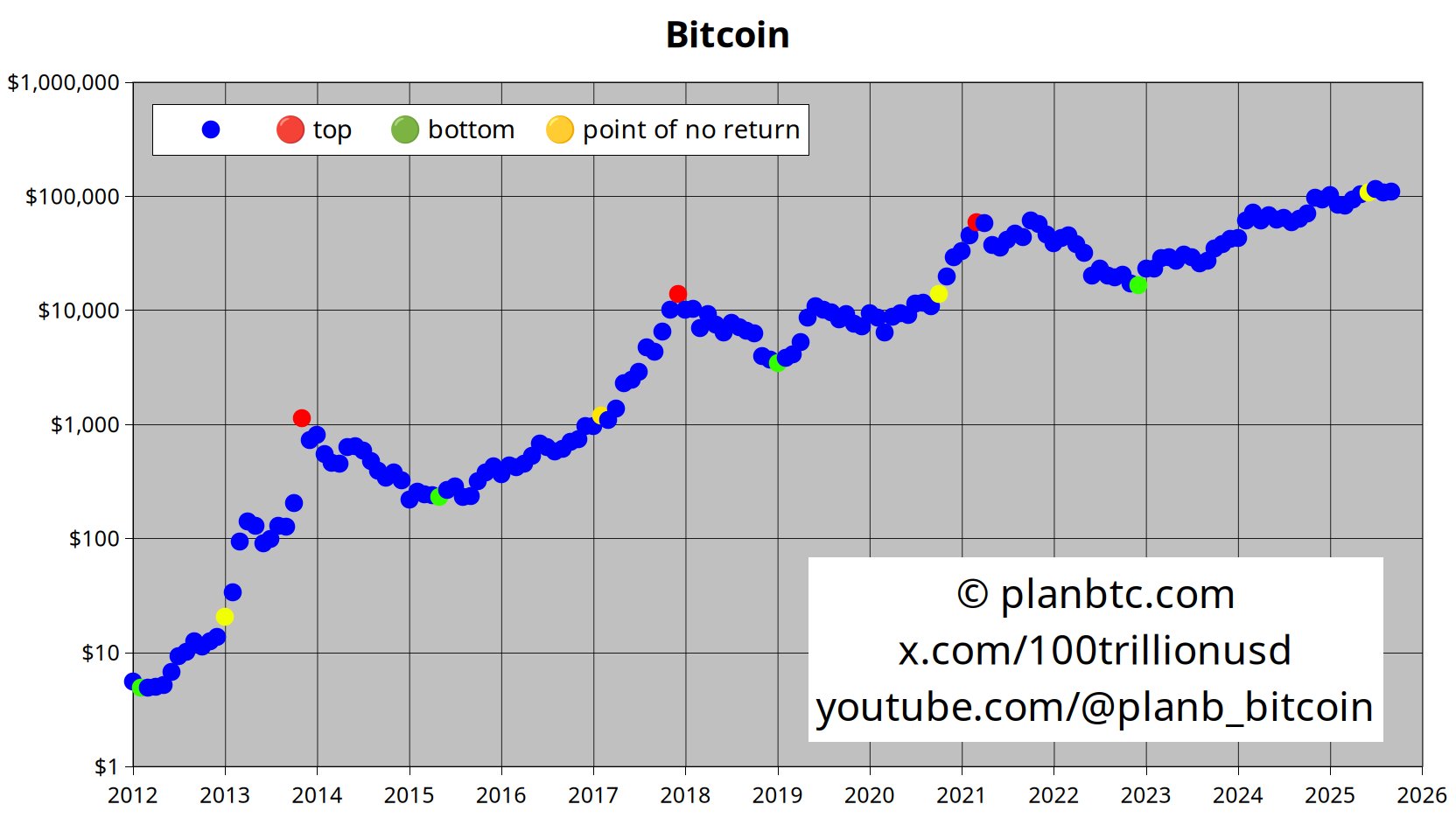

Quant Analyst PlanB Says Bitcoin Now at Point of ‘No Return,’ Similar to 2020, 2017 and 2013 Bull Markets

A popular crypto analyst thinks the Bitcoin ( BTC ) bull market isn’t over yet.

The pseudonymous trader PlanB tells his 2.1 million X followers that BTC has passed the “point of no return.”

“I think [the] Bitcoin bull market has not ended and will continue. I don’t know until when, or how high. It could also be a long, steady uptrend, without FOMO+crash. IMO, we passed the point of no return (yellow dots) in June 2025, similar to October 2020, February 2017 and January 2013.”

