Date: Fri, Sept 19, 2025 | 10:40 AM GMT

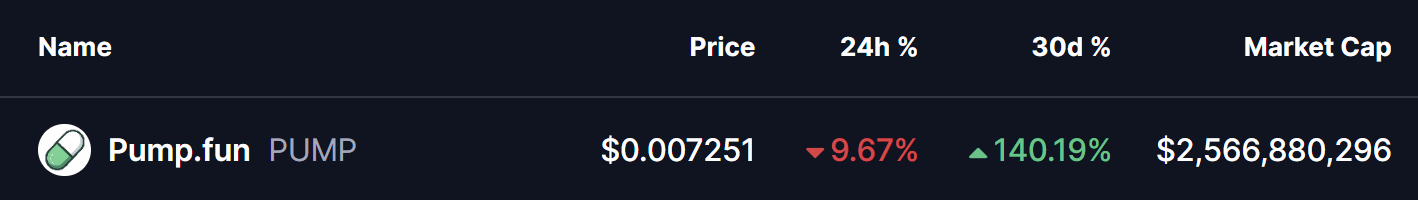

The cryptocurrency market is witnessing a mild retracement today after the initial surge that followed the Fed’s rate cut decision. Both Bitcoin (BTC) and Ethereum (ETH) are trading slightly lower, and the weakness has spilled over into altcoins , including Pump.fun (PUMP).

Despite today’s red candles, PUMP has been one of the best-performing tokens over the past 30 days, rallying over 140% in that period. Currently down by over 9%, the chart is hinting at something interesting — the possible formation of a “Power of 3” (PO3) pattern that may set the stage for a sharp rebound.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 Pattern in Play?

On the 2H chart, PUMP is showing early signs of a Power of 3 setup, a classic structure often characterized by three distinct phases:

Accumulation Phase

For nearly a week, PUMP consolidated inside a broad range between $0.00873 (resistance) and $0.00750 (support). This sideways action suggested quiet accumulation by larger players, while volatility compressed.

Pump.fun (PUMP) 2H Chart/Coinsprobe (Source: Tradingview)

Pump.fun (PUMP) 2H Chart/Coinsprobe (Source: Tradingview)

Manipulation Phase

Earlier today, the token slipped below the $0.00750 support, dropping into the $0.00720 zone. This red-shaded region reflects the manipulation phase, where weak holders are often shaken out via false breakdowns before price sets up for a potential reversal.

What’s Next for PUMP?

At present, PUMP is still trading inside the manipulation zone, which leaves room for another dip toward the $0.00690 support. However, if buyers step in and defend this red zone, pushing price back above $0.00750, the token could transition into the expansion phase — the most bullish leg of the setup.

A decisive breakout above $0.00873 would validate this bullish scenario, opening the way toward the $0.01056 range — an upside of more than 45% from current levels.

That said, it’s important to note that the pattern is still in its early phase and playing out on a lower timeframe (2H chart), making it riskier to fully rely on. Until PUMP reclaims the $0.00750 level, the risk of further downside remains.