EPT is live! Bullish or bearish? Join to share 480,000 EPT!

Bitget Insights2025/04/22 11:22

By:Bitget Insights

🔥 New coin EPT now live on Bitget! Users who hold or have traded EPT are eligible to win activity rewards and share a prize pool of up to 480,000 EPT! You can share your views on EPT’s price predictions, trading experiences, or your next trading plans.

First-time posters in Insights can additionally share a prize pool of up to 120,000 EPT! Additionally, outstanding posts and high-quality comments will be selected for extra rewards, and get official promotion (including a featured spot on the EPT K-line - Insights Community page).

🙋 Join the topic: https://www.bitget.com/insights/topics/details/13405

💎 Prize Pool Requirements:

- You must hold or have traded EPT during the activity period.

- Posts must include the topic tag and coin tag $EPT.

- At least one post must have more than 3 interactions (likes + comments).

Activity Period: From 2025-04-21 12:00 UTC to 2025-04-28 16:00 UTC.

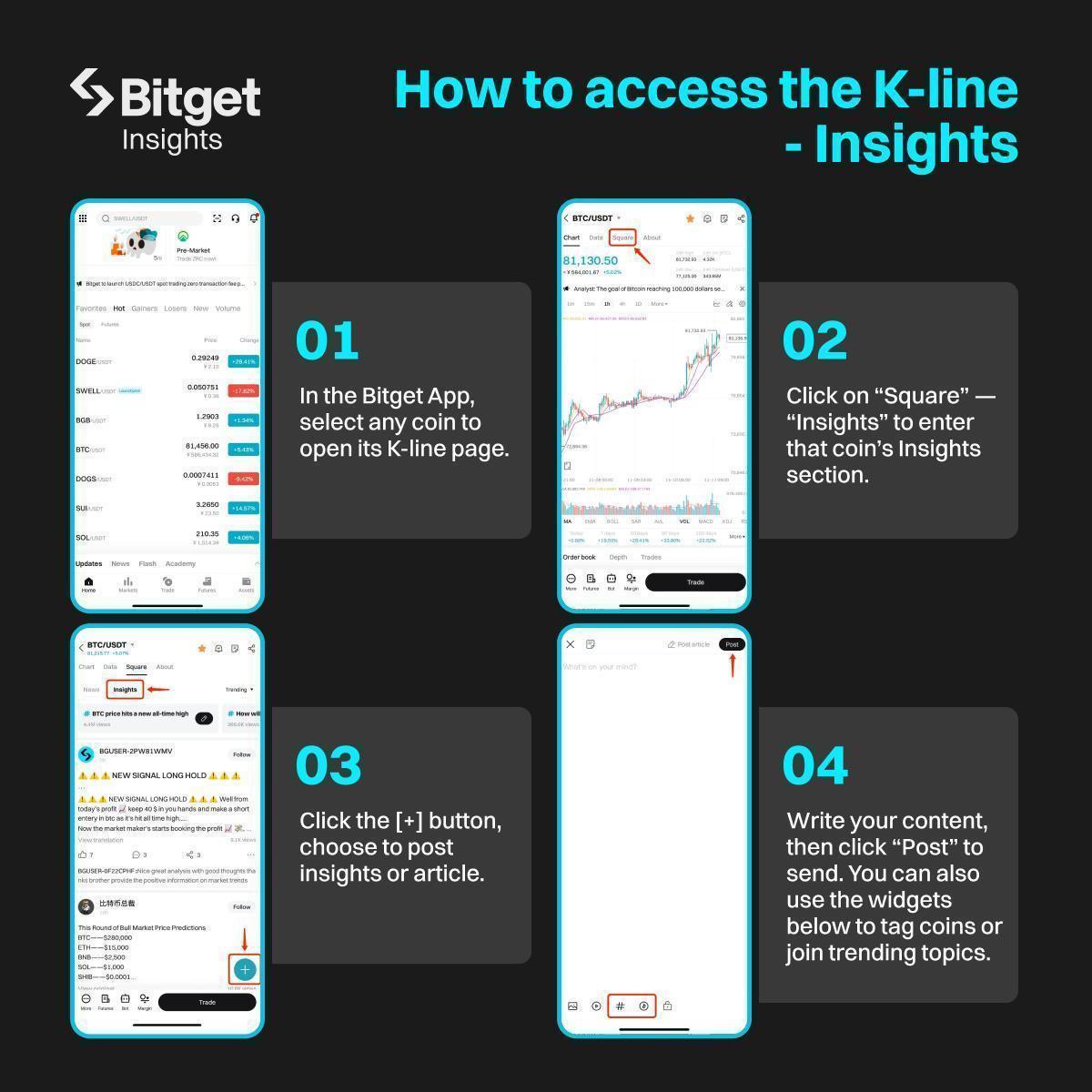

You can post your insights directly from the coin’s K-line page for more exposure and interactions. Here’s how:

Activity Rules:

1️⃣ Participation Prize: Share a total prize pool of up to 300,000 EPT

Award Rules: The prize pool increases based on the number of participants.

Number of participants Prize Pool

Less than 100 20,000 EPT

100-500 participants 80,000 EPT

500-1,000 participants 160,000 EPT

More than 1,000 participants 300,000 EPT

2️⃣ First-time Poster Prize: Share a total prize pool of up to 120,000 EPT

Award Rules: The prize pool increases based on the number of first-time posters.

Number of participants Prize Pool

Less than 50 10,000 EPT

50-100 participants 20,000 EPT

100-200 participants 60,000 EPT

More than 200 participants 120,000 EPT

3️⃣ High-Quality Post and Comment Prize:

- Each post will receive 4,000 EPT

Award Rules: 10 selected high-quality posts will each receive 4,000 EPT.

