billion and $75.9 billion in circulating supply. Together, they account for almost 85% of all circulating supply. PYUSD itself accounts for 0.84% of the stablecoin market.

PYUSD stablecoin is taking off

At launch, many called the PYUSD stablecoin a “nothing burger” , citing its limited reach beyond the PayPal and Venmo ecosystem. Still, the firm has worked on decentralizing PYUSD, enabling users to send to external wallets and holding it non-custodially.

PYUSD’s all-time high coincided with the stablecoin market cap breaking the total value of $300 billion. U.S.-denominated stablecoins lead the charge, with USDC growing rapidly. What is more, the monthly stablecoin transfer volume reached $3.27 trillion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin Backs ZKsync: Igniting Ethereum Layer 2 Innovation and Ushering in the Next Era of DeFi

- Vitalik Buterin's endorsement of ZKsync's Atlas upgrade accelerates Ethereum's ZK-based scalability strategy, positioning ZKsync as a key DeFi infrastructure player. - The upgrade achieves 15,000+ TPS with near-zero fees via ZK Stack, enabling 30% stablecoin dominance and bridging Ethereum's L1-L2 liquidity gaps. - Institutional adoption surges as ZK token gains 50% post-endorsement, supported by $15B in ZK-related DeFi inflows and StarkNet's TVL tripling in Q4 2025. - Upcoming Fusaka upgrades (30,000 TP

ZK Atlas Enhancement and Its Influence on Layer 2 Scaling

- The ZK Atlas Upgrade (Oct 2025) revolutionized Layer 2 scalability with 15,000+ TPS and $0.0001/tx costs via innovations like Atlas Sequencer and Airbender prover. - Vitalik Buterin's GKR protocol reduced ZK verification costs 10-15x, slashing Ethereum gas fees by 90% and boosting DeFi competitiveness. - ZK ecosystem TVL hit $3.5B by 2025, with $15B in Bitcoin ETF investments and 60.7% CAGR projected for ZK Layer 2 market growth to $90B by 2031. - Institutional adoption accelerated as stablecoins capture

Bitcoin Updates Today: Veteran Bitcoin Holders Selling Raises Questions: Is the Market Unstable or Undergoing a Tactical Change?

- Bitcoin OG holders are accelerating sales of decade-old BTC stashes, with $1B+ moved from pre-2018 wallets in 2025. - Analysts debate motives: Erik Voorhees sees long-term adoption focus, while Willy Woo cites quantum risk mitigation and SegWit address shifts. - Price volatility intensifies as BTC struggles to reclaim $105k-$106k support, with $722M realized losses and ETF buying ($530M) failing to offset selling pressure. - Historical patterns suggest potential 15-20% corrections, with on-chain expert D

DeFi’s Latest Gateway: How DASH’s Calculated Strategy Demonstrates Trustworthiness to Institutions

- Aster DEX's DASH token, with institutional backing, drives DeFi adoption through hybrid models. - DASH's yield-collateral model offers 5-7% returns, bridging traditional and decentralized finance. - Partnerships with Binance and $17.35B TVL validate Aster DEX's institutional credibility. - Price volatility and regulatory risks persist, but hybrid compliance tools mitigate challenges. - DASH's strategic move highlights DeFi's potential as a bridge to next-gen financial infrastructure.