Bitcoin Bottomed Out the Last Seven Times This Signal Flashed, Says Analytics Platform – Here’s the Outlook

New data from the crypto intelligence platform Swissblock reveals that Bitcoin ( BTC ) and altcoins are on the cusp of a reset phase that should have them seeing green.

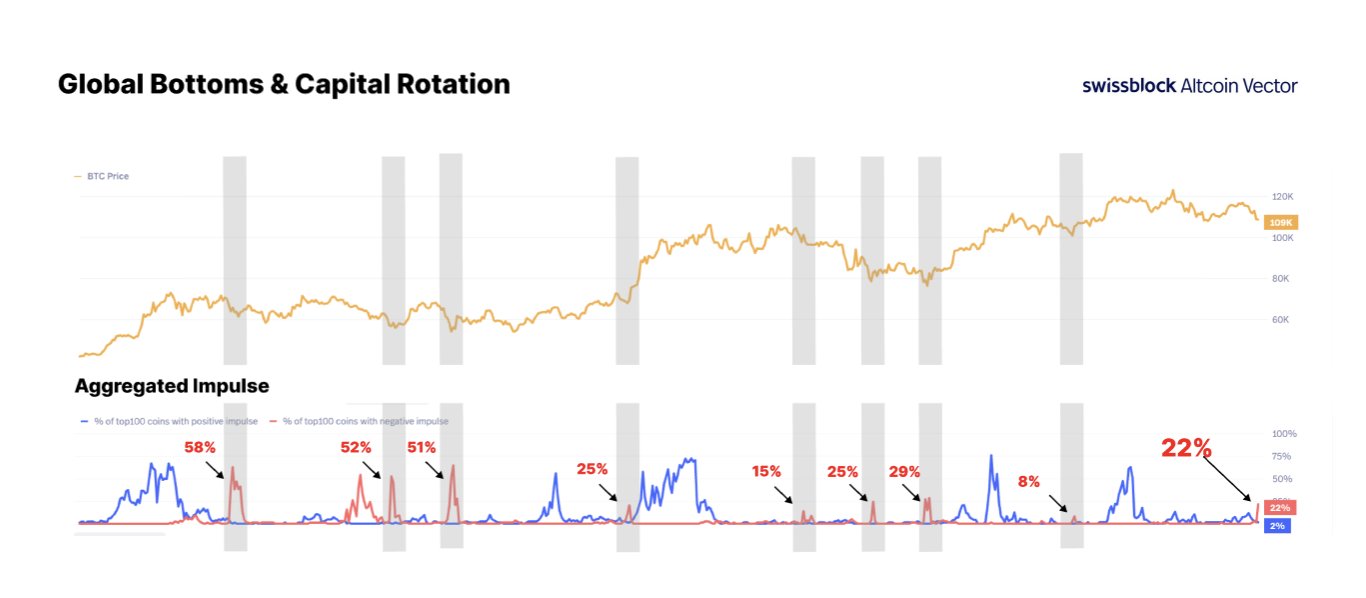

In a new thread on X, Swissblock says the aggregated impulse technical indicator – or the measurement of the exponential price structure of the top 350 digital assets – shows that most assets are about to bottom out and reset.

“We’re in the reset phase. The last 7 times this signal triggered since 2024, it marked a major bottom. What happened next? BTC rallied +20-30%. Altcoins surged +50-150%.

We track this with the most accurate tops and bottoms signal in the market: Aggregated Impulse, by Altcoin Investor, It measures exponential price structure across the top 350 assets.”

Swissblock says the indicator shows 22% of altcoins are at a negative impulse, with bottoms usually forming when 15-25% of them are displaying a negative impulse. According to the crypto analytics platform, Ethereum ( ETH ) and alts tend to rise after the reset completes.

“What’s it telling us now? 22% of altcoins show negative impulse. Historically, bottoms form in the 15-25% zone. Once the reset completes, ETH and alts tend to lead the next rotation.”

