An unexpected national-level technical report has torn off the disguise of "righteous law enforcement," exposing a meticulously orchestrated digital asset plundering drama that spanned five years. 127,000 bitcoins, with a market value soaring from $3.5 billion to $15 billion, saw their ownership transferred in a process that was far from a simple law enforcement seizure. Instead, it resembled a "perfect scam" orchestrated by state-level hackers and whitewashed by judicial procedures. This ultimate "black eats black" showdown is not only about massive wealth but also signals the fangs of state hegemony extending into the era of "digital gold."

I. Timeline Decryption: Five Years of Precise "Steal First, Seize Later" Harvest

On the surface, this appears to be old news: In October 2025, the U.S. Department of Justice made a high-profile announcement about the confiscation of 127,000 bitcoins held by Chen Zhi, chairman of Cambodia's Prince Group. However, the report from the National Computer Virus Emergency Response Center paints a completely different truth.

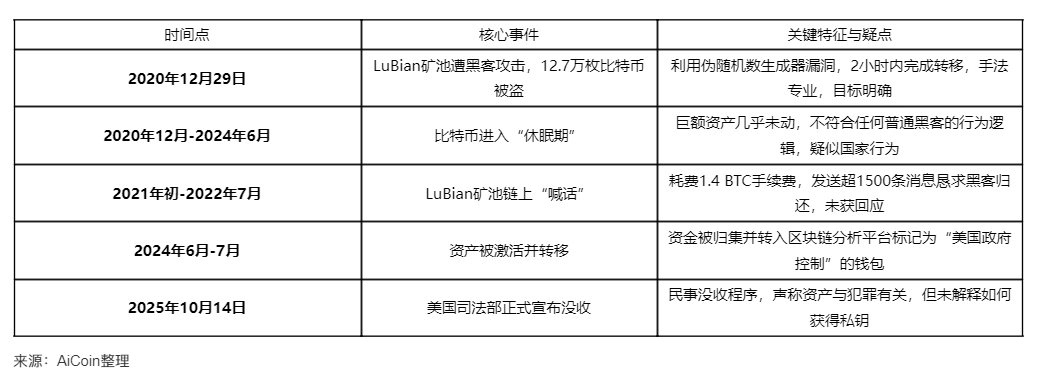

The table below clearly reveals that this operation was no accident, but rather a precisely coordinated plan:

Interpretation and Doubts:

● The "Dormant" Stolen Funds: No hacker in the world could resist cashing out such a huge sum. Nearly four years of "hibernation" only means one thing: the attacker intended to control the assets long-term rather than seek short-term profit. This reflects the strategic patience of a nation-state.

● Perfect "Buy Low, Announce High": The U.S. government gained actual control of the bitcoins in 2024 when the price was about $48,000 each, but only announced the seizure in 2025 after the price soared to $118,000. This was not a spur-of-the-moment law enforcement action, but a precise wealth harvest that perfectly captured the enormous premium in the bitcoin cycle.

II. The Collapse of the "Decentralization" Myth in the Face of State Power

The report reveals even more chilling technical details: how the so-called "digital fortress" was shattered from within.

● Fatal Flaw: Pseudorandom Number Generator (PRNG)

○ Theoretical Security: A standard bitcoin private key is a 256-bit binary number, with 2²⁵⁶ possibilities (about 1.16×10⁷⁷). Even with a supercomputer, brute-forcing it would take longer than the age of the universe.

Source: Wallstreetcn

○ Reality Collapse: The LuBian mining pool used the Mersenne Twister (MT19937-32), an insecure pseudorandom number generator. Its effective entropy was only 32 bits, reducing the possible private key combinations from cosmic scale to about 4.29 billion (2³²).

○ Vulnerable: Exploiting this flaw, attackers could use a supercomputer to brute-force all possible private keys in about 1.17 hours. This is like replacing a quantum lock on a vault with a simple four-digit suitcase lock.

Source: Wallstreetcn

● The "Betrayal" of Transparency

The blockchain's public ledger, combined with the Prince Group's specific transaction patterns, actually made it easy for U.S. investigators to pinpoint and track targets using clustering algorithms. The openness of the code became a double-edged sword in the face of national-level analytical capabilities.

When private key generation is flawed and state power controls technical vulnerabilities, transferring bitcoin becomes as simple as operating one's own bank account. The U.S. used this technical means to gain actual control of the assets as early as 2024, with the so-called "seizure" being merely a legal formality completed afterward.

III. The Double Act of "Long-Arm Jurisdiction" and "Civil Forfeiture"

In this case, the U.S. Department of Justice performed a brilliant legal sleight of hand, successfully "laundering" assets seized from "black eats black."

● The Unlimited Expansion of "Long-Arm Jurisdiction"

○ The main criminal acts and the suspect's nationality were both in Cambodia. The U.S. asserted jurisdiction based on the "minimum contacts" principle (such as possible use of U.S. technical infrastructure).

○ This is a typical case of "digital long-arm jurisdiction", placing its domestic law above the judicial sovereignty of other countries, aiming to seize the rule-making power in the digital finance sector.

● The Procedural Trap of "Civil Forfeiture"

○ The U.S. used a civil forfeiture procedure, which is an "in rem" (against the property) rather than "in personam" (against the person) lawsuit. This means the government only needs to prove by "preponderance of the evidence" (more likely than not) that the assets are related to a crime, not that the owner is guilty.

○ Reversal of the Burden of Proof: The asset owner (Chen Zhi) must prove the "legitimacy" of the assets, which is extremely difficult in practice. This is a "presumption of guilt," "seize first, prove later" model that seriously undermines procedural fairness.

● Strategic Intent for Asset Destination

○ According to U.S. law, confiscated criminal proceeds are usually first used to compensate U.S. victims. In this case, victims may be worldwide, potentially preventing international victims from receiving fair compensation.

○ Even more noteworthy, in March 2025, the Trump administration signed an executive order to establish a "Strategic Bitcoin Reserve". This means the confiscated bitcoin may not be auctioned but directly incorporated into the U.S. Treasury as a national strategic asset. This raises ethical questions about whether the U.S. is using judicial actions to enrich national assets.

IV. Competing for "Digital Gold" Pricing Power: The U.S. Launches a "Digital 9/11"

The transfer of ownership of these $15 billion worth of bitcoins should never be seen as a simple law enforcement action. Behind it lies a deeper strategic intent:

● The Essence of Hegemony, Plundering Wealth: Under the guise of "combating telecom fraud," the real aim is to "enrich the national treasury." The injection of this massive amount of bitcoin will add a heavy "digital gold" weight to the U.S. national balance sheet, marking a key step in its "nationalization of digital assets" strategy.

● Rule-Making, Establishing Hegemony: Through this case, the U.S. is declaring to the world: in the battlefield of digital assets, code belongs to code, but hegemony will always belong to hegemony. It seeks to show the world who truly holds the ultimate interpretive and controlling power over digital currencies.

● The Ultimate Questioning of "Digital Gold" Status: Bitcoin is hailed as "digital gold" for its scarcity and decentralization. But when the most powerful state apparatus systematically seizes it using technical flaws and legal tools, we must ask: does bitcoin's ultimate premium come from code consensus, or from the potential future endorsement of state violence?

A Wake-Up Call for Global Crypto Holders

From discovering the vulnerability in 2020 to the "legal" confiscation in 2025, the U.S. spent five years executing a perfect closed loop of "discovering the flaw—technical control—waiting for appreciation—completing the procedure." This is not only a tragedy for Prince Group, but also a deafening wake-up call for global digital currency holders.

When state hegemony bares its fangs, the paradise of "digital gold" is no longer peaceful. This 127,000 bitcoin mystery may be just the tip of the iceberg. It forces every market participant to re-examine: in the triangular relationship of technical security, legal boundaries, and state power, where exactly do our digital assets stand?