To make it easier for you to qualify:

- Provide analysis to support your view and show unique insights on EPT’s price movements or predictions.

- Data support: Reference relevant market data, charts, or screenshots to strengthen your content’s credibility.

- Each high-quality comment earns 2,000 EPT

Winning Rules: 10 high-quality comments will be selected, each receiving a 2,000 EPT reward.

Terms and Conditions:

- Avoid posting duplicate content; copying others’ posts or repeating submissions may result in disqualification.

- Rewards will be distributed to winners’ accounts within 7 business days after the event ends.

- Posts must be relevant to the event theme. Spam, irrelevant content, or cheating behaviors such as fake accounts or like manipulation will lead to immediate disqualification. For more details, please refer to the:

https://www.bitget.com/support/articles/9139373288473-insights-agreement-and-disclaimer.

- Bitget reserves the right of final interpretation for this event. For inquiries, please join the official Insights Telegram group (

@BitgetInsightsOfficial).

2

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Analyst Pinpoints Shiba Inu’s Make-or-Break Levels for Bullish Comeback

Cryptonewsland•2025/11/16 16:15

XRP Slips Into Danger Zone as Investor Interest Drops

Cryptonewsland•2025/11/16 16:15

Uniswap Whale Sells $75M UNI While ‘UNIfication’ Rockets 44% – A Sign of Trouble?

Cryptonewsland•2025/11/16 16:15

Institutions Bet Big on Solana: $118M Signals Altcoin Awakening

Cryptonewsland•2025/11/16 16:15

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$94,178.7

-1.84%

Ethereum

ETH

$3,083.83

-2.86%

Tether USDt

USDT

$0.9992

-0.03%

XRP

XRP

$2.18

-2.61%

BNB

BNB

$917.25

-1.68%

Solana

SOL

$136.49

-3.30%

USDC

USDC

$0.9998

-0.07%

TRON

TRX

$0.2916

-0.24%

Dogecoin

DOGE

$0.1582

-2.65%

Cardano

ADA

$0.4823

-4.30%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now