Why the Latest 50% Decline in SOL Price Presents a Prime Chance to Reenter

- Solana's 50% price drop reflects broader market pressures but highlights structural strengths like institutional adoption and DeFi innovation. - Robust on-chain metrics show $29B DEX volume and $10.3B TVL, outperforming Ethereum despite stablecoin depegging challenges. - U.S. Solana ETFs attracted $200M+ inflows, signaling institutional confidence in long-term value despite crypto market volatility. - Bullish social sentiment and Solana 2.0 upgrades position it to weather "altcoin winter," creating asymm

On-Chain Liquidity: A Core Strength

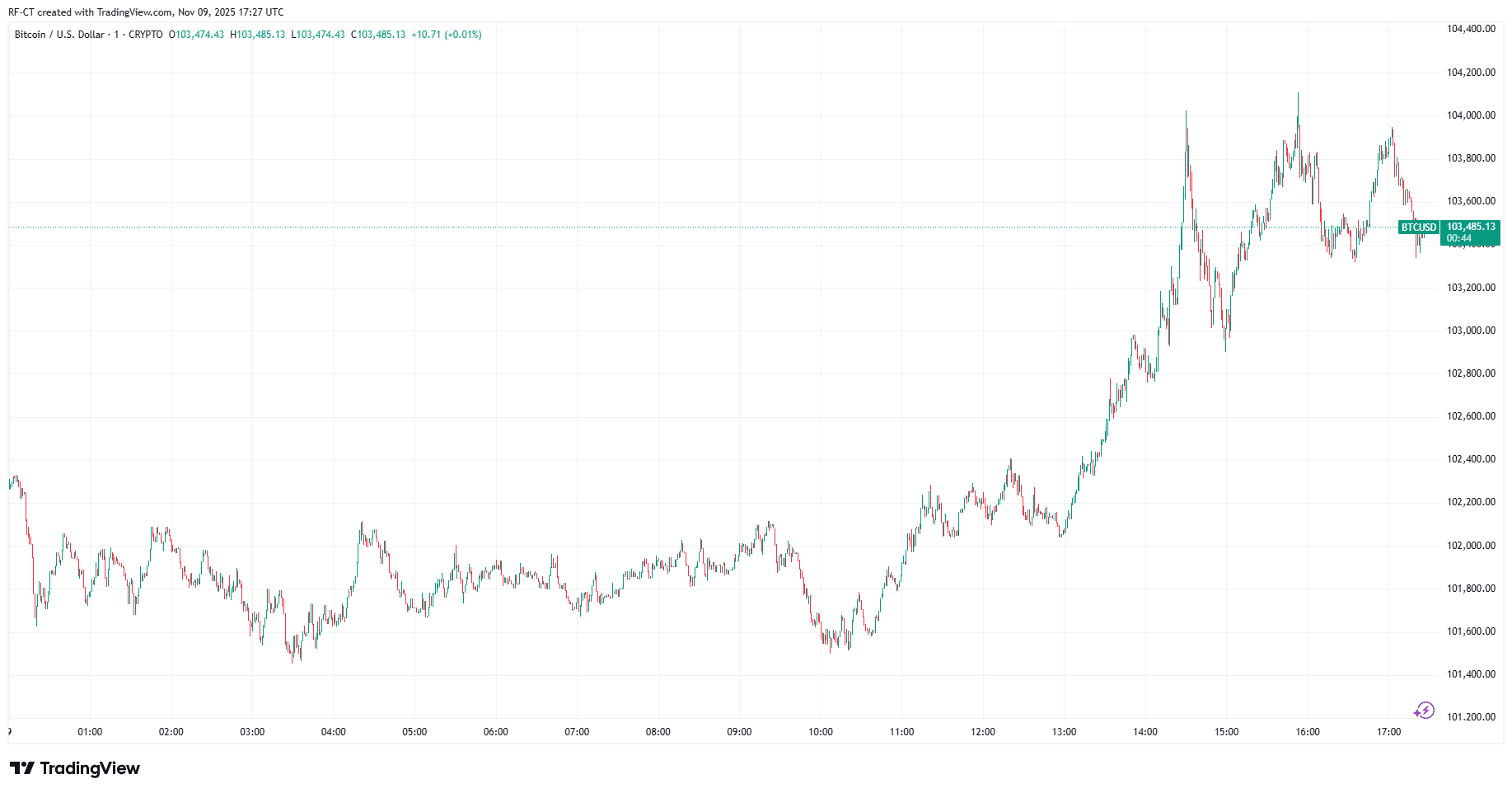

Even with the recent steep drop in price, Solana’s on-chain liquidity indicators remain strong. In late 2025, weekly decentralized exchange (DEX) trading volume reached $29 billion, nearly twice Ethereum’s $15.9 billion, highlighting Solana’s capacity to handle high-frequency trading and dApp activity, according to

Institutional capital has also shown persistence. U.S. spot

Nonetheless, obstacles remain. The wider DeFi sector encountered a liquidity crunch at the end of 2025, with TVL falling 24% due to stablecoin instability and withdrawals, according to

Market Sentiment: Enduring a Bearish Phase

Investor mood has been uncertain, with blockchain data pointing to an “altcoin winter” as most digital assets, including Solana, have dropped 35.5% since the start of the year, according to

The platform’s ability to process over 3,800 transactions per second at low cost continues to draw developers, even as interest in

Solana’s online community remains optimistic. On platforms like X (formerly Twitter), positive posts and supportive messages from the community suggest that retail enthusiasm persists, as referenced in the

Strategic Reentry: Weighing Risks and Opportunities

The halving of Solana’s price has opened a valuation gap that could be closed by ongoing structural advantages. The network’s TVL and DEX activity show that its ecosystem remains robust, while increasing ETF inflows point to rising investor interest. Furthermore, the Solana 2.0 plan—which emphasizes scalability improvements and DeFi growth—offers a clear path for future expansion, according to

That said, caution is warranted. The crypto sector’s liquidity issues and uncertain macroeconomic factors, such as changing interest rates, could extend the downturn. Nevertheless, history suggests that during periods of panic, crypto prices often diverge from underlying fundamentals, creating unique opportunities for those who can differentiate between short-term disruptions and lasting value.

Conclusion

Solana’s recent 50% price correction is more a sign of overall market weakness than a reflection of its core strengths. With solid on-chain liquidity, increasing institutional participation, and a dedicated developer base, Solana stands out as a strong candidate for renewed investment. Although the recovery may be uneven, the combination of supportive macro trends and ongoing innovation suggests that the current low valuation is likely temporary, not a sign of lasting damage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DTCC Lists Five XRP Spot ETFs, Fueling Anticipation for U.S. Market Debut

Trump’s Stimulus Could Spark a Crypto Rally Even Crazier Than 2020

Astar 2.0: Is This a Strong Opportunity for Institutional Investors to Enter?

- Astar 2.0 upgrades blockchain scalability via Polkadot's async protocol, cutting block time to 6 seconds and boosting TPS to 150,000. - Institutional adoption grows with $3.16M ASTR purchase, 20% QoQ wallet growth, and partnerships with Sony , Casio, and Japan Airlines. - Cross-chain liquidity via Chainlink CCIP and hybrid architecture position Astar as a bridge between decentralized innovation and enterprise needs. - Analysts project ASTR could reach $0.80–$1.20 by 2030, though liquidity constraints and

Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism