This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

This year's hottest cryptocurrency trades have suddenly cooled down. Some investors say they "saw it coming," while others are doubling down on their bets.

This was the "go-to trade" for most of the year: selling stocks or borrowing money, then pouring funds into bitcoin, ethereum, and other cryptocurrencies. Investors pushed up the stock prices of these "crypto treasury companies," viewing them as tools to amplify returns from the highly volatile crypto market.

Michael Saylor pioneered this model in 2020, when he transformed a small software company called MicroStrategy into what is now known as Strategy, a bitcoin giant. But as the prices of bitcoin and ethereum plummeted, the stock prices of Strategy and its imitators also fell in tandem. The company's market capitalization peaked at about 128 billion USD in July and has now shrunk to about 70 billion USD.

This sell-off has impacted big-name investors, including well-known venture capitalist Peter Thiel—who has backed several crypto treasury companies—as well as ordinary investors who followed the "evangelists" into these stocks.

Saylor himself remains as bullish as ever, declaring on social media that bitcoin is currently "on sale." Skeptics had long anticipated this pullback, as the stock prices of crypto treasury companies typically trade at a premium to the intrinsic value of their token holdings.

"The whole concept makes no sense to me, it's like paying $2 for a $1 bill," said Brent Donnelly, president of Spectra Markets. "These premiums will eventually be compressed."

When these crypto treasury companies first emerged, they provided institutional investors—who previously had difficulty accessing crypto directly—with an investment channel. But in the past two years, cryptocurrency exchange-traded funds (ETFs) have also begun offering the same solution.

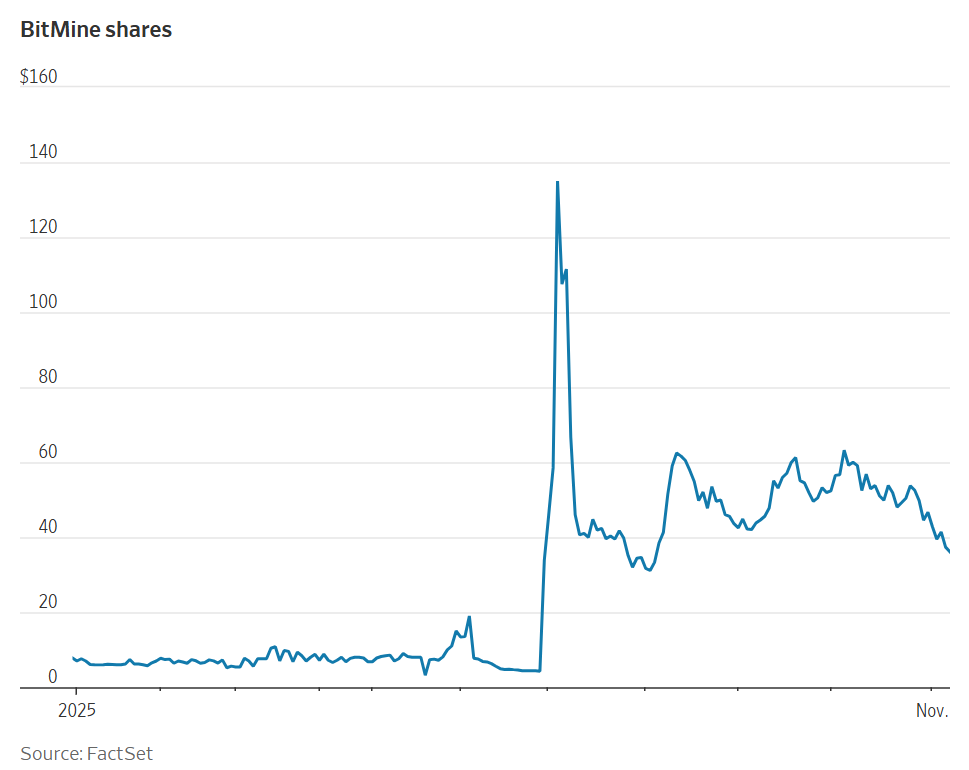

BitMine Immersion Technologies, a major ethereum treasury company backed by Thiel and run by veteran Wall Street strategist Tom Lee, has seen its stock price drop more than 30% in the past month.

