Litecoin Bucks Market Trend, Gains 10% as Whales Increase Holdings

From beincrypto by Abiodun Oladokun

Layer-1 coin Litecoin has emerged as the market’s top gainer over the past 24 hours, bucking the prevailing downtrend seen in the broader cryptocurrency market.

The 10% rally comes amid a notable increase in whale accumulation, with large investors gradually building their positions over the past week. With a growing bullish bias, LTC appears poised to extend its current gains.

Litecoin Whales Increase Holdings

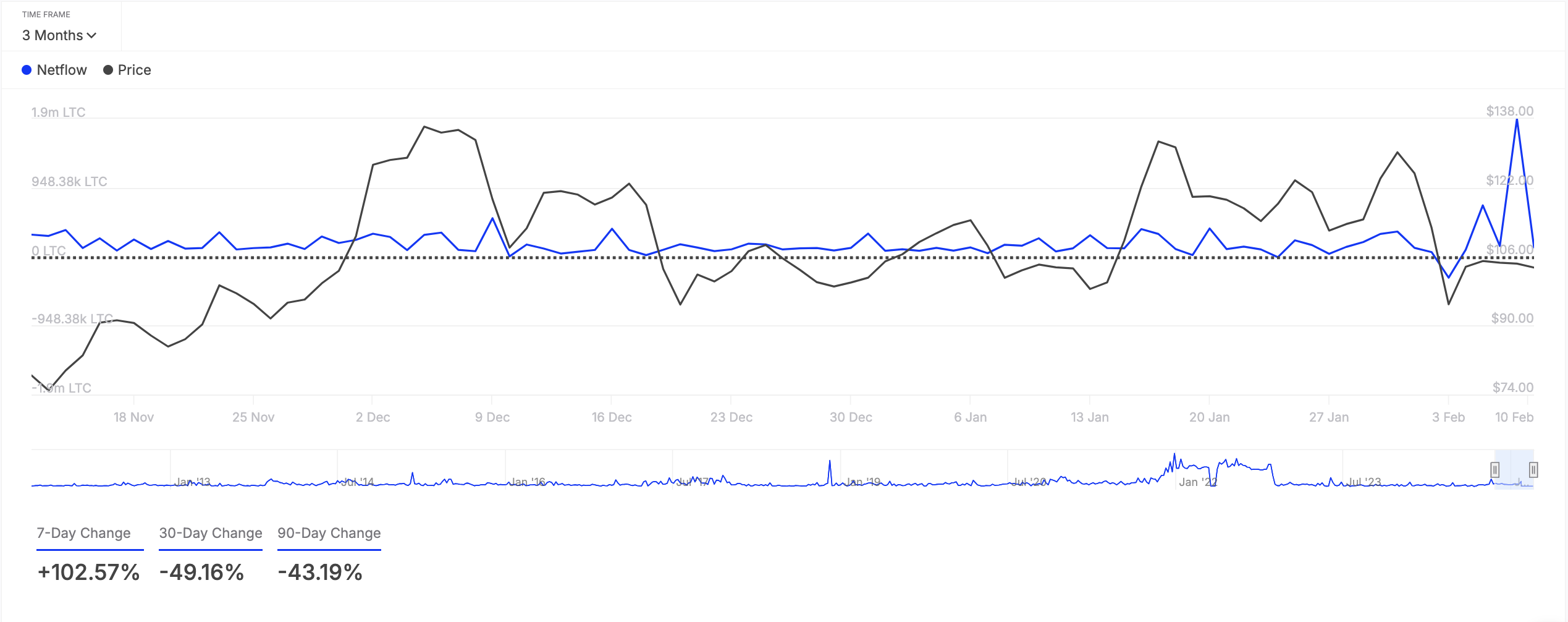

On-chain data reveals that LTC has seen a triple-digit surge in its large holders’ netflow over the past week. According to IntoTheBlock, this has climbed by 103% during that period.

