XRP is currently trading above $3, indicating strong bullish momentum. However, increased exchange activity suggests potential profit-taking may occur soon.

-

XRP holds firmly above $3 as bullish momentum builds, but increased exchange inflows point to rising profit-taking pressure.

-

Technical charts show bullish patterns forming with $2.80 as crucial support while $3.45 could unlock new all-time highs for XRP.

-

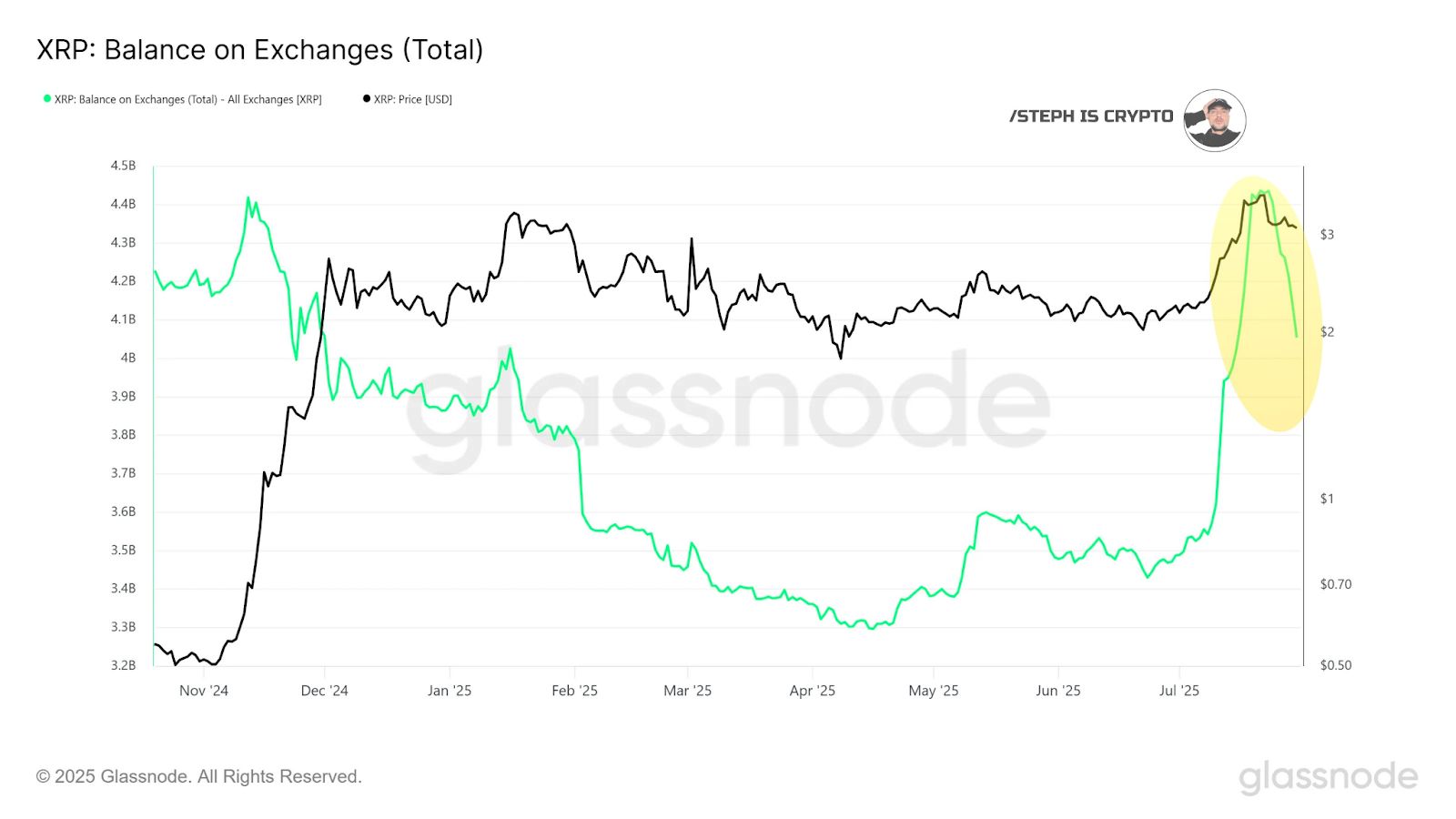

Over 600M XRP withdrawn recently signals long-term confidence, though exchange balance spikes hint at a near-term tug of war.

