Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

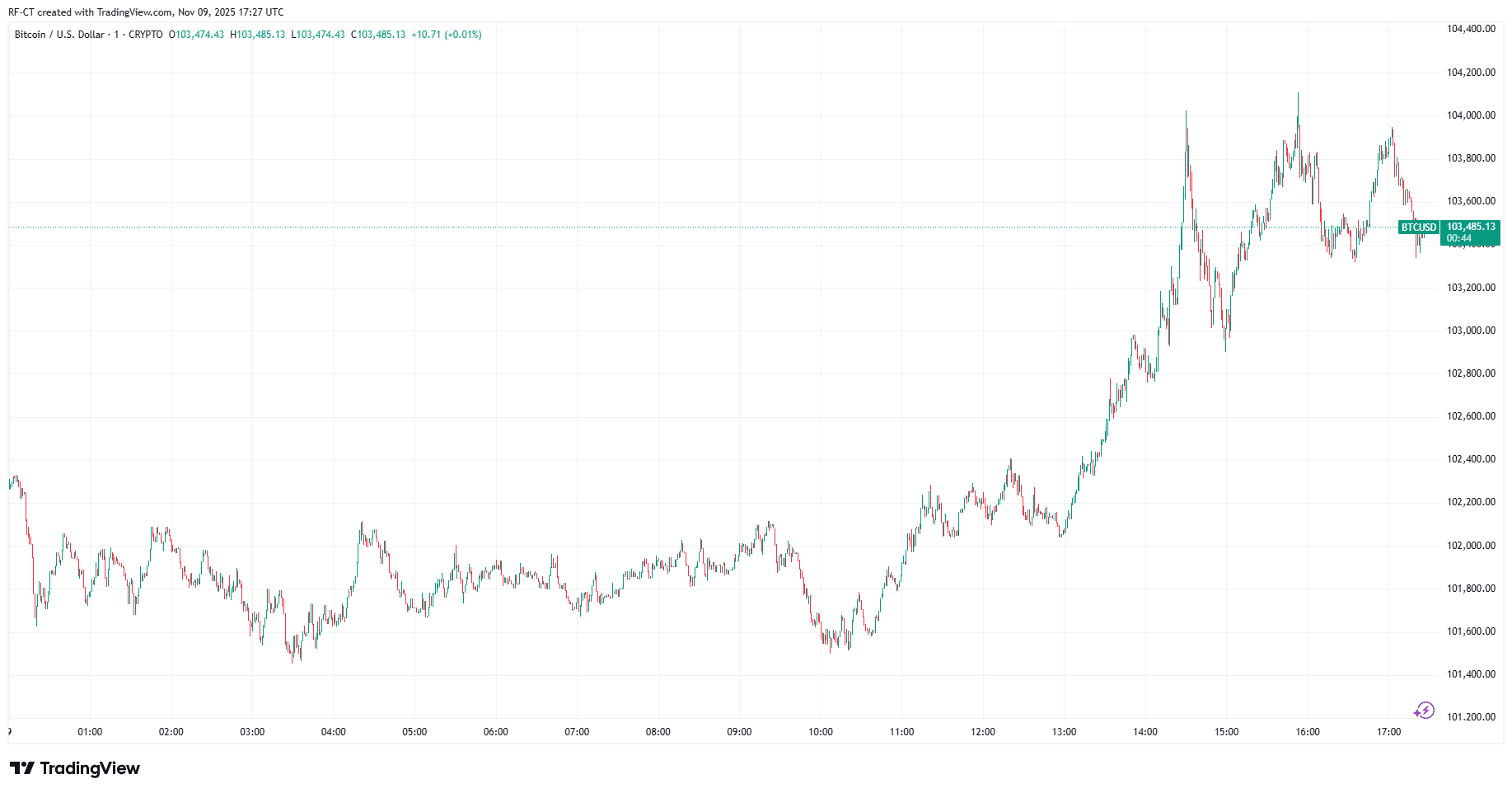

Bitcoin is showing renewed strength after a volatile week, climbing above $103,000 as two major catalysts dominate the headlines: President Trump’s $2,000 “tariff dividend” plan for U.S. citizens, and Michael Saylor’s cryptic message hinting at another round of Bitcoin accumulation.

These developments have revived optimism across the crypto market, reminding investors of the powerful link between fiscal policy, liquidity, and digital assets.

Bitcoin’s Rebound and Trump’s Dividend Plan

After briefly dipping below the key $100K support, Bitcoin bounced back strongly following Trump’s post announcing that every American could receive at least $2,000 as a “tariff dividend.”