Litecoin Large Holders Netflow. Source: IntoTheBlock

Litecoin Large Holders Netflow. Source: IntoTheBlock

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset experiences a spike in large holder netflow, its whale addresses are increasing their holdings. This is a bullish signal, typically driving upward price momentum as these big investors bet on the asset’s future growth.

Retail investors often follow this trend, seeing the increased whale activity as a sign of confidence. As whales accumulate, the rising demand could push LTC’s price higher, creating a positive feedback loop in the market.

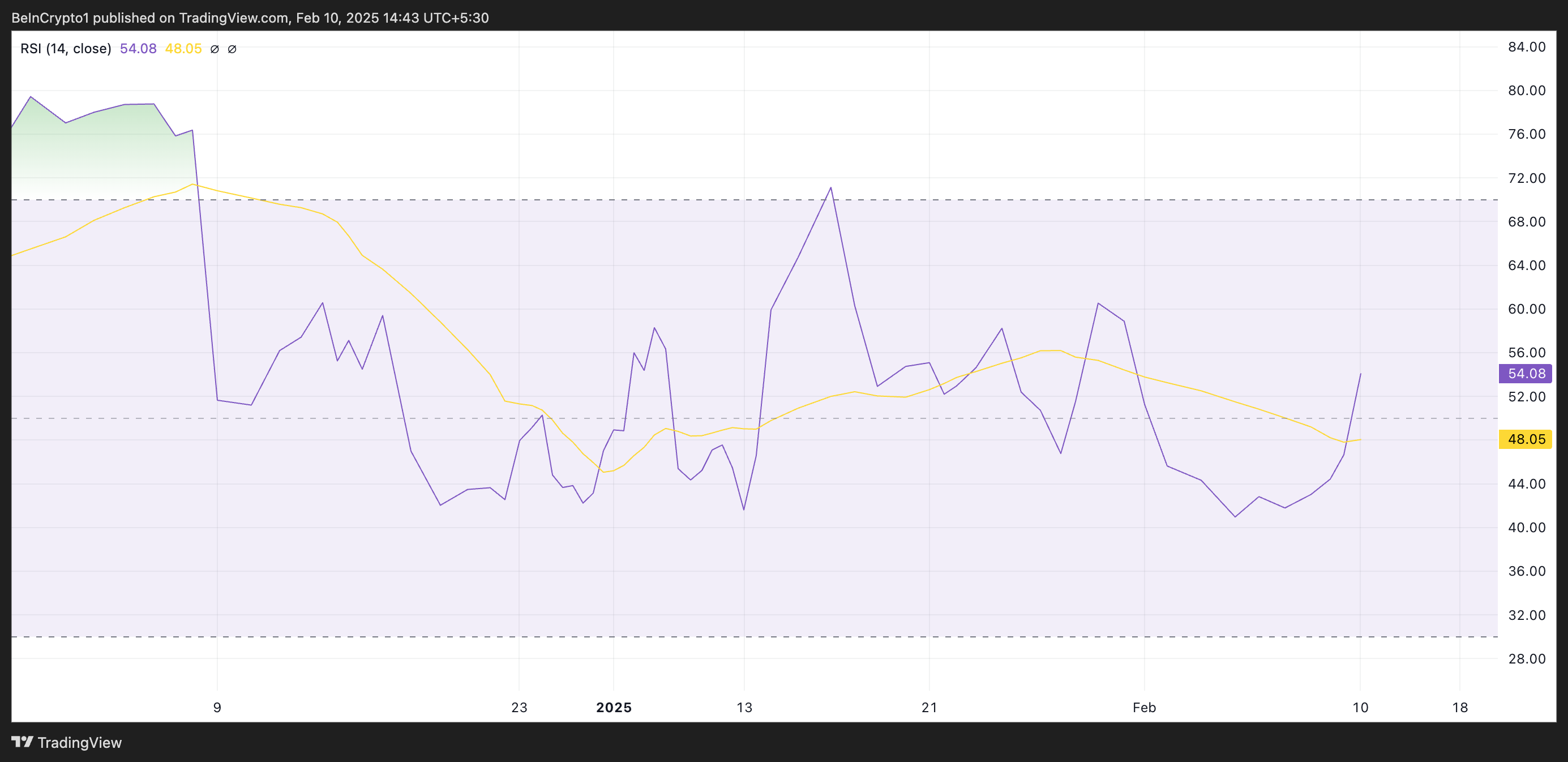

Further, the coin’s Relative Strength Index ( RSI ), assessed on the daily chart, confirms the surge in demand. At press time, LTC’s RSI is at 54.08 and is on an upward trend.

Litecoin RSI. Source: TradingView

Litecoin RSI. Source: TradingView

This momentum indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values under 30 suggest that the asset is oversold and may witness a rebound.

At 54.08 and climbing, LTC’s RSI suggests a moderate bullish momentum. It indicates growing buying pressure with the potential for further upward movement if the trend continues.

LTC Price Prediction: Could $124 Be Next?

LTC’s Elder-Ray Index has posted a positive value for the first time in eight days, highlighting the bullish shift in market trends. At press time, it is at 4.26.

An asset’s Elder-Ray Index measures the relationship between its buying and selling pressure in a market. When the index is positive, it indicates that bullish momentum is dominant, suggesting that buyers are in control and the asset’s price is likely to continue increasing.

If this holds, LTC’s value could rocket above $120 to trade at $124.03.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

However, if profit-taking resurfaces, LTC’s price could shed current gains and drop to $109.81.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Infrastructure-Focused Economic Growth in Webster, NY

