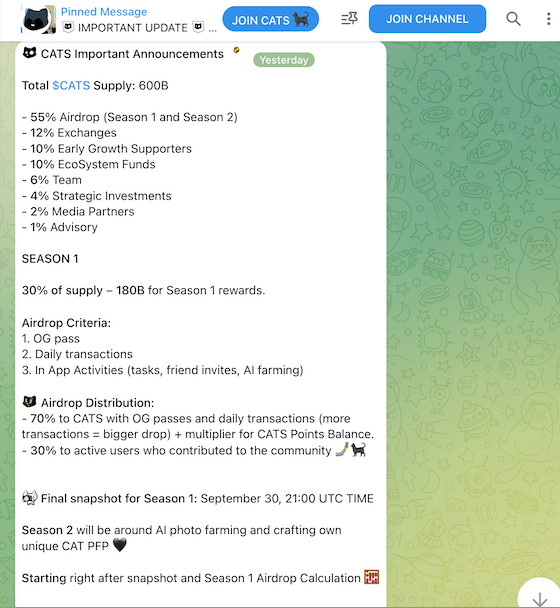

Important Announcements From CATS community

Total $CATS Supply: 600B

- 55% Airdrop (Season 1 and Season 2)

- 12% Exchanges

- 10% Early Growth Supporters

- 10% EcoSystem Funds

- 6% Team

- 4% Strategic Investments

- 2% Media Partners

- 1% Advisory

SEASON 1

30% of supply – 180B for Season 1 rewards.

Airdrop Criteria:

1. OG pass

2. Daily transactions

3. In App Activities (tasks, friend invites, AI farming)

Airdrop Distribution:

- 70% to CATS with OG passes and daily transactions (more transactions = bigger drop) + multiplier for CATS Points Balance.

- 30% to active users who contributed to the community

Final snapshot for Season 1: September 30, 21:00 UTC TIME

Season 2 will be around AI photo farming and crafting own unique CAT PFP

Starting right after snapshot and Season 1 Airdrop Calculation

At CATS, we value the clever cats who know that free cheese only comes in a mousetrap , far more than the mice and hamsters who just want to tap and expect millions. While some may believe they can earn big rewards with little effort, we reward those who truly understand the game and invest their time and resources wisely.

The bigger, juicier rewards are reserved for the real CATS — those who value the project and are ready to be part of it, growing together with the community in this new era of digital renaissance

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE experiences a 14.6% decline over 7 days as large investors make moves and short positions are rebalanced

- AAVE fell 14.6% in 7 days amid whale activity, including a $561M ETH withdrawal from Aave to Binance. - BitMEX co-founder Arthur Hayes sold $4.96M in crypto assets, including 1,630 AAVE tokens, reflecting broader portfolio adjustments. - Whale short positions and leveraged trades highlight risks in DeFi markets, with $125M paper losses and $7M floating profits exposing high-stakes strategies.

Bitcoin News Today: Chinese Pensioners Defrauded in £4.6 Billion Cryptocurrency Pyramid Scheme, Mastermind Receives 11-Year Sentence in Historic UK Trial

- UK sentences Qian Zhimin to 11 years for £4.6B crypto Ponzi scheme defrauding 128,000 investors. - Case marks largest UK crypto seizure (61,000 BTC, $5-6B) in history, involving global cross-border investigation. - Victims, mostly Chinese retirees, lost life savings via patriotic-themed scams exploiting false political endorsements. - Sentencing highlights cross-border crypto crime challenges despite international cooperation between UK and Chinese authorities.

Solana News Today: "Solana Treasury Allocates Billions in Staking, Offering 7.7% Returns Amid Ongoing Market Skepticism About Crypto Rebound"

- Upexi , a Nasdaq-listed Solana treasury firm, reported $66.7M net income in Q1 2026, driven by $78M in unrealized gains from its 2.18M SOL holdings. - The Solana treasury sector now holds 24.2M SOL ($3.44B), with Upexi ranking fourth and staking yields averaging 7.7% as a corporate asset class. - Market volatility triggered defensive moves like Upexi's $50M share buyback, while its stock trades at 0.68x NAV amid broader crypto skepticism. - Solana's on-chain activity outpaces Ethereum , with TVL reaching

COAI's Significant Price Decline: The Result of Leadership Instability, Ongoing Legal Issues, and Ambiguous Regulatory Environment

- COAI Index fell 88% YTD in 2025, driven by AI/crypto AI sector selloff amid governance failures and regulatory uncertainty. - C3.ai's leadership crisis and unresolved lawsuit eroded investor trust, compounding COAI's decline as index cornerstone. - Vague CLARITY Act left AI-based crypto projects in legal gray zones, triggering risk-off trading toward established tech stocks. - C3.ai's $116.8M Q1 loss and sector-wide weakness highlighted structural risks despite 21% revenue growth. - Analysts debate if CO