Aqua 1 denies ties to Web3Port after $100 million crypto purchase

- Aqua 1 disputes connection with Web3Port in report

- Foundation purchased $100 million in crypto tokens

- Web3Port banned for market manipulation

The UAE-based Aqua 1 Foundation has denied any relationship with market-making firm Web3Port following accusations published by a journalist who linked both entities. The fund, which recently acquired $100 million in tokens from World Liberty Financial, was cited in a report linking it to market manipulation practices.

Journalist Jacob Silverman claimed that Dave Lee, co-founder of Aqua 1, was actually David Jia Hua Li, associated with Web3Port. He claimed they both have similar profiles, including finance degrees from NYU and a Chinese-Brazilian background. The report also mentioned that the websites of Aqua 1, Web3Port, and the BlockRock platform use the same AWS server.

Silverman questioned how a figure with a past in a Chinese state-owned company and alleged involvement in Web3Port could have raised $100 million to invest in cryptocurrencies linked to current U.S. President Donald Trump through World Liberty Financial. This Trump-backed company is also an investor in Movement Labs—the target of allegations against Web3Port for dumping MOVE tokens on exchanges shortly after its listing.

In response, Dave Lee stated on the X network:

I came across a factually inaccurate report about me and Aqua1 today. We're already in touch with the journalist involved to clarify.

The Aqua 1 Foundation published an official statement reinforcing that it operates independently, without financial or operational connections to unrelated entities.

The statement added that, while committed to transparency, some details remain confidential for regulatory reasons. Dave Lee also stated that he left his previous company earlier this year, without revealing the name of the entity. The company did not comment directly on the allegations related to the servers or digital connections mentioned.

Web3Port, which has already faced sanctions for practices deemed abusive in the cryptocurrency market, has been banned from several platforms. Among the cases associated with the company are operations with the GoPlus, Myshell, and Movement Labs projects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

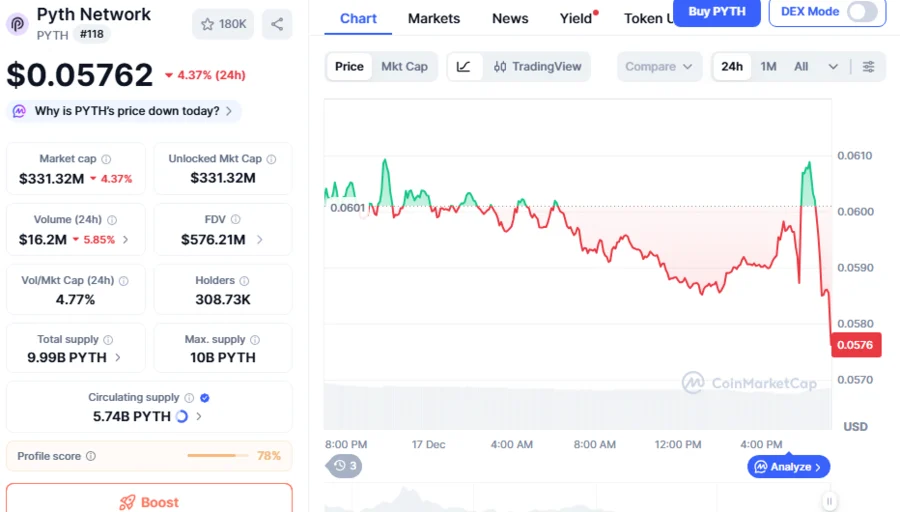

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day