The Ondo price prediction sees a 7.80% price increase over the past 24 hours of trading as the coin touches the daily high at $1.27.

Ondo Prediction Statistics Data:

- Ondo price now – $1.26

- Ondo market cap – $1.75 billion

- Ondo circulating supply – 1.39 billion

- Ondo total supply – 10 billion

- Ondo CoinMarketCap ranking – #64

The ONDO token has experienced remarkable growth since its all-time low of $0.08355 on January 18, 2024, rising by +1403.38%. ONDO price peaked at $1.48 on June 3, 2024, and currently fluctuates between $1.12 and $1.27 in the last 24 hours . This impressive performance underscores the token’s potential for significant growth, making it an important one to track in the crypto space.

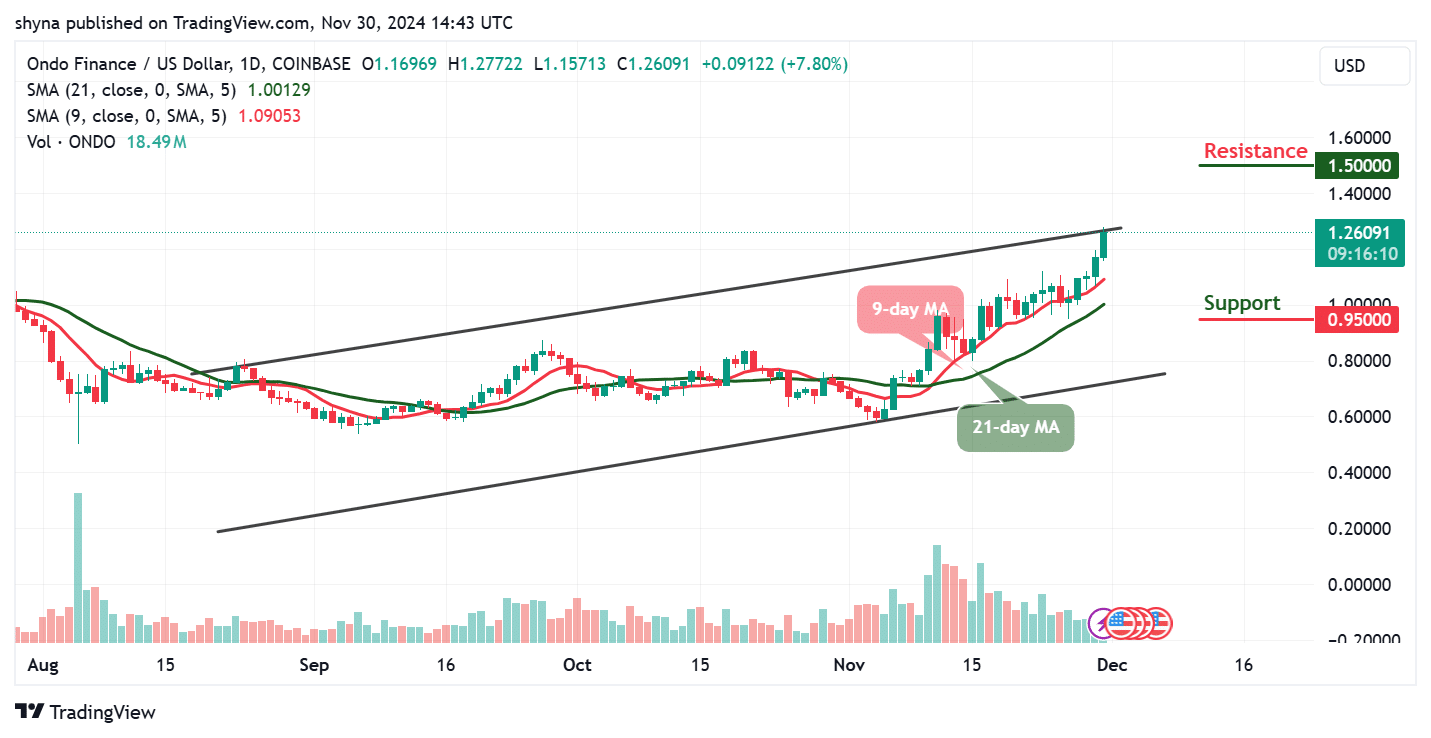

ONDO/USD Market

Key Levels:

Resistance levels: $1.50, $1.60, $1.70

Support levels: $0.95, $0.85, $0.75

ONDOUSD – Daily Chart

ONDOUSD – Daily Chart

ONDO/USD is currently experiencing a significant bullish trend that commenced after November 10th. This upward momentum, triggered by breaking key resistance levels, has been persistent with several buying opportunities, leading to higher valuations. As of the latest price action, ONDO surpassed the $1.10 level, marking an important milestone. At the time of writing, the movement is shifting back into the bullish favor, with the bulls resuming back into the market.

Ondo Price Prediction: Ondo (ONDO) Could Spike Above $1.50 Level

The Ondo price may need to hit and cross above the resistance level of $1.30 if the buyers keep the price above the 9-day and 21-day moving averages. Meanwhile, the key resistance zone lies at $1.25, where the price has stalled, despite the overall uptrend. This level is historically significant and has presented challenges for ONDO in maintaining upward momentum. However, the prevailing market dynamics, particularly the pressure from Bitcoin’s price action and its dominance, pose short-term risks for altcoins like ONDO.