XRP trades above $3 with strong bullish signals and growing exchange activity, hinting at a potential breakout or short-term pullback.

What is Driving XRP’s Price Surge?

XRP is flashing warning signs and bullish signals at the same time, creating urgent anticipation in the crypto markets. The token has surged past the crucial $3 mark—a psychological level for traders. This price action is happening as XRP supply dynamics shift drastically across centralized exchanges.

How Are Exchange Flows Impacting XRP?

According to Egrag Crypto and Steph Is Crypto, the charts on lower time frames show a brewing battle between accumulation and selling pressure. While some traders expect further highs, others are preparing to lock in profits.

Frequently Asked Questions

What are the key support levels for XRP?

The most critical support level for XRP is at $2.80. Staying above this level keeps the bullish momentum intact.

How does exchange activity affect XRP’s price?

Increased exchange activity can indicate profit-taking, which may lead to short-term price fluctuations.

Key Takeaways

- XRP is above $3: This price point is crucial for maintaining bullish sentiment.

- Exchange activity is rising: Increased inflows suggest potential profit-taking.

- Support levels are critical: $2.80 remains a key level to watch for price stability.

Conclusion

XRP’s recent surge above $3 highlights significant bullish momentum, but rising exchange activity indicates potential profit-taking. As traders navigate this volatile landscape, monitoring key support levels will be essential for future price movements.

-

XRP trades above $3 with strong bullish signals and growing exchange activity, hinting at a potential breakout or short-term pullback.

-

Technical charts show bullish patterns forming with $2.80 as crucial support while $3.45 could unlock new all-time highs for XRP.

-

Over 600M XRP withdrawn recently signals long-term confidence, though exchange balance spikes hint at a near-term tug of war.

XRP is flashing warning signs and bullish signals at the same time, creating urgent anticipation in the crypto markets. The token has surged past the crucial $3 mark—a psychological level for traders. This price action is happening as XRP supply dynamics shift drastically across centralized exchanges.

According to Egrag Crypto and Steph Is Crypto, the charts on lower time frames show a brewing battle between accumulation and selling pressure. While some traders expect further highs, others are preparing to lock in profits.

Technical analyst Egrag Crypto has identified a clear bullish structure forming on the 4-hour XRP chart. Recent candlestick closings above $3 suggest solid market confidence.

Furthermore, the presence of upper wicks without full breakdowns implies that sellers are active but not dominant. This is giving bulls room to maintain control. However, any drop below the $2.80 support level could trigger a major shift in sentiment.

Source: Egrag Crypto

Support Zones and Upside Targets Take Center Stage

Egrag pinpoints $2.96–$2.93 as the likely retest zone if prices cool temporarily. However, the most critical support level remains at $2.80. Staying above this level keeps the bullish momentum intact. On the flip side, if XRP closes above $3.185, the next targets will be $3.25 and $3.33. A confirmed break of $3.45 may set the stage for a new all-time high.

Additionally, historical data supports a pattern of strong accumulation during prior price consolidations. Steph Is Crypto reports over 600 million XRP were withdrawn from exchanges in the last five days. That move often indicates long-term holding intent, not short-term speculation.

Exchange Flows Confirm Both Accumulation and Selling

From February to April 2025, XRP exchange balances dropped from 4.0 billion to 3.3 billion. That period was marked by strong accumulation around the $2–$3 range. However, as XRP moved past $3 in July, balances surged back to 4.4 billion. This recent influx signals potential profit-taking.

Source: Steph is Crypto

Moreover, the yellow-highlighted zone on exchange charts indicates critical volatility. Here, accumulation meets rising selling pressure, creating a zone of uncertainty. Hence, XRP may either explode to new highs or face a short-term pullback.