The 2025 Altcoin Season: Identifying High-Potential Altcoins for Beginners

- 2025 altcoin season highlights AVAX, IOTA, and XYZVerse as high-conviction entry points amid Bitcoin's declining dominance. - AVAX shows institutional momentum with $27 breakout potential, while IOTA's IoT utility and XYZ's deflationary model drive speculative growth. - Strategic allocations (5-10% AVAX, 3-5% IOTA, 2-3% XYZ) balance institutional-grade exposure with risk-managed diversification. - Technical indicators, on-chain metrics, and market dynamics underscore these altcoins' potential to outperfo

As the crypto market transitions from Bitcoin dominance to a more diversified landscape, 2025 has emerged as a pivotal year for altcoins. With Bitcoin’s dominance index dipping below 60% and Ethereum ETF inflows surging, the stage is set for a robust altseason. This article identifies three high-conviction altcoins—Avalanche (AVAX), IOTA (IOTA), and XYZVerse ($XYZ)—as strategic entry points for beginners, emphasizing technical indicators, community momentum, and risk-managed allocation.

Avalanche (AVAX): A Layer 1 Powerhouse with Institutional Momentum

Avalanche’s technical chart paints a compelling case for a breakout. The asset is consolidating within a symmetrical triangle pattern, with key support at $23.50 and resistance between $27–$28. A confirmed close above $27, supported by strong volume, could trigger a rally to $30–$32 and potentially $50 in the long term. On-chain metrics reinforce this bullish narrative: daily active addresses surged 57% quarter-over-quarter, and the Octane upgrade reduced transaction fees by 42.7%, driving a 493% increase in daily transactions.

Institutional adoption further strengthens AVAX’s case. SkyBridge’s tokenization of $300 million in hedge funds on Avalanche and the Grayscale AVAX ETF filing signal growing institutional interest, mirroring Bitcoin ETF-driven dynamics. However, risks persist, including a $42 million token unlock in late 2025 and competition from Ethereum and Solana . For beginners, a 5–10% allocation in AVAX could balance exposure to institutional-grade altcoins while mitigating downside risk.

IOTA (IOTA): Bridging IoT and Blockchain with Technical Resilience

IOTA’s technical indicators suggest a moderately bullish outlook. The 50-day and 200-day moving averages are at $0.203 and $0.173, respectively, while the RSI (58) and MACD crossover indicate positive momentum. Key support levels at $0.14 and $0.17, and resistance at $0.25 and $0.28, define a potential trading range. With a market cap of $803.51M and a Fear & Greed Index at 53, the market remains cautiously optimistic.

IOTA’s real-world utility in IoT applications—such as supply chain tracking and smart contracts—positions it for long-term growth. The project’s focus on interoperability and lightweight transactions aligns with the growing demand for scalable solutions in decentralized infrastructure. For beginners, IOTA offers a lower-risk entry point compared to speculative meme coins, with a recommended allocation of 3–5% in a diversified portfolio.

XYZVerse ($XYZ): Meme Coin with Deflationary Mechanics and FOMO-Driven Growth

The project’s deflationary model, which burns 17.13% of its supply, contrasts with traditional meme coins and creates scarcity-driven demand. Strategic partnerships, such as with bookmaker. XYZ , and gamified community engagement (Telegram mini-games, airdrops) have driven a 21,000-follower surge on X (Twitter).

However, XYZ’s speculative nature demands caution. The token’s price is tied to its progress and exchange listing potential, with projections of $0.10 if listed on major exchanges. For risk-tolerant beginners, a 2–3% allocation in XYZ could capitalize on momentum while limiting exposure to its inherent volatility.

Strategic Allocation and Risk Management

The 2025 altseason demands a disciplined approach to entry points and diversification. A strategic allocation could include:

- 30–40% in Ethereum for foundational infrastructure exposure.

- 20–30% in Solana/Arbitrum for programmable settlement.

- 5–10% in AVAX for institutional-grade altcoins.

- 3–5% in IOTA for IoT-driven utility.

- 2–3% in XYZ for speculative growth.

Timing is critical. AVAX’s $27 resistance level offers a clear entry trigger. Meanwhile, IOTA’s support/resistance zones provide opportunities for swing trading. Beginners should also employ stop-loss orders and rebalance portfolios quarterly to mitigate risks.

Conclusion

The 2025 altseason presents a unique window for beginners to capitalize on high-conviction altcoins. AVAX’s institutional adoption, IOTA’s technical resilience, and XYZ’s community-driven momentum each offer distinct opportunities. By prioritizing strategic entry points, diversification, and risk management, investors can navigate the altseason with confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hedera integrates ERC-3643 standard to enhance asset tokenization compliance capabilities

Rethinking Sideways Trading: Major Cryptocurrencies Are Undergoing a Massive Whale Shakeout

Ignas also pays special attention to lending protocols that generate fees.

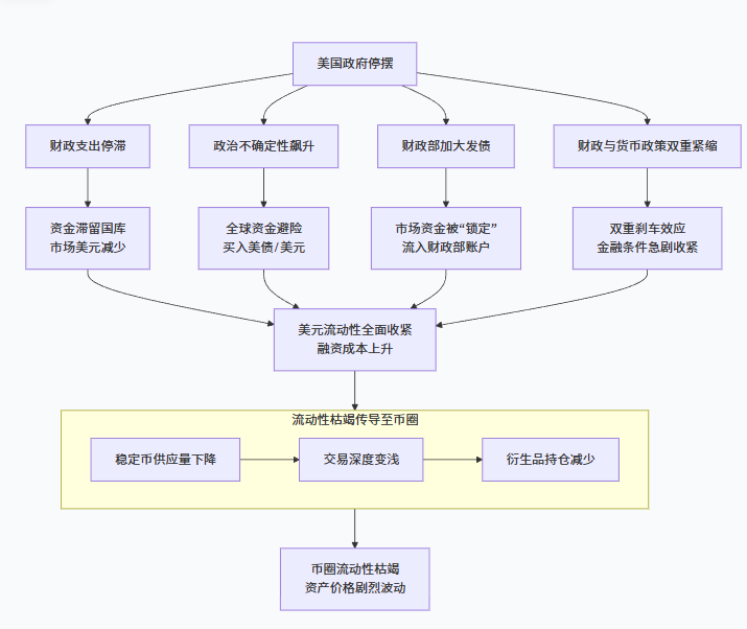

How could a U.S. government shutdown strangle crypto market liquidity?