Hyperliquid stablecoin about to launch: Why did the new team Native Markets acquire USDH?

Even the arrival of Paypal is not enough.

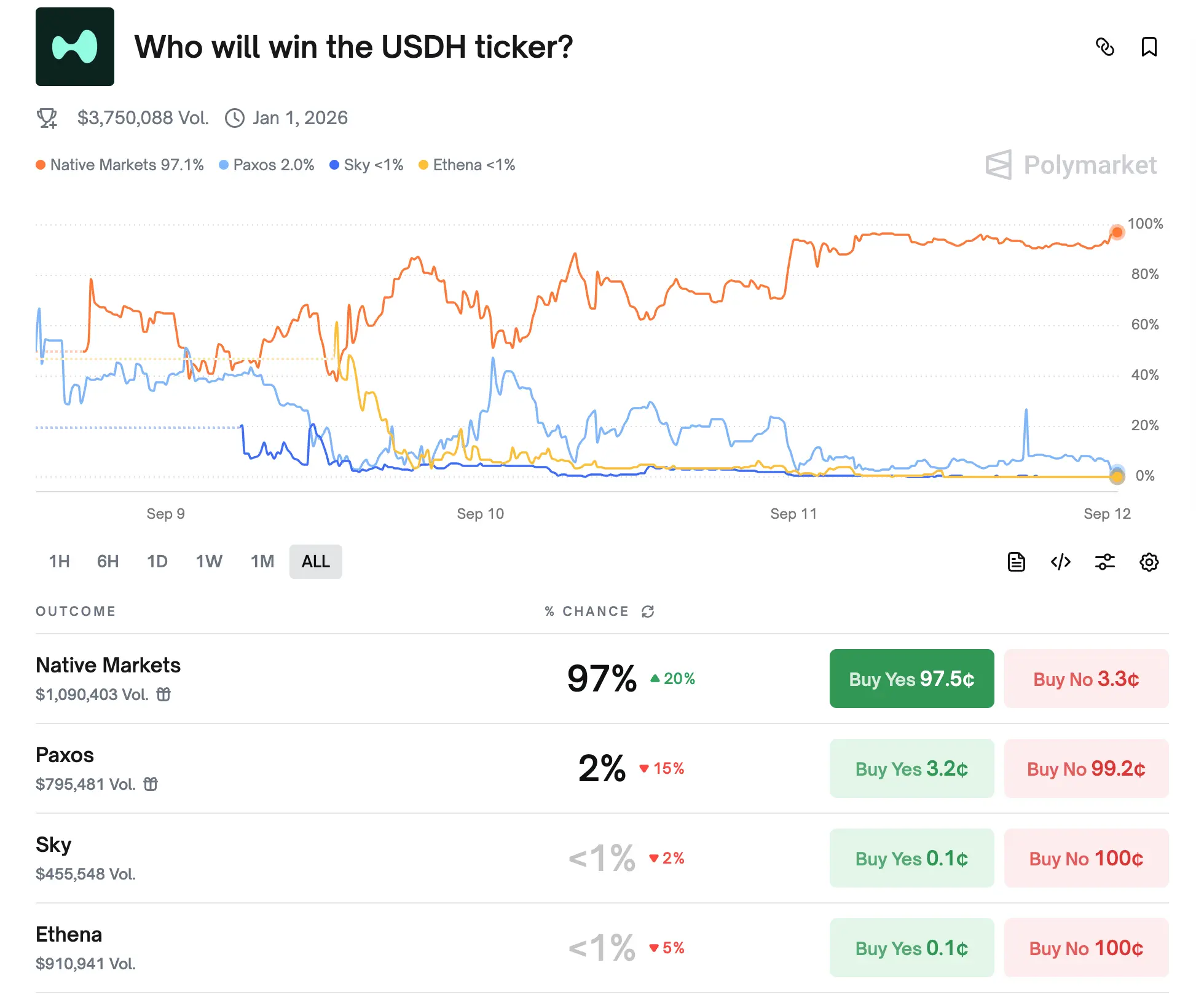

Recently, the decentralized derivatives trading platform Hyperliquid witnessed a highly anticipated stablecoin battle. On September 5, the official team announced the upcoming Ticker auction for its native stablecoin USDH, instantly igniting the market. Multiple institutions, including Paxos, Ethena, Frax, Agora, and Native Markets, submitted proposals to compete for the right to issue USDH. As a leading player in the popular perp DEX sector, Hyperliquid has become a strategic opportunity that institutions feel compelled to enter, even if it is "not profitable." Currently, Native Markets is leading by a landslide with a 97% advantage, almost securing victory.

01 Native Markets' Strategy

Native Markets proposes that USDH reserves be jointly managed by BlackRock (off-chain) and Superstate (on-chain), ensuring both compliance and issuer neutrality. Its mechanism is unique: reserve interest is split in half—one half goes to the Assistance Fund for HYPE buybacks, while the other half is invested in ecosystem development, including the growth of the HIP-3 market and HyperEVM applications.

Users can mint or redeem USDH via Bridge, and more fiat on-ramp channels will be opened in the future. The protocol's core component, CoreRouter, has been audited and open-sourced, encouraging direct community participation in development. Native Markets also promises that USDH will comply with US GENIUS regulatory standards and inherit the global compliance qualifications and fiat channel capabilities of its issuer, Bridge. Notably, Bridge was acquired last year by payment giant Stripe, and Native plans to leverage its network to deeply integrate stablecoins with fiat currencies.

Although Native Markets is the least well-known among the major bidders, it has become the most favored player thanks to its team's long-term involvement in the Hyperliquid chain and the addition of several industry heavyweights (from Paradigm, Uniswap, etc.).

02 Founding Team

@fiege_max

Over the past year, Max has been deeply involved in the Hyperliquid ecosystem, driving nearly $2.5 billion in HyperEVM TVL and $15 billion in HyperCore trading volume as an investor and advisor. He previously led product and strategy at Liquity and Barnbridge, focusing on stablecoins and fixed-rate instruments. As a community leader at Hyperion, he also spearheaded the establishment of a Hyperliquid DAT-listed company.

@Mclader

Mary-Catherine Lader previously served as President and COO of Uniswap Labs (2021–2025). As early as 2015, she drove BlackRock's digital asset strategy and, as Managing Director at Goldman Sachs, invested in fintech. She is now ready to guide the development of USDH and Hyperliquid in the post-GENIUS era.

@_anishagnihotri

Anish is a blockchain researcher and software engineer with over a decade of experience. He was the first employee at Ritual, briefly the youngest researcher at Paradigm, and a proprietary DeFi trader at Polychain. He also has a long-standing influence in MEV and open-source DeFi tools.

03 Community Controversy

Of course, there are many doubts about this community vote. Haseeb Qureshi, Managing Partner at well-known VC Dragonfly, wrote on Tuesday that he "started to feel the USDH RFP is a bit absurd," claiming that validators seem unwilling to seriously consider any team other than Native Markets.

He added that Native Markets' bid appeared almost immediately after the RFP was released, "which means they were notified in advance," while other bidders were busy preparing their documents. He stated that although more established participants like Paxos, Ethena, and Agora submitted stronger proposals, the process seemed "tailored for Native Markets."

However, Nansen CEO @ASvanevik refuted this speculation, stating that as one of the largest validator node operators on Hyperliquid, they and the @hypurr_co team invested significant effort in reviewing proposals and communicating with bidders, aiming to find the optimal stablecoin solution. They ultimately chose to support Native Markets.

After seeing the overwhelming trend, Ethena Labs announced its withdrawal from the USDH bid, stating that although some questioned Native Markets' credibility, their success perfectly exemplified the characteristics of Hyperliquid and its community: this is a fair arena where emerging participants can win community support and have a fair chance at success.

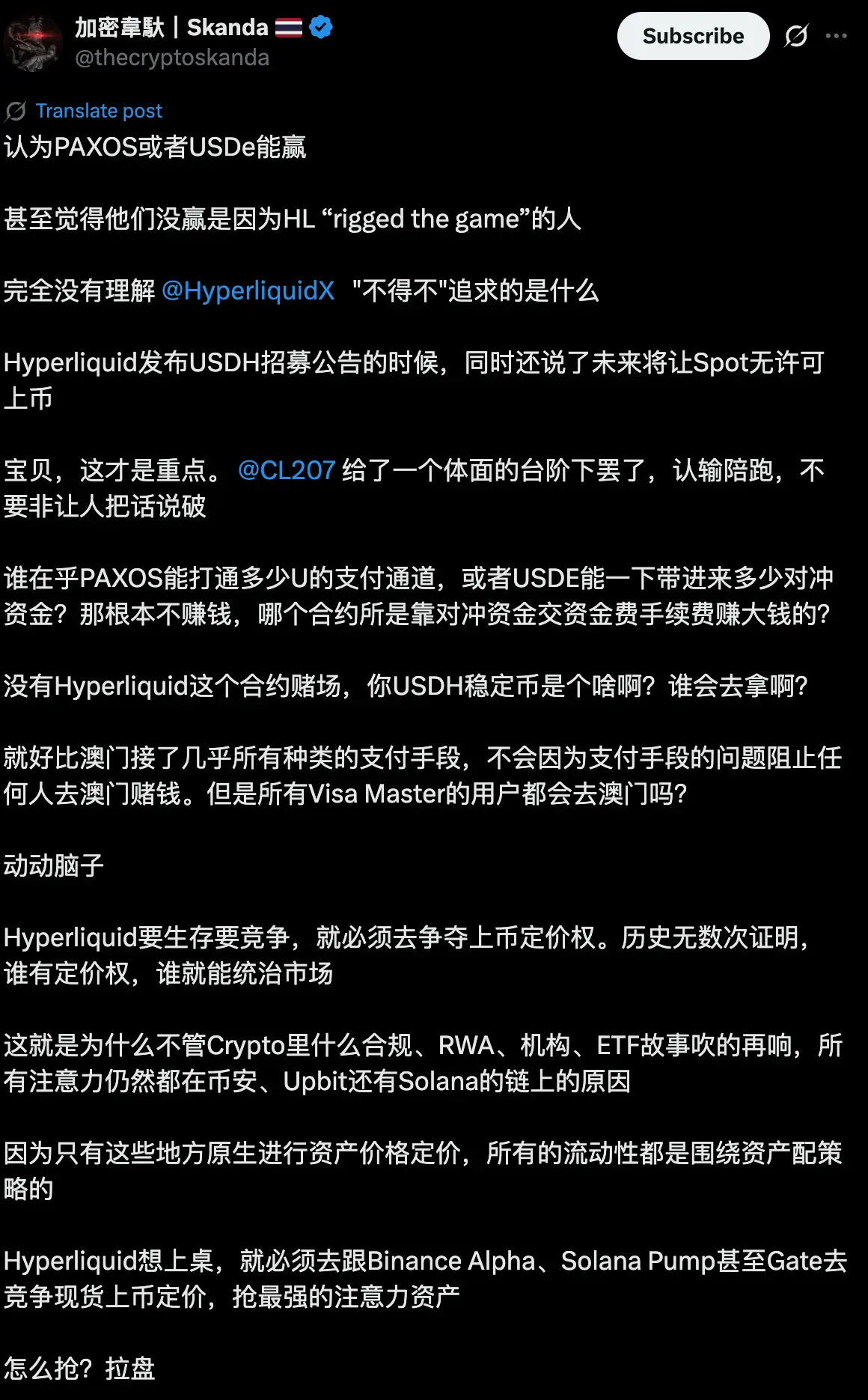

KOL Crypto Skanda @thecryptoskanda said that Native Market's selection was inevitable, as the core of an exchange is token listing and pricing, and other teams could not meet Hyperliquid's most obvious needs.

On the Hyperliquid chain, the accumulation of USD liquidity has long relied on external stablecoins such as USDC, with circulation once reaching about $5.7 billion, accounting for 7.8% of USDC's total issuance. The Hyperliquid team's choice essentially means they are directly transferring potentially hundreds of millions of dollars in annual interest income to the community.

For this reason, the right to issue USDH is not only about a huge market share, but also about who can control this massive potential revenue. In Hyperliquid's case, we see stablecoin issuers willing to give up almost all profits just to gain distribution opportunities in the ecosystem—a scenario that was almost unimaginable in the past. It is foreseeable that once USDH is successfully launched and establishes a positive cycle of "returning profits to the community and feeding value back to the ecosystem," other exchanges or public chains will inevitably follow suit, triggering a major shift in the industry's stablecoin strategies. At that point, the "Stablecoin 2.0 era" may truly begin.

Click to learn about ChainCatcher job openings

Recommended reading:

Regulatory Breakthrough, Institutional Entry: A Review of a Decade of Cryptocurrency's Penetration into Wall Street

Pantera Capital In-Depth Analysis: The Value Creation Logic of Digital Asset Treasuries (DATs)

Backroom: Information Tokenization, A Solution for Data Redundancy in the AI Era? | CryptoSeed

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

80% is hype? Six major red lines reveal the true intentions of Stable

It appears to be an infrastructure upgrade, but in essence, it is an early, insider-friendly issuance.

Global assets are falling simultaneously—why have safe havens collectively failed?

Weekly Decoding of Major Events in the Crypto Market!

Extreme sentiment nears a tipping point: Is Bitcoin about to stop falling?