In the short term, ONDO/USD is likely to experience some consolidation, with prices retracing to the $1.10 – $1.00 range. This pullback offers an attractive buy zone, with the potential for a 12-21% decrease from the current price. Nevertheless, on the upside, the first level of resistance lies at $1.35, while the potential resistance levels lie at $1.50, $1.60, and $1.70. In other words, if the sellers bring the price to the downside and cross below the 9-day and 21-day moving averages, the market price may locate the supports at $0.95, $0.85, and $0.75 respectively.

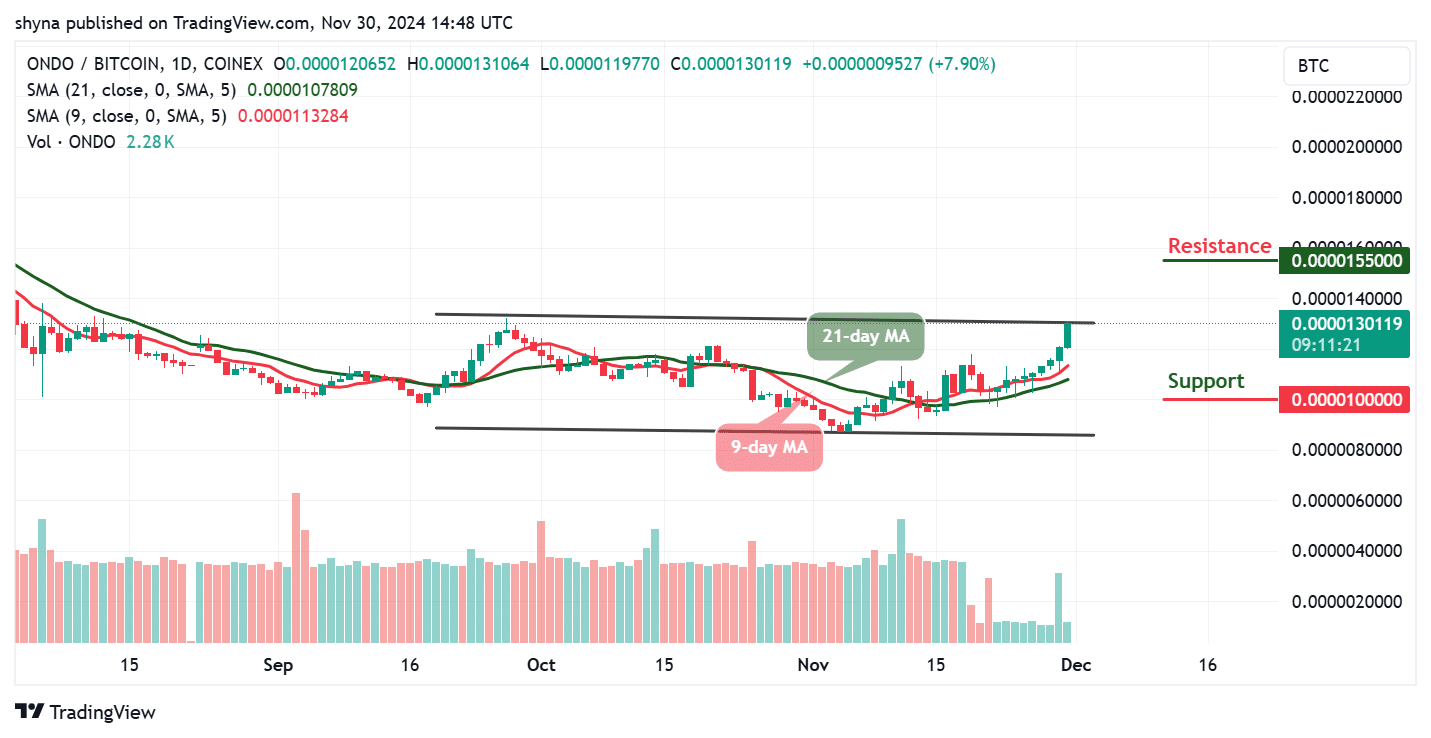

ONDO/BTC May Swing to the Upside

Against Bitcoin, the ONDO price is hovering above the 9-day and 21-day moving averages. The Ondo price is likely to cross above the upper boundary of the channel if the bulls increase the pressure. Meanwhile, from the above, the nearest resistance level is likely to touch 1400 SAT if the bulls push the coin above the upper boundary of the channel. Above this, higher resistance lies at 1550 SAT and above.

ONDOBTC – Daily Chart

ONDOBTC – Daily Chart

On the other hand, if the selling pressure creates a fresh low, lower support may be found at 1000 SAT and below. Therefore, the coin may also follow the sideways movement to give opportunity for more buyers to step into the market. However, the 9-day MA remains above the 21-day MA, which shows that the market may be preparing for an uptrend.

Nevertheless, @nology3000 updated his followers on X (formerly Twitter) that while the more bullish scenario didn’t play out, he was off by about 3 cents on the target. If the projection holds, $ONDO is expected to experience a long-duration wave 4 with a rejection around $3. He also mentioned having an ultra-bullish scenario in mind, but he will only share it if there’s a reason.