Trader Says Bitcoin Primed for More Downside Before ‘Up-Only Mode,’ Updates Outlook on Ethereum

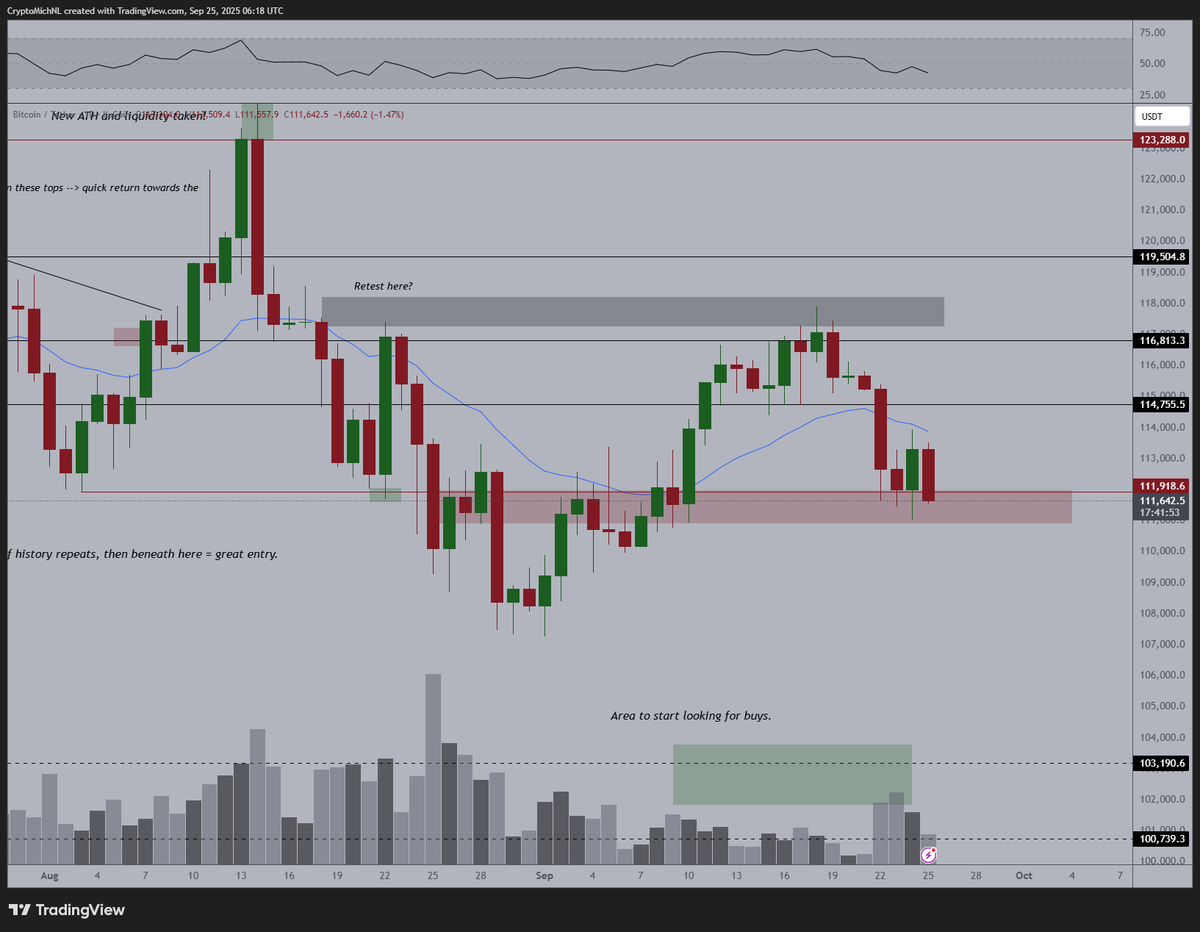

Crypto trader Michaël van de Poppe says that Bitcoin ( BTC ) may have a deeper correction before an explosive move to the upside.

Van de Poppe tells his 808,600 followers on X that Bitcoin may decline below its current $111,000 range before entering a period of bullish momentum.

“I would assume that we’ll be going to get some more downside and then we’re done for the current period, meaning that we’ll be in up-only mode.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Looking at his chart, the trader suggests Bitcoin may retest the level around $108,000 similar to late August.

Bitcoin is trading for $111,075 at time of writing, down 2.3% in the last 24 hours.

