"Aster's Airdrop Gambit: Sparking DeFi's Latest Battle With Hyperliquid"

- James Wynn, known for a $1.2B Bitcoin leveraged trade, now holds a 3x leveraged position on ASTER, anticipating a major airdrop. - Aster's 8.8% airdrop (704M tokens) aims to boost liquidity and user engagement, with claims open until October 17, 2025. - Aster's $24B daily trading volume and 300x leverage on HYPE tokens intensify competition with Hyperliquid, which lost market share. - Wynn's bullish stance contrasts with his skepticism toward Hyperliquid, citing privacy features and MEV protection as adv

James Wynn, a trader operating under a pseudonym and previously recognized for a $1.2 billion leveraged long position on

The upcoming airdrop for Aster, which has attracted considerable interest, is central to Wynn’s investment thesis. The project has set aside 8.8% of its total 8 billion ASTER tokens—704 million—for the community, with claims available from September 17 to October 17, 2025. Eligibility is based on trading, staking, and participation in the platform’s points initiatives. More than half of the total supply is allocated for airdrops, aiming to boost liquidity and user participation. The Token Generation Event (TGE), planned for September 17, will officially launch the token, and any unclaimed tokens will be redirected to ecosystem growth MEXC Blog, *Aster Airdrop: $704M In $ASTER Tokens* [ 4 ].

Aster’s rapid ascent is reflected in its market activity. The platform’s 24-hour perpetual trading volume hit $24 billion in late September, outpacing Hyperliquid’s $12 billion, and it generated $10 million in daily revenue—four times that of Hyperliquid. This surge is driven by features like MEV-free transactions, stealth orders, and dual trading modes, which address major challenges in decentralized trading. Institutional interest is apparent, with blockchain data showing two large holders acquiring 118.25 million ASTER tokens ($270 million), and another 68.25 million tokens ($156 million) withdrawn by several wallets associated with industry insiders Coingape, *Hyperliquid Will Die Slow Death Explains Trader James Wynn* [ 6 ]. These trends position Aster as a strong competitor to Hyperliquid, whose share of the on-chain perpetuals market fell from 71% in May to 38% by the end of September.

Wynn’s optimism for ASTER stands in contrast to his doubts about Hyperliquid. He credits Aster’s success to its privacy-oriented design and advanced risk controls, which protect traders from front-running and MEV exploits. “Hyperliquid will have a slow and painful death,” he posted, highlighting Binance co-founder Changpeng Zhao’s support for Aster as a key advantage. Meanwhile, Hyperliquid’s HYPE token dropped nearly 26% in a week, while ASTER soared by more than 2,200% during the same period Coingape, *Hyperliquid Will Die Slow Death Explains Trader James Wynn* [ 6 ]. The rivalry intensified when Hyperliquid introduced ASTER with 3x leverage, and Aster countered by offering 300x leverage on HYPE, further increasing market turbulence.

Analysts point to the broader significance of this competition. The on-chain perpetuals sector, once led by a handful of protocols, now includes over 80 platforms, illustrating DeFi’s rapid diversification. Aster’s airdrop approach follows successful examples like

The ASTER airdrop and Wynn’s leveraged position highlight the evolving landscape of decentralized trading. As projects like Aster use token incentives and privacy features to challenge established players, competition in the sector is set to become even fiercer. For market participants, the relationship between airdrop involvement, platform growth, and large holder activity will be crucial for evaluating long-term prospects. With the October 17 deadline for claims approaching, how the market reacts to Aster’s token distribution may further influence the future of decentralized finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

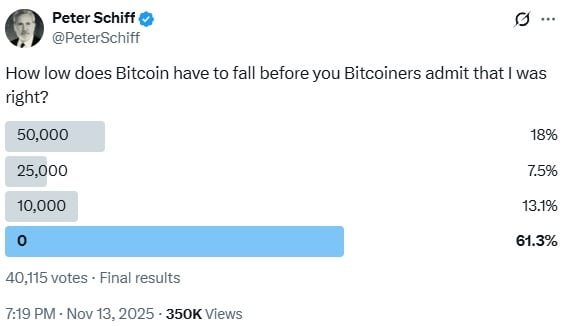

Peter Schiff Warns Bitcoin May Keep Sinking as Sentiment Tests Major Thresholds

Bitcoin Updates: As Crypto Markets Waver, Founder’s BTC Acquisition Reflects Enduring Confidence

- Cryptocurrency markets fell for a third day, with Bitcoin dropping below $100,000, erasing $130B in value as panic spread. - Equation founder's BTC purchase signaled long-term confidence despite bearish sentiment and a "consolidation limbo" trapping Bitcoin. - Macroeconomic uncertainty from the U.S. government shutdown and $1B in liquidations worsened the selloff, while the Crypto Fear and Greed Index hit "Extreme Fear." - Institutional interest in crypto products like Canary XRPC ETF and decentralized p

DCR is currently trading at $37.04, up 10.6% in the last 24 hours.

STRK broke through $0.23, with a 24-hour increase of 29.3%.