- Webster , NY leverages $9.8M FAST NY grant to upgrade infrastructure, targeting industrial growth via Xerox campus redevelopment and blight removal. - Xerox's 300-acre brownfield site transforms into a $650M industrial hub by 2025, creating 250 jobs at fairlife® dairy facility with enhanced utilities. - Blight removal at 600 Ridge Road and $1.8M road realignment projects unlock 300 acres for development, improving logistics and downtown connectivity. - WEDA and municipal coordination streamline land sale

BNB News Today: BNB Jumps 4%—Is This a Bullish Breakout or the Start of a Bearish Trend?

- BNB surged 4% on Nov 24, 2025, driven by a break above its 50-day SMA, signaling renewed buying pressure and bullish momentum. - Key technical levels at $860 (support) and $920 (20-day EMA) highlight potential for reversal or pullback, with volume/on-chain data critical for confirmation. - Market optimism stems from BNB Chain upgrades, DeFi growth, and macro factors like BNP Paribas' $1.15B buyback, indirectly boosting investor sentiment. - Future gains depend on ecosystem scalability, cross-chain adopti

Tech Issues Compel MegaETH to Return $500M After $1B Fundraising Mishap

- MegaETH refunds $500M after technical errors in KYC system and multisig transaction caused its $1B fundraising to exceed limits. - Project admits "sloppy execution" led to premature cap increase and user exploitation during pre-deposit phase. - Crypto community reacts with criticism over preventable mistakes, while praising transparency in disclosing failures. - Parallel Berachain case highlights industry risks through unusual $25M refund clause with unverified compliance requirements. - Incidents unders

Deciphering How Municipal Infrastructure Grants Influence Real Estate Growth and Investment Prospects

- New York's FAST NY program allocated $283M to transform 7,700 acres of industrial land into "shovel-ready" sites for high-tech manufacturing and semiconductors . - Infrastructure upgrades like water/sewer systems directly increased land values by 20% in industrial zones, attracting anchor tenants like Chobani and Micron . - 2025 tax reforms (100% bonus depreciation) amplified private investment, with Q3 2025 real estate deals hitting $310B as manufacturers targeted upgraded sites. - Critics highlight rur