Source: Swissblock/X

Source: Swissblock/X

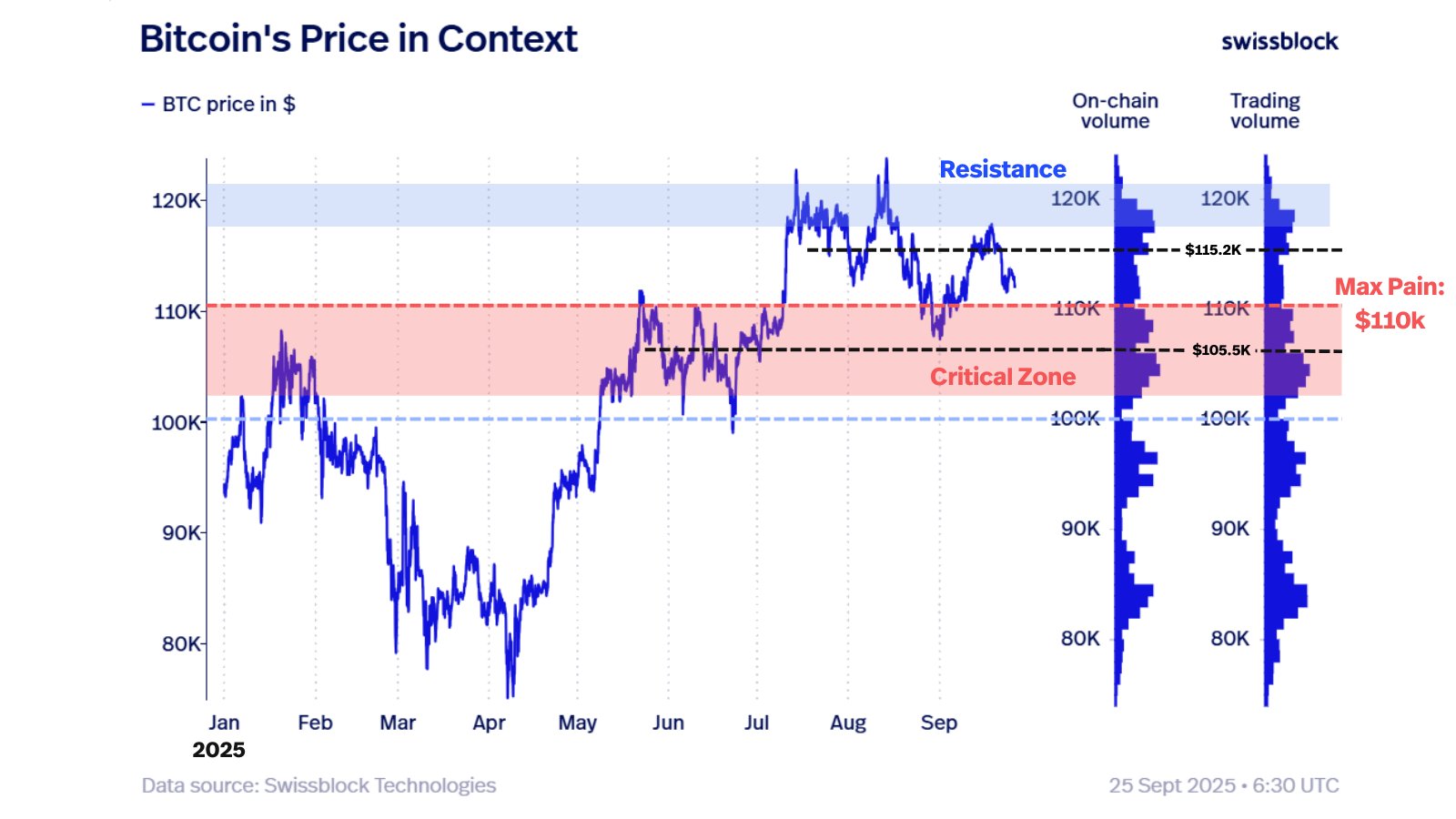

Concluding its analytics with the crypto king, Swissblock says that a retest of the $110,000 area appears imminent and if it were to fail, it could be feeling “max pain.”

“Bitcoin lost $113,000 and hovers under $112,000: a retest of $110,000 looks imminent. BTC sits in a delicate balance: Above $115,200 ? opens $120,000. Below $110,000 ? exposes $105,500-$100,000. $110,000 = max pain. Likely to be touched, leaving Friday’s options worthless.”

Source: Swissblock/X

Source: Swissblock/X

Bitcoin is trading for $109,053 at time of writing while Ethereum is valued at $3,948.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin Faces Challenges Amid Stablecoin Uncertainty and Changing Regulations

- Bitcoin's structural resilience persists amid monthly volatility, driven by evolving regulations, institutional adoption, and shifting market sentiment. - SEC's 2025 regulatory framework aims to streamline crypto oversight, potentially reducing uncertainty and aligning with global standardization efforts. - Tether's USDT stability downgrade raises concerns over Bitcoin's role in reserves, while Arthur Hayes predicts $80k-$250k price swings tied to liquidity and Fed policy. - Infrastructure projects like

Bitcoin News Update: Cryptocurrency Markets Confront Threefold Challenges: Increased Regulatory Oversight, Shifting Corporate Strategies, and Technical Hurdles Hamper BTC Rebound

- Asian markets and crypto assets fell as Japan's BOJ policy shifts drove capital out of equities and digital currencies, with Bitcoin dropping below $82,000. - Tether defended its USDt stablecoin amid S&P's "weak" rating, citing $215B in Q3 2025 assets, but ongoing stability concerns persist in the crypto sector. - Binance faces legal challenges including a Hamas attack-related lawsuit, compounding regulatory risks for crypto exchanges amid compliance scrutiny. - Grayscale's Zcash ETF filing highlights ni

Ethereum News Update: Apeing’s 10x Presale Advantage Depends on Prompt Community Participation

- Apeing ($APEING) presale offers 10x potential gains via early whitelist access, contrasting its $0.0001 presale price with a projected $0.001 listing. - Community-driven projects like FARTCOIN and PEPE demonstrate how cultural relevance and engagement drive meme coin growth, mirroring Apeing's strategy. - Ethereum's gas improvements and XRP's institutional adoption create a favorable market backdrop, supporting speculative meme coin opportunities. - Investors are urged to assess risks despite projected 1

Deciphering the ZKsync Boom: The Impact of Vitalik's Support on Layer 2 Adoption

- Vitalik Buterin's endorsement boosted ZKsync's $ZK token by 143%, signaling growing institutional and retail confidence in ZK rollups. - The Atlas upgrade achieved 43,000 TPS with 70% lower gas fees, attracting Deutsche Bank and UBS for asset tokenization and compliance solutions. - ZKsync trails Arbitrum ($16.63B TVL) but aims to close gaps via privacy-centric design and the upcoming Fusaka upgrade targeting 30,000 TPS. - Institutional partnerships and Ethereum's ZK roadmap position ZKsync as a key play