ETHZilla, which transitioned from a biotech company to an ethereum treasury company, also counts Thiel as an investor. Its stock price has fallen 23% in a month.

For most of this year, cryptocurrency prices continued to rise, driven by the crypto-friendly Trump administration. The frenzy sparked by crypto treasury companies further pushed up token prices. But this rally came to an abrupt end on October 10—when uncertainty over US-China trade relations triggered a market sell-off. A record-long government shutdown and uncertainty over Federal Reserve monetary policy also put pressure on prices.

Bitcoin prices have fallen 15% in the past month. During the same period, Strategy's stock price dropped 26%, and the related ETF under Tuttle Capital Management CIO Matthew Tuttle—MSTU (which aims to deliver twice the returns of Strategy)—fell 50%.

"Digital asset treasury companies are essentially leveraged crypto assets, so when crypto falls, their declines are even greater," Tuttle said. "Bitcoin has proven it won't disappear, and buying the dip will be rewarded."

Where are crypto treasury stocks headed?

At least one big-name investor has adjusted his portfolio after these stocks plunged. Globally renowned short-selling hedge fund manager Jim Chanos closed his hedge fund in 2023, but he still trades personally and advises clients. He had previously shorted Strategy and bought bitcoin, believing that since investors could buy bitcoin directly, paying a premium for Saylor's company made no sense. Last Friday, he told clients it was time to close out this trade.

In an interview last Sunday, he said, crypto treasury stocks are still overvalued—partly because their stock prices remain above the value of the crypto they hold, but it's no longer outrageous. "The investment thesis has basically played out," he wrote in a letter to clients.

As long as crypto holdings retain their value, most companies that financed crypto purchases are unlikely to face a crisis in the short term. Some companies have raised large amounts of capital and still hold ample cash, allowing them to buy crypto at lower prices or even acquire competitors.

But analysts say that companies facing losses will find it difficult to issue new shares to buy more crypto, which could put pressure on crypto prices and raise questions about the business models of these companies.

"A lot of companies are in trouble," said Matt Cole, CEO of bitcoin treasury company Strive. Earlier this year, Strive raised funds to buy bitcoin at an average price more than 10% higher than the current price.

Strive's stock price has fallen 28% in the past month. He said Strive is well-positioned to "weather the volatility" because the company recently raised funds through preferred stock rather than debt.

Cole Grinde, a 29-year-old investor from Seattle who works in beverage sales, bought about $100,000 worth of BitMine stock at around $45 per share earlier this year when BitMine began accumulating ethereum. So far, this investment has lost about $10,000.

Nevertheless, Grinde says he is increasing his holdings. He has offset some of his losses by selling BitMine options. His confidence in BitMine comes from the growing popularity of the ethereum blockchain (the network that issues ethereum) and Lee's influence.

"I think since he took over, his connections and personal charisma have helped the stock soar," he said of Lee. Lee worked at JPMorgan for 15 years, is a managing partner at Fundstrat Global Advisors, and is a frequent commentator on business television programs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The U.S. "national team" turns on itself: The perfect scam of swallowing 127,000 bitcoins

ZK Roadmap "Dawn": Is the roadmap to Ethereum's endgame accelerating across the board?

ZKsync has become a representative project of the Ethereum ZK track and has shown outstanding performance in the RWA sector, with on-chain asset issuance second only to the Ethereum mainnet. Its technological advancements include a high-performance sequencer and privacy chain architecture, accelerating Ethereum's transition into the ZK era. Summary generated by Mars AI. The accuracy and completeness of this summary's content, generated by the Mars AI model, are still in the iterative update stage.

20x in 3 months, is the ZEC $10,000 prophecy coming true?