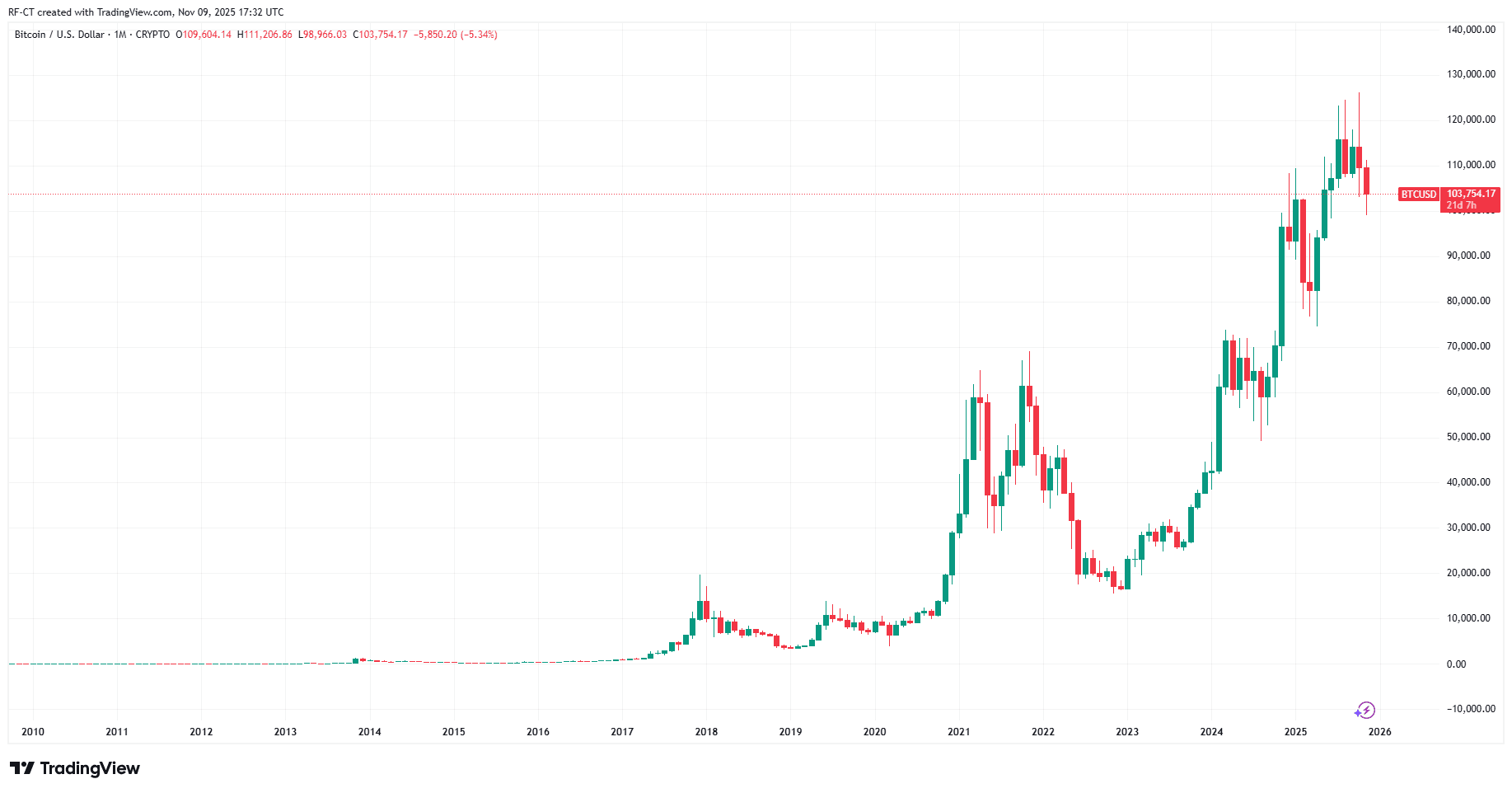

Crypto analyst drew an important parallel — the last time such direct payments occurred, during the COVID-19 stimulus checks in 2020, it triggered the 2021 crypto bull run, when Bitcoin surged from $3,800 to $69,000.

Trump’s exact post read:

“A dividend of at least $2,000 a person (not including high-income people!) will be paid to everyone.”