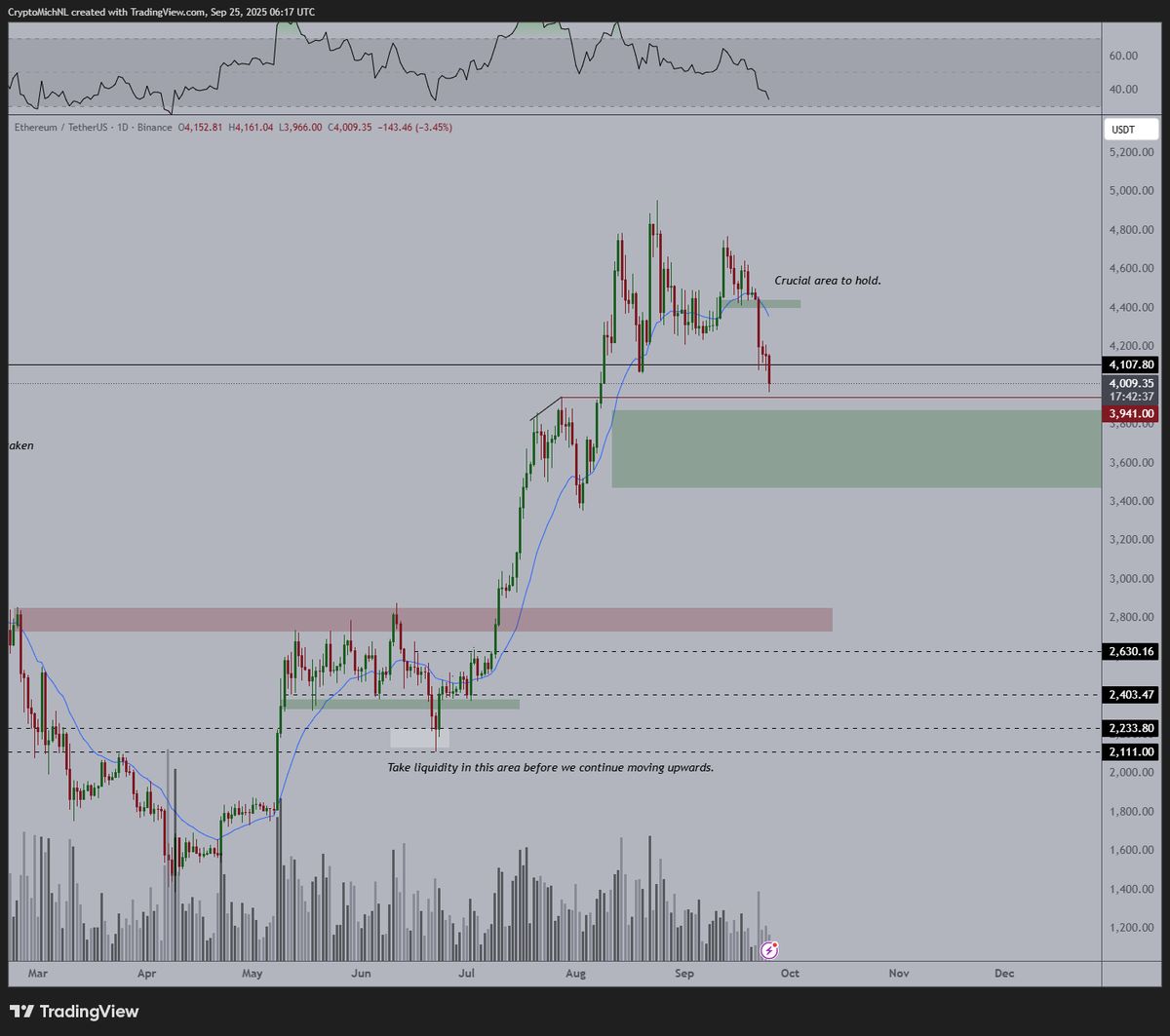

Next up, the analyst says that Ethereum ( ETH ) may form a local market bottom around the $3,800 level.

“I don’t think there’s much more downside to come. Would suggest that the green zone is where we’ll be bottoming out. Perhaps another 5% drop on ETH and that should be it.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

The analyst also predicts that ETH will hit five-figures this cycle and other altcoins may increase 400% from their current values.

“It’s near the bottom on altcoins and ETH. What’s next? ETH at $10,000. Altcoins to go 3-5x. It’s not the end of the bull market, it’s the start of the bull market and recent listings have shown proof of this.”

ETH is trading for $4,002 at time of writing, down 4.5% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of a Fluid Clean Energy Marketplace: How CleanTrade is Transforming Institutional Investment in Renewable Resources

- CleanTrade's CFTC-approved SEF platform transforms VPPAs, PPAs, and RECs into institutional-grade renewable energy commodities. - The platform addresses historic market issues like illiquidity and opacity, enabling $16B in notional trading volume within two months. - Industry giants Cargill and Mercuria validate clean energy as a serious asset class through strategic participation in the regulated market. - By aligning financial and ESG goals, CleanTrade creates scalable alpha opportunities as global cle

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean

The Growing Significance of Financial Well-Being in Planning for Lasting Wealth

- Financial wellness is redefining long-term wealth planning by integrating personal well-being with financial outcomes. - Intentional habits and AI-driven tools boost resilience, reducing behavioral underperformance by 2.5% annually. - Debt management via sustainable finance mitigates risks, especially in developing economies with robust policies. - Early financial education and four-quadrant frameworks balance objective metrics with subjective well-being. - Technology and financial therapy bridge gaps, e

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance