For weeks, Cardano investors have watched hopes for a $1 rally slip further away. ADA, long hailed as a smart contract powerhouse, now feels quieter, its usual buzz replaced by a hint of hesitation. Traders are stepping back, with futures activity dropping 23% since mid-September. Additionally, the $0.76 support level is under pressure, while attempts to reclaim the $0.84 demand zone have been unsuccessful, leaving many to wonder if the Cardano price momentum will regain its strength.

Source: TradingView

With analysts tracking the market, this stagnation highlights a subtle opening: while Cardano price shows what happens when promise meets slow adoption, emerging protocols like Paydax Protocol demonstrate how real utility and measurable engagement can turn tokens into working assets regardless of market movements.

The Hype Trap In Crypto: Why Momentum Falls And How Paydax Protocol Addresses It

Crypto markets are flashing cautionary signals, and the Cardano price is a prime example. CoinGlass data shows ADA’s futures open interest has slid to around $1.50 billion — down 23% since mid-September, with an additional 3.5% shaved off in just the last day. That kind of decline means fewer traders are stepping in, making it harder for the Cardano price to rebuild traction. Paydax Protocol offers a different path.

Rather than depending on speculation, Paydax ties PDP’s value to measurable financial activity. Borrowing, lending, and staking within the ecosystem create recurring demand: every loan and stake generates real utility that supports token usage. So even if short-term traders retreat, platform activity continues to create buying pressure. By anchoring growth to genuine usage instead of viral buzz, Paydax Protocol reframes momentum as something earned through function, not clicks.

The Mechanics Driving Paydax Protocol's Utility Forward

Paydax Protocol is designed to sustain token momentum by grounding value in real-world applications rather than hype. Here’s how it works:

-

Real-world collateral: Paydax enables users to borrow and lend not only with cryptocurrency but also with tokenized tangible assets, ranging from gold and real estate to fine art and luxury items. This multi-asset design expands utility beyond the narrow limits of crypto-only lending, creating demand rooted in tangible value.

-

High-yield incentives: Stakers and lenders on Paydax Protocol can earn yields up to ~40%. These returns aren’t artificial; they flow from actual loan interest and farming strategies, tying token demand to real financial activity.

-

Built on trust: Security and transparency are at the core. Paydax Protocol collaborates with Brink’s custody for asset storage. Assure DeFi thoroughly audits its contracts , and the team is doxxed and KYC-verified.

-

Tokenomics with purpose: PDP isn’t just a trading ticker. It powers governance, staking rewards, and fee discounts. By embedding value into platform activity, Paydax ensures that PDP grows in tandem with network usage, rather than relying on fleeting social buzz.

Source: Paydax Protocol

Paydax项目引发市场关注

近期,Paydax被市场广泛关注。投资者越来越倾向于寻找与真实金融活动相关联的协议。

Source: Paydax Protocol

The weakness in the Cardano price makes the shift clear. Futures open interest has been declining, and the Cardano price appears to be stalled, leaving traders seeking projects where capital is actually put to work. That’s where Paydax comes in.

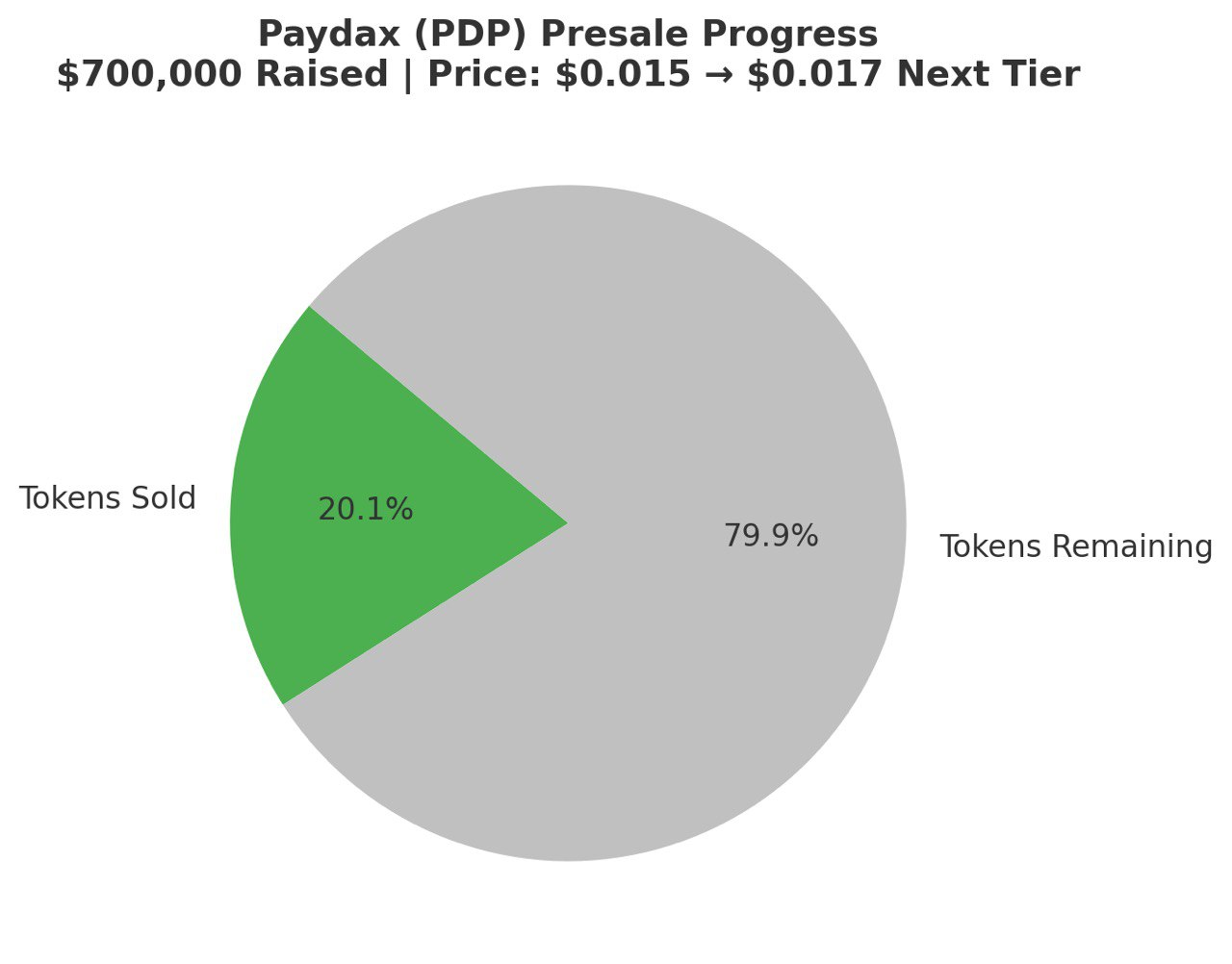

More than 20% of PDP tokens have already been sold, and demand is tied directly to lending, borrowing, and asset-backed collateral. For ADA holders watching the Cardano price charts go sideways, Paydax offers something different: a system built to turn participation into utility and long-term rewards, not just fleeting market moods.

The People's DeFi Bank Will Turn Vision Into Demand

The idea behind Paydax Protocol has always been clear: build a true People’s DeFi Bank. Early buyers are locking into an ecosystem built for usage, from loan interests to token incentives that tie value directly to activity.

The current success signals rising confidence as $700,000 has already been raised at the current price, reflecting a positive response in the market.