The announcement immediately energized markets, echoing the same liquidity boost that once fueled massive retail inflows into Bitcoin and altcoins. Traders now speculate that history could repeat itself if the dividend plan materializes in early 2026.

By TradingView - BTCUSD_2025-11-09 (1D)

By TradingView - BTCUSD_2025-11-09 (1D)

Michael Saylor’s Hint Adds Fuel to the Fire

While Trump’s announcement stirred excitement on the macro level, Michael Saylor — founder of MicroStrategy and one of Bitcoin’s largest corporate holders — added to the momentum with a subtle yet powerful post shared by Watcher.Guru.

His words, “Best continue,” came alongside data showing MicroStrategy’s Bitcoin portfolio now valued at $65.45 billion, holding over 641,000 BTC.

This has fueled speculation that Saylor may either be buying the dip or waiting for another correction before resuming large-scale accumulation — a strategy that has historically signaled bullish turning points for Bitcoin.

Market Context and Institutional Flows

Despite renewed optimism, institutional activity remains mixed. U.S. spot Bitcoin ETFs just recorded their largest daily outflow since August, suggesting that while sentiment is improving, some institutional players are still waiting for confirmation — or possibly aligning their entries with Saylor’s buying timing.

Meanwhile, Ethereum followed Bitcoin’s lead, recovering to around $3,480, as DeFi inflows and staking activity picked up after days of muted trading.

Can History Repeat Itself?

If Trump’s dividend plan injects real liquidity into the economy and Saylor’s next accumulation wave begins, Bitcoin could aim for the $110K–$115K range — a zone where short liquidations are heavily clustered.

On the other hand, if a short-term pullback emerges, it may set the stage for a “buy-the-dip” scenario that institutional investors like Saylor thrive on.

By TradingView - BTCUSD_2025-11-09 (All)

By TradingView - BTCUSD_2025-11-09 (All)

Between Trump’s fiscal stimulus rhetoric and Saylor’s unwavering conviction, the narrative driving Bitcoin’s next chapter is clear: liquidity meets belief.

Whether the market experiences another dip or pushes higher, the stage for a renewed bull phase appears set — and traders are watching every move closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin’s Decline Fuels Ongoing Discussion About the Ambitious Fundraising Approach

- Strategy Inc. raised €620M via upsized 10% dividend-bearing preferred stock to fund Bitcoin purchases amid market declines. - The offering expanded from €350M due to strong demand, with proceeds allocated to Bitcoin acquisitions and operations. - Short-seller Chanos closed MSTR short position as mNAV ratio dropped to 1.23x, signaling reduced valuation premium. - Despite Bitcoin trading below $100K and MSTR's 27% stock decline, Saylor maintains bullish stance with 641,205 BTC holdings. - Analysts debate s

Ethereum Latest Updates: Institutions Accumulate ETH While Derivatives Indicate Renewed Optimism for a Recovery

- Ethereum derivatives traders show rebound optimism with $40.11B open interest, led by Binance and CME, as 65% of options bets favor price above $3,500. - Institutional demand surges: BitMine adds $389M ETH (2.9% of total supply), citing attractive dip opportunities amid Bitcoin's $106K rally. - Technical analysts highlight bullish patterns - weekly pennant and Fibonacci projections suggest $7,700-$30,500 targets if $3,600-$3,700 support is reclaimed. - Market volatility persists with $4K-$6K call options

LUNA drops 0.44% over 24 hours despite turbulent 7-day rise

- LUNA dropped 0.44% in 24 hours but rose 10.17% in 7 days, contrasting with a 78.32% annual decline. - Short-term volatility reflects mixed market sentiment, balancing 7-day resilience against 30-day bearish momentum. - Technical analysis highlights critical support/resistance levels and 200-day moving average as key trend indicators. - Long-term challenges persist due to regulatory risks, ecosystem adoption issues, and macroeconomic crypto market pressures.

SOL Price Forecast 2025: Enhanced On-Chain Engagement and Network Improvements Propel Solana Toward Its Upcoming Bull Run

- Solana (SOL) gains traction in 2025 with 17.2M active addresses and 543M weekly transactions, outperforming Ethereum and BNB Chain. - Network upgrades like Alpenglow (Q1 2026) and Firedancer (Q3 2025) aim to achieve sub-second finality and 1M+ TPS, boosting institutional adoption. - ZK Compression v2 slashes transaction costs by 5,200x, while $118M inflows during October 2025 outflows highlight growing ETF and retail demand. - Rising TVL ($42.4B peak) and Bitcoin Hyper integration position Solana as a sc