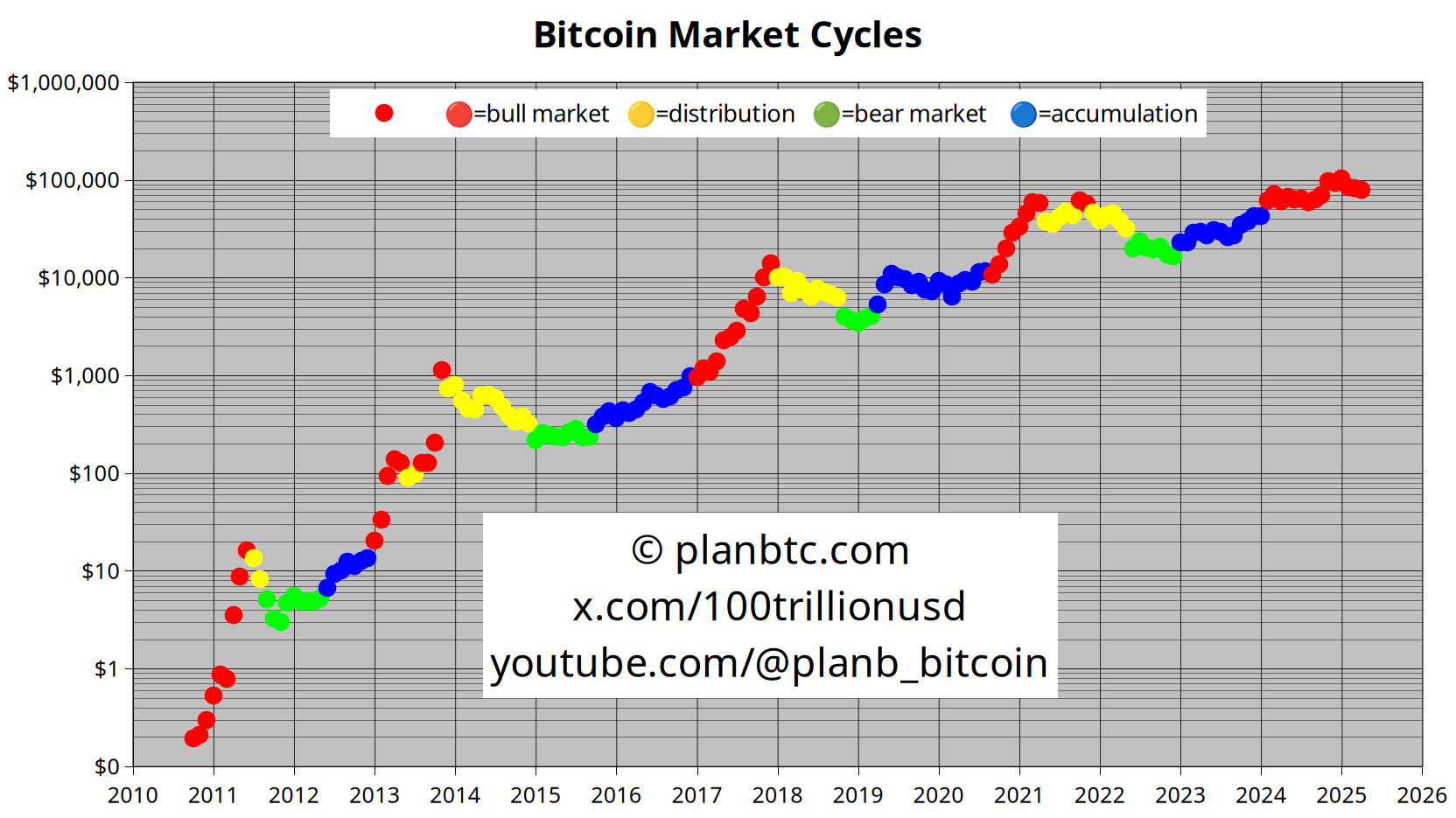

Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

Widely followed on-chain analyst PlanB says that Bitcoin’s ( BTC ) current correction is part and parcel of regular bull market conditions.

The pseudonymous analyst tells his 2.1 million followers on the social media platform X that the indicators he watches are still signaling bullishness for the flagship crypto asset.

Says PlanB,

“Even with today’s low bitcoin prices my on-chain indicators still signal bull market. So in my opinion this is a normal bull market dip and not a transition from bull phase to distribution phase (and then bear phase).”

Source: PlanB/X

Source: PlanB/X

PlanB’s color-coded dot chart indicates the number of months until each halving – when BTC miners’ rewards are cut in half – with the red dots representing the beginning of the halving cycles.

In a recent video update, the analyst told his 209,000 YouTube subscribers that a combination of 200-week means suggests Bitcoin may soon enter an explosive uptrend based on historical precedent.

The analyst says that the 200-week arithmetic and the 200-week geometric are currently running close together on the chart, signaling a possible Bitcoin breakout.

“It might be that the bull market is still forming and that the [arithmetic mean] will separate again, will diverge again, from the geometric mean.

One more thing on those two lines. Notice that you can’t have a bear market or a big crash when the 200-week [arithmetic mean] and the geometric mean are together. The big crashes here [in 2021 and 2022] are happening when there’s a diversion between the two lines. Also, here in 2018, there was a big gap between the two [means]. Same here in 2014 and 2015.”

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Quantum Computing and Blockchain Converge in the Quest to Safeguard Future Technologies

- IonQ and IBM advance in DARPA's QBI program, targeting 2M qubits by 2030 and fault-tolerant quantum systems. - D-Wave reports mixed Q3 results but raises 2025-2026 revenue forecasts after $1.8M German contract and analyst optimism. - Belden and WISeKey develop quantum-safe networking/satellite solutions to protect infrastructure from future quantum threats. - Crypto market surges 30-34% post-shutdown resolution, with institutional interest in cross-border payment tokens like HBAR/XLM. - Blaqclouds and ra

Ethereum News Update: Crypto Shares Rally Even as Ethereum Falls 12% with Whales Purchasing $1.37 Billion

- U.S. major stock indexes rose 0.23-1.5% on Nov 10, 2025, driven by crypto stocks like Coinbase (+4%) and Circle (+4.94%) amid renewed sector confidence. - Mercurity Fintech was added to MSCI Global Small Cap Indexes, enhancing institutional visibility and liquidity for its blockchain-powered fintech services. - Ethereum fell 12% to $3,000 but saw $1.37B in whale purchases, signaling long-term institutional confidence despite short-term price declines. - European indexes rebounded 0.47-1.22% as U.S. shutd

Bitcoin Updates: U.S. 10-Year Treasury Yield Ignores Downward Trends, Poised for Potential 6% Surge

- U.S. 10-year Treasury yields near 4% show bullish technical patterns mirroring Bitcoin's 2024 rally setup. - Divergence between bearish momentum indicators and price action suggests potential breakout to 6.25%. - Stacked SMAs and Ichimoku cloud confirm long-term uptrend, last seen in the 1950s. - Parallel to Bitcoin's $100k surge highlights market strength building beneath surface indicators. - Yield rise could pressure equities/cryptos but recent political stability may push Bitcoin toward $112k.