Source: PlanB/X

Source: PlanB/X

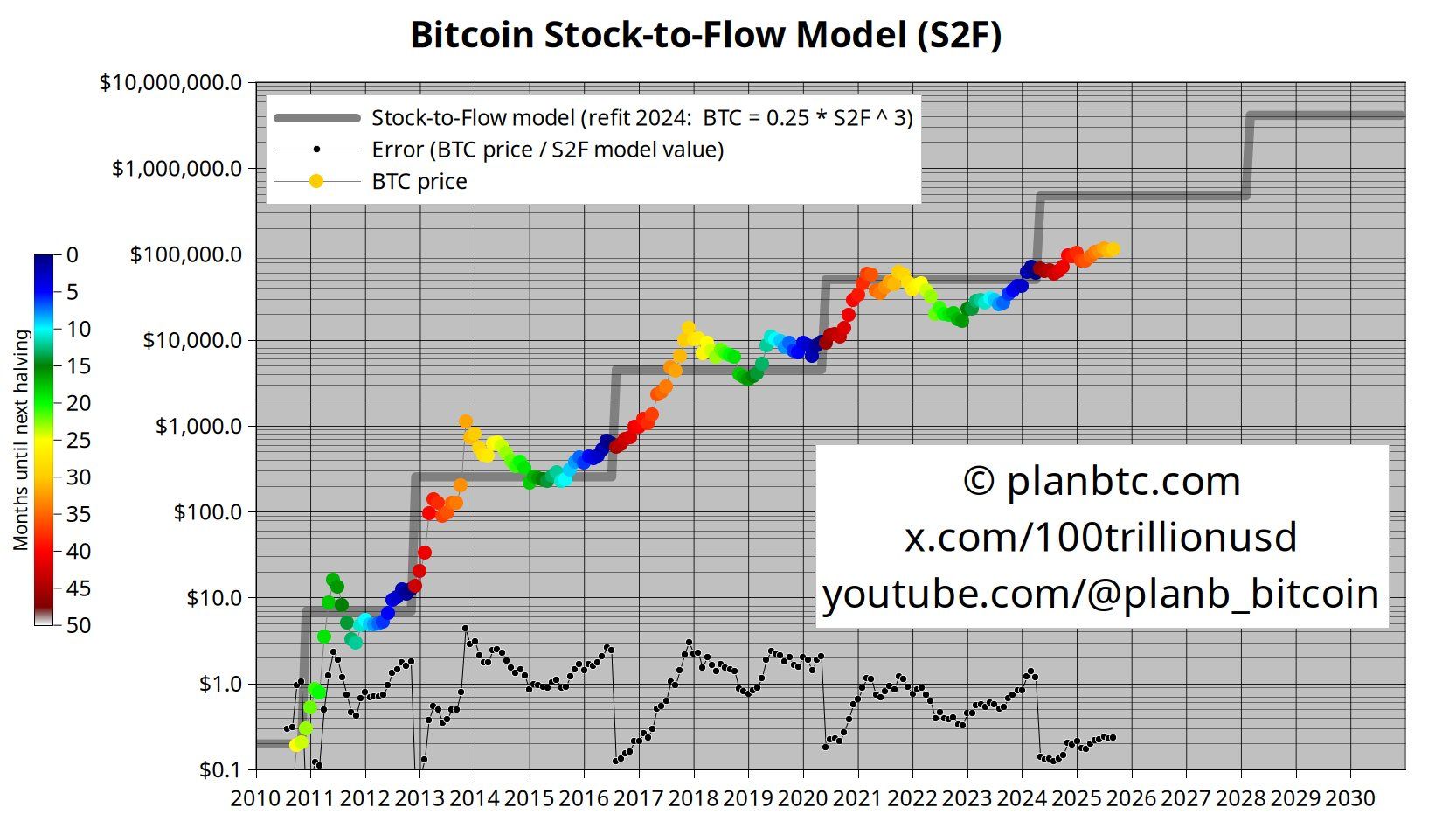

PlanB also shares a graph of the stock-to-flow model, a predictive tool that assumes the scarcity of a commodity drives its price.

“Whether you like it or not, Bitcoin’s value is very much linked to its scarcity. Fiat will be printed, Bitcoin will rise.”

Source: PlanB/X

Source: PlanB/X

While the stock-to-flow model was originally created to track traditional commodities, PlanB was one of the first analysts to apply it to Bitcoin.

Earlier this month, the crypto analyst argued that all asset prices – including gold, BTC, and the S&P 500 – have been rising during the last decade due to the Fed printing money.

“How will there be diminishing returns when debasement is exponential? All asset prices increased exponentially last 10 years (driven by money printing): -Gold 3x (~$1,000 to ~$3,000) -S&P 3x (~$2,000 to ~$6,000) -Bitcoin 250x (~$400 to ~$100,000). In my opinion, it is a unit of account phenomenon.”

BTC is trading at $114,471 at time of writing. The top-ranked crypto asset by market cap is up nearly 2% in the past 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean

The Growing Significance of Financial Well-Being in Planning for Lasting Wealth

- Financial wellness is redefining long-term wealth planning by integrating personal well-being with financial outcomes. - Intentional habits and AI-driven tools boost resilience, reducing behavioral underperformance by 2.5% annually. - Debt management via sustainable finance mitigates risks, especially in developing economies with robust policies. - Early financial education and four-quadrant frameworks balance objective metrics with subjective well-being. - Technology and financial therapy bridge gaps, e

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance

Anthropology-Inspired Advancements in Higher Education: The Impact of Cross-Disciplinary Research on Student Success and Institutional Worth

- Farmingdale State College integrates anthropology with STEM/edtech to cultivate critical thinking and cross-disciplinary skills, aligning with evolving workforce demands. - Its Anthropology Minor (15 credits) and STS program emphasize cultural context, societal implications of technology, and data-driven problem-solving for STEM-aligned careers. - Partnerships like the $1.75M Estée Lauder collaboration and $75M Computer Sciences Center demonstrate how interdisciplinary approaches attract investment and a