Key Notes

- Trump-backed mining company ABTC soared 72% in debut trading after completing merger with Gryphon Digital Mining.

- Company accumulated massive Bitcoin treasury of 2,443 BTC worth $273M, up dramatically from initial 152 BTC holdings.

- ABTC plans $2.1B stock offering to fund aggressive Bitcoin acquisition strategy and next-generation mining operations.

American Bitcoin Corporation , backed by President Trump’s sons and mining firm Hut 8 , debuted on Nasdaq on Wednesday under the ticker ABTC following a merger with Gryphon Digital Mining.

The company disclosed in a September 3 SEC filing that it holds 2,443 BTC at the start of the month, valued at nearly $273 million, a sharp increase from its first disclosure of 152 BTC.

American Bitcoin also outlined plans to sell up to $2.1 billion in Class A common stock, with proceeds earmarked for Bitcoin purchases, ASIC acquisitions, and general corporate purposes.

American Bitcoin Corp (ABTC) First Day Trading Price Action | Source: Nasdaq via Yahoo Finance, September 3, 2025

The ABTC shares made an instant splash on the market with prices surging as much as 72% in early Nasdaq trading, according to Yahoo Finance .

Co-founder Eric Trump also chimed in, calling the Nasdaq listing a huge honor.

I have put a tremendous amount of love and energy into @AmericanBTC over the past 12 months. It is a huge honor to be listed on the @Nasdaq and begin trading today! #ABTC

— Eric Trump (@EricTrump) September 3, 2025

The company’s strategy combines self-mining with opportunistic Bitcoin purchases. Through its partnership with Hut 8, American Bitcoin accesses next-generation ASIC hardware and colocation infrastructure to expand operations.

“As of September 1, 2025, we had accumulated approximately 2,443 Bitcoin in reserve, which included approximately 2,234 Bitcoin pledged to Bitmain pursuant to the ABTC Bitmain Purchase Agreement. We consider our reserve a core strategic asset, managed adaptively to support balance sheet strength with a view to enhancing long-term stockholder value,” stated American Bitcoin Corporation in its SEC filing.

In the official press release , Executive Chairman and CEO of Hut 8 Asher Genoot also said the debut positions ABTC as a Bitcoin accumulation leader, leveraging mining, direct market purchases, and Hut 8’s infrastructure to drive Bitcoin-per-share growth.

Bitcoin Price Analysis: Can Bulls Flip the $120K Resistance?

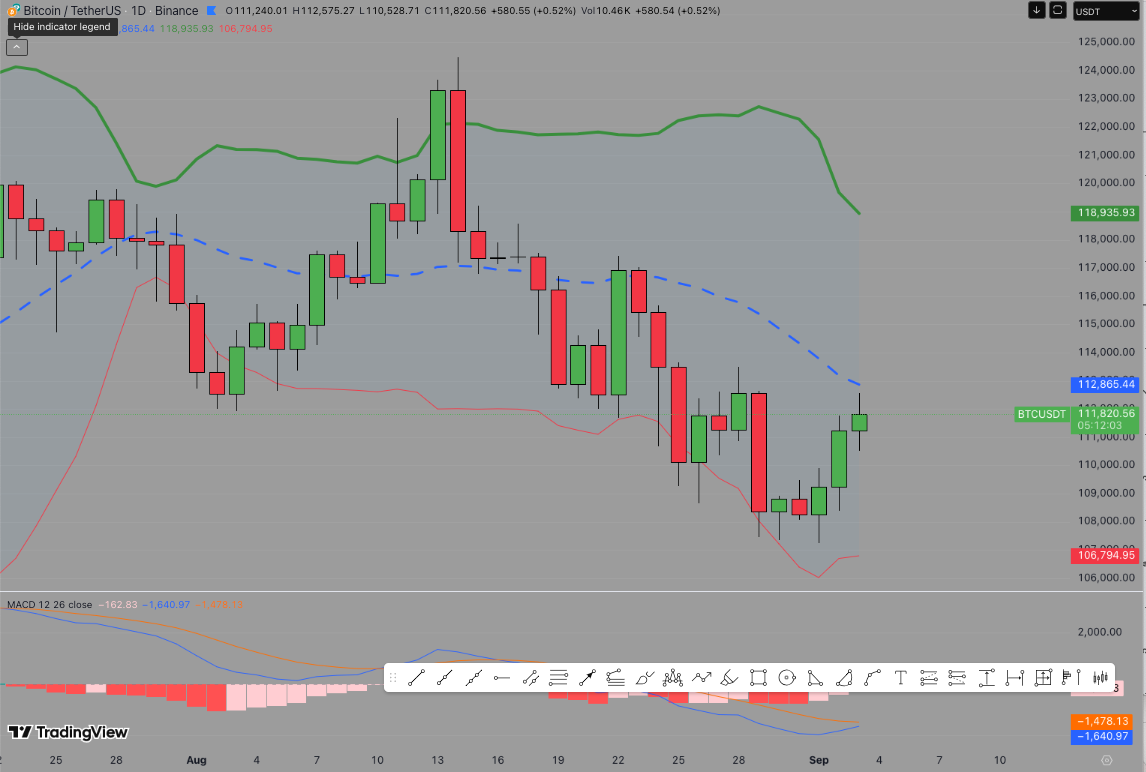

Bitcoin BTC $110 789 24h volatility: 0.4% Market cap: $2.21 T Vol. 24h: $36.12 B traded at $111,820 on Wednesday, staging a modest 0.5% rebound but still constrained by overhead resistance. The daily chart highlights that BTC remains capped below the 20-day SMA at $112,865, a key pivot point that traders are closely monitoring.

Bollinger Bands show compressed volatility with the mid-band (20-day SMA) acting as immediate resistance, while the upper band sits at $118,936, aligning with the next bullish target zone. The lower band near $106,795 provides crucial support that recently halted Bitcoin’s latest price correction phase in late August.

Bitcoin (BTC) Technical Price Analysis | TradingView

Momentum indicators remain cautious. The MACD line at -1,478 is trending below the signal line at -1,640, but the histogram is narrowing, signaling weakening bearish momentum. This shift suggests potential for short-term recovery if BTC can secure a daily close above the $112,865 mid-band resistance.

If bulls succeed, Bitcoin could extend gains toward $115,000–$118,000, levels that align with the Bollinger Band ceiling and historical supply pressure. On the downside, failure to hold $110,500 could expose BTC to renewed selling, with bears eyeing a retest of the $106,795 lower Bollinger Band support.

Overall, while ABTC’s Nasdaq debut has injected optimism, Bitcoin’s technical structure signals consolidation between $106,800 and $118,900 until a decisive breakout emerges.

Best Wallet项目市场表现引发关注

The Nasdaq debut of American Bitcoin pumps in fresh institutional capital, and liquidity is flowing toward multi-chain crypto storage solutions like Best Wallet (BEST